“Are the prices just not passed through yet? No, I think what’s happening is everything’s evening out. You know, when we charge, see what people don’t understand the other countries have been charging almost — every country charges us tariffs. We had deficits with everybody for years for… decades. And we were like this big monolith that made bad deals with everybody.”

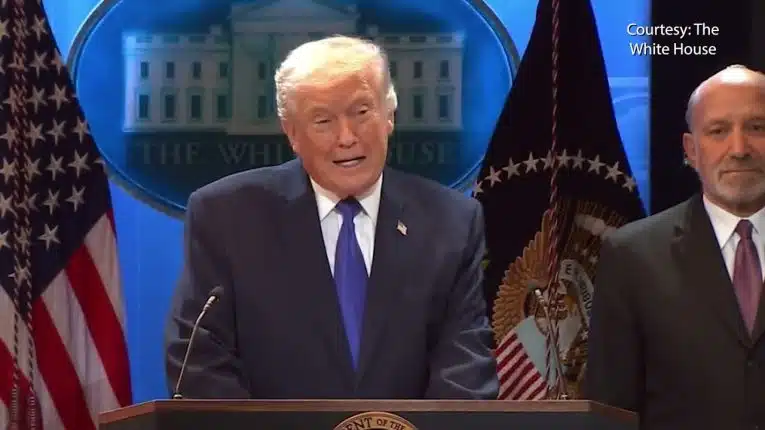

That was President Donald Trump’s reaction at a July 8 Cabinet meeting at the White House to a question inquiring about a Council of Economic Advisors report showing that the price of imported goods has been in outright decline throughout 2025.

Citing data from the Department of Commerce and the Bureau of Economic Analysis, the Council — a think tank inside the White House — found that the Personal Consumption Expenditure (PCE) Price index for imported goods dropped 0.11 percent from January through May, and the Consumer Price Index for imported goods dropped 0.76 percent.

Focusing on March through May, the PCE Price Index for imported goods dropped 0.58 percent and the CPI dropped 1.04 percent. This was in the run-up and initial to President Trump’s reciprocal tariffs that began in April, but also the first rounds of tariffs announced against top trade partners Canada, Mexico and China in February.

Throughout the process, critics of the President’s trade policies, including Democrats in Congress and a couple of Republicans, have insisted—without evidence—that prices would increase. They still haven’t, whether in anticipation of the February or April announcements, or in response to them.

The reasons for this are certainly dynamic, but a few factors to consider: Real inflation-adjusted consumer expenditures have slowed down slightly from 3.1 percent monthly in December to 2.2 percent in May, and consumer credit owned and securitized was in outright contraction from December through February and only grew at 0.4 percent in May compared to 9.9 percent near the peak of the inflation in May 2022.

This shows lower demand, not surprising following the recent bout of inflation as households get their budgets in order and pay down debt. High interest rates also slow down consumer spending as big purchases are forestalled.

But besides those macro factors, there is also an element of anticipation of the tariffs by trade partners, who whether through currency weakening or just competitive pricing have to the ability to bring prices down to offset the tariffs, even if they haven’t been fully levied yet.

Meaning, with a slower economy in the first quarter, a drop of 0.5 percent in the real inflation-adjusted Gross Domestic Product, plus anticipation of the Trump tariffs, there is actually wiggle room for prices, defying the gloomy pessimism of the critics of the policy who maintained the sky was falling.

Now, with the President’s August 1 deadline for trade negotiations looming, if and when there is a price increase, it might just be a one-time hike, with an open question of whether will it even exceed the preceding drops.

In the meantime, Federal Reserve Chairman Jerome Powell has been keeping interest rates high throughout this entire discussion, even with central banks all over the world cutting rates in the midst of a drop in global demand, and as consumer inflation continuing to slow, currently at 2.4 percent over the preceding twelve months as of May.

To be fair, usually the central bank will keep rates elevated following an inflation event until unemployment ticks up significantly.

At the moment, the unemployment rate is relatively low historically at 4.1 percent, although elevated from its 3.4 percent low from April 2023. And, since Jan. 2023, the overall unemployment level has in fact increased by 1.26 million to its current 7 million. Which is what usually happens when prices and demand slows down. Is that significant enough?

For his part, President Trump still thinks there’s room to lower the rates, noting the rate cut last September during the election at the Cabinet meeting, “We should get somebody in there that’s going to lower interest rates… I think he’s terrible. I think look, we’re paying I call him too late. Too late. Like two tall Jones for the Dallas Cowboys, right? Too late. Uh he’s always late, but he wasn’t late with Biden before the election. He was cutting him like crazy. It didn’t help too much, did it? But he was cutting them like crazy before the election with Kamala and Biden. He was trying to get them in, I guess.”

In other words, the slowing economy and rising unemployment was enough to prompt an interest rate cut last year, so what about now? Not every prediction will turn out to be true, so when the Fed does finally resume cutting rates, you’ll know for certain they have given up on the fantasy of the tariff inflation. Stay tuned.

Robert Romano is the Executive Director of Americans for Limited Government Foundation.