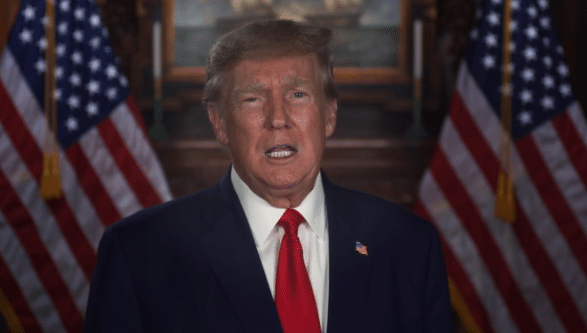

President Donald Trump on Aug. 7 via executive order directed federal departments and agencies to take on debanking by financial institutions, which deny access to checking accounts, payment processors and other financial services due to political grudges and other viewpoint-based discrimination that has taken place against small businesses, individuals and even the President himself who was debanked from the payment processor Stripe following the riot at the U.S. Capitol on Jan. 6, 2021.

For political conservatives, the political abuses by the Internal Revenue Service, via Operation Chokepoint, by financial institutions or private social media companies are nothing new, but now finally, the issue of cancel culture is finally getting the attention it deserves. Americans need access to the financial system in order to prosper and when they are quietly canceled by financial institutions, the harmful impacts are felt by impacted households.

The focus on financial services and debanking is a new development for the Trump administration although the policy something long sought by conservative activists.

In the President’s order, the Department of the Treasury, the Federal Reserve Board, the Office of the Comptroller of the Currency, the Federal Deposit Insurance Corporation (FDIC), the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), the Federal Housing Finance Agency (FHFA), the National Credit Union Administration (NCUA), the Consumer Financial Protection Bureau (CFPB) and the Small Business Administration (SBA) must end political and other unlawful discrimination in banking.

The agencies must “remove the use of reputation risk or equivalent concepts that could result in politicized or unlawful debanking, as well as any other considerations that could be used to engage in such debanking, from their guidance documents, manuals, and other materials (other than existing regulations or other materials requiring notice-and-comment rulemaking) used to regulate or examine financial institutions over which they have jurisdiction.”

The order applies to all financial institutions subject to regulations by those departments and agencies, and will include rescinding or amending existing regulations that make debanking possible under the current framework: “The Federal banking regulators shall also consider rescinding or amending existing regulations, consistent with applicable law, to eliminate or amend any regulations that could result in politicized or unlawful debanking and to ensure that any regulated firm’s or individual’s reputation is considered for regulatory, supervisory, banking, or enforcement purposes solely to the extent necessary to reach a reasonable and apolitical risk-based assessment.”

This is a sea change in financial regulation, but much still depends on the strategy that will be laid out by Secretary of Treasury Scott Bessent who will “develop a comprehensive strategy for further measures to combat politicized or unlawful debanking activities of financial regulators and financial institutions across the Federal Government, including consideration of legislative or regulatory options to eliminate such debanking.”

That’s a fairly wide mission, and the analysis will undoubtedly have to consider whether existing laws go far enough to prevent political discrimination in financial services, or if civil rights laws need to be updated to reflect the times and financial technologies that all citizens need to thrive in today’s digital-based economy.

Particular attention will need to be given not just the FDIC-insured and SBA lenders, but also the very thorny issue of payment processors, whose control over who gets to charge credit cards is the nexus of the financial cancel culture monopoly that must be addressed. Also, look at how diversity, equity and inclusion (DEI) standards were imposed on financial institutions via Environmental, Social and Governance (ESG) investing and other policies led directly to the cancelations.

But this is long overdue. Thank you, Mr. President. Already, enough people complained over the repeated violations it finally got the attention it deserves by the executive branch. Congress can pour cement on this executive order with further action and should conduct hearings. Let these households and small businesses tell their stories and be heard. For them, this is only the beginning.

Robert Romano is the Executive Director of Americans for Limited Government.