Consumer prices slowed to 2.7 percent growth the past 12 months, down from 3 percent in September, the latest data from the U.S. Bureau of Labor Statistics (BLS) shows. The news comes on the heels of the latest income reporting with average weekly earnings in the private sector growing at 3.5 percent the past year, with incomes outpacing inflation for about 29 months now.

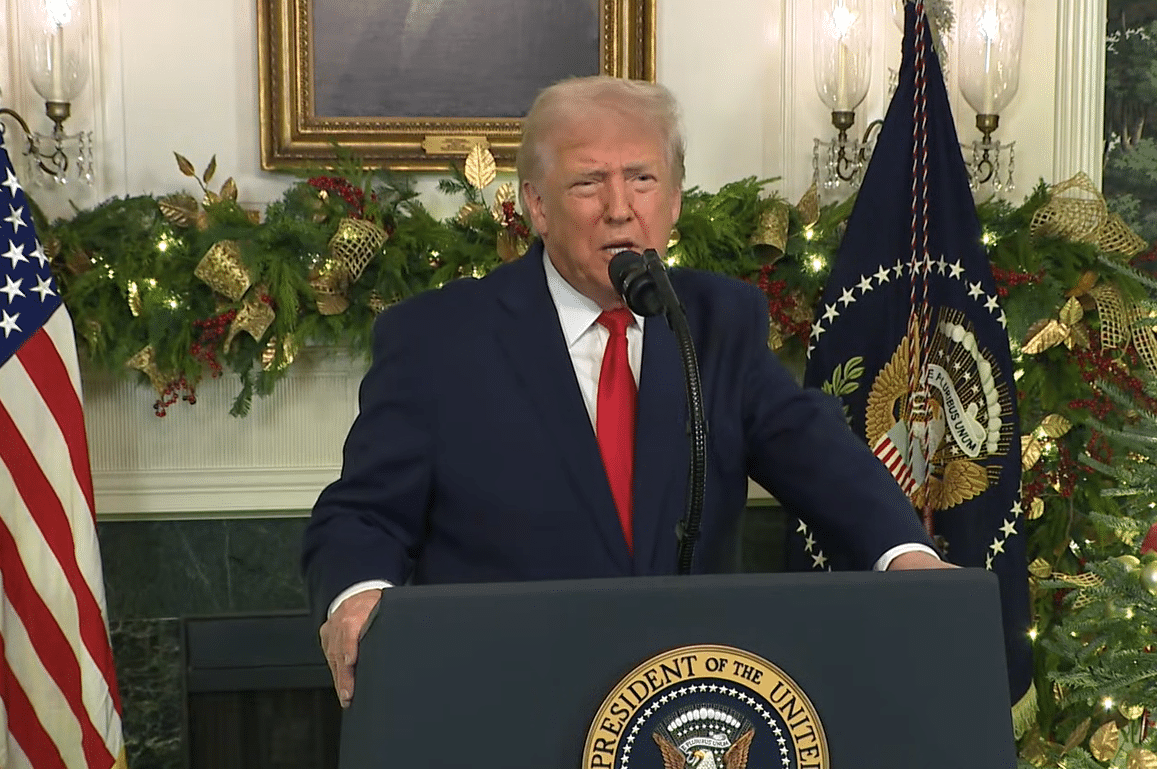

Eventually, that will be felt by the American people. Dutifully, President Donald Trump reminded the American people in a national address on Dec. 17, stating, “You will see in your wallets and bank accounts in the new year. After years of record setting falling incomes, our policies are boosting take-home pay at a historic pace. Under Biden, real wages plummeted by $3,000. Under Trump, the typical factory worker is seeing a wage increase of $1,300. For construction workers, it’s $1,800. For miners, we’re bringing back clean, beautiful coal, it’s $3,300. And for the first time in years, wages are rising much faster than inflation… How big is that?”

So, it’s happening, you can see it on the chart, that wages and incomes are catching up. It’s a really good argument, academically. But, politically, here’s the problem.

That takes a really long time.

“How big is that?” If you go back to Jan. 2021, consumer prices on all goods have increased 23.75 percent. But average weekly earnings have still only increased 20.7 percent.

Meaning, we’re still feeling the inflation from the Biden years.

Now, I could go and cite, since Jan. 2025, again, with ten months of data since Trump was sworn in again, consumer prices are only up 1.6 percent and average weekly earnings are up 3.5 percent. That’s great news, and for the most part, historically, that’s what the American people are used to: Getting wealthier.

But the American people don’t feel it yet because we’re still behind where we were at the beginning of 2021. We remember.

Making matters worse, if the present annual rates for inflation — 2.7 percent consumer price inflation and 3.5 percent earnings — were to hold just where they are, in one year, in 2026, again, going back to 2021, prices would still be up 26.8 percent and earnings only up 24.9 percent.

In two years, in 2027, prices would still be up 30.3 percent and earnings only up 29.3 percent.

In three years, in 2028, prices would still be up 33.8 percent and earnings up 33.85 percent.

Meaning, at current rates, it will take about another three years before we ever break even from the inflation that began under former President Joe Biden. That’s how big it is, right now.

By then, again, it will be 2028. That’s when Vice President J.D. Vance or some other Republican will be running for president.

So, yes, academically speaking, eventually wages and incomes will overcome the inflation, but it’s going to take a really long time if that’s the only intervening factor.

Politically, for President Trump and Republicans headed into the 2026 Congressional midterms, it’s a flashing red light, not even a year into the new administration.

Here’s more bad news. Before Covid, the average annual growth of average weekly earnings was only 2.5 percent. Inflation was lower, at 1.7 percent. In 2026, inflation is expected to cool more, but what usually happens is then so do earnings.

Generally, wages and incomes should stay ahead of inflation, but not by enough for the American people to really feel it in time for the next election. 2028 is curious, since by then, wages and incomes will have been outpacing inflation for more than six years, and yet the numbers show we still have a long way to go to get out of the hole the Biden economy left the American people.

In 2024, Republicans were the beneficiaries of inflation eating incomes. Now, those same forces that catapulted them into power will work against them. Rosy projections won’t change that. Optimism won’t change that. Even if President Trump had virtually flawless messaging, and he doesn’t, it might not change it.

For the wages beating inflation story to be big enough when it will matter the most for Republicans — when the American people vote — earnings will need to increase much faster, and what would really help would be if prices went down or even just stopped growing for a little while. The problem there is the only proven method for cutting prices are recessions. Of course, no politician wants to hear that. And it doesn’t solve the problem: Recessions tend make wages and incomes slow down, too.

But we might get a recession anyway. Or already be in one. Or already had one, with the unemployment level up almost 2.1 million since Jan. 2023. Which is what usually happens after peak inflation, which was reached in June 2022 at 9.1 percent.

So, another thing to try would be to absolutely flood markets with more goods. We need a lot more food, a lot more electricity and so forth. And politically, to sustain the current administration, you need them now. Boost production, import more, whatever it takes to increase supplies. Don’t just pause tariffs on food, you need to get more food here, fast. It worked with eggs. Boosting supplies is key.

The only other thing to try might be to burn a trillion dollars in a bonfire to reduce the money supply. Instant recession! In all seriousness, though, the Federal Reserve has already switched to cutting interest rates to support labor markets post-peak inflation.

The bottom line is the American people are still behind where they were when President Trump left office the first time. No, you can’t wave a magic wand to make it all better. The President is making about as strong a case as he can that things are getting better and will get better, eventually. But, politically, believe it or not, time is already running out. Joe Biden tried to tell his story, too.

Robert Romano is the Executive Director of Americans for Limited Government Foundation.