$4.242 trillion. That’s how much debt has been added since Nancy Pelosi and Harry Reid took control of Congress and passed their first budget. That’s a 32 percent increase to the national debt in less than three years, which now stands at to roughly $13.249 trillion, according to the U.S. Treasury.

Put another way, one out of every three dollars every individual American now owes in debt they can thank Reid and Pelosi for. That’s approximately $18,912 for every adult in the U.S., and $36,886 for every household.

Thanks, Nancy and Harry!

Although Barack Obama prefers to say that he inherited the bleak budget from the Bush Administration, it is more accurate to look at the composition of Congress, since it wields the power of the purse. By that measure, Obama has his colleagues in the House and Senate to blame for the budget deficits, and since 2007, Congress has been controlled by Democrats.

For 2010 alone, the deficit is expected to be a record $1.47 trillion, according to the White House’s Office of Management and Budget (OMB). Again, that falls right on Reid and Pelosi’s laps. Next year, OMB projects the deficit will total $1.42 trillion, $150 billion more than previously projected.

To be fair, the debt will actually have grown by a lot more than $1.47 trillion in 2010. That number will be more like $1.825 trillion, after $197 billion for “direct loan accounts” is taken into account and another $158 billion is raided from the Social Security and Medicare trust funds, if the OMB’s 2010 projections are to be trusted.

But, for simplicity’s sake, let’s just stick with the $1.47 trillion deficit. Put into perspective, to close that $1.47 trillion budget hole, Congress would have to cut the equivalent of one-hundred Departments of Labor, with its $14 billion budget, 16,000 employees, and whatever offices and equipment it uses, to balance the budget. That represents some $875,000 that is spent on a per employee basis, not for salary, but in total.

Assuming fairly consistent spending per employee between all departments, the government would have to lay off more than 1.6 million federal employees and eliminate the departments and agencies they work for just to balance the budget.

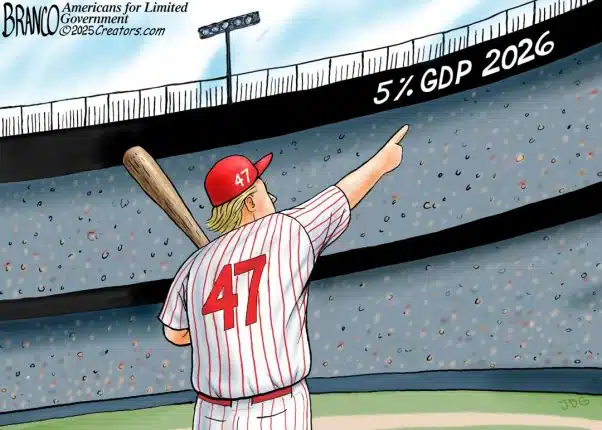

In short, the federal government has simply become unsustainable. And yet, Obama, Reid, and Pelosi propose adding another $10.6 trillion to the national debt by 2020, when it will total $25.777 trillion. And that is assuming the White House’s rosy economic growth projections, which it says will average 3.92 percent every year. No recessions. No other financial crises.

If they are wrong, we’re in big trouble. It the numbers are off, interest owed on the debt will grow faster than projected, as will the total debt owed.

What’s worse is the toll that all of this deficit-spending is taking on the real economy. The $1.825 trillion in U.S. treasuries sold for 2010 to finance the debt represents $1.825 trillion of lost opportunities. Instead of investing in companies — and jobs — money is flowing through a useless paper trade to fund government spending.

Increasingly, the public treasury, and not productivity, is the central source of “wealth.” But considering that the Federal Reserve owns about $777 billion of treasuries, much of that is just monopoly money. As the Department of Treasury comes up short at future auctions to service the debt, the Fed will undoubtedly print more money to fill in the gap.

Make no mistake, that’s not good. One need only look at the example of the Weimar Republic to know that one cannot just print money for long before it is no longer accepted as a means of debt repayment.

When that happens, the American people will know who to thank. In the meantime, there is no doubt that this mountain of debt that cannot be repaid is strangling the economy, killing jobs, and destroying any hope that the U.S. will remain the world’s economic superpower.

Thanks, Nancy and Harry — for nothing.

Robert Romano is the Senior Editor of Americans for Limited Government (ALG) Bureau.