Among the zombie regulators held over from the Obama administration, including Consumer Financial Protection Bureau director Richard Cordray and now outgoing Internal Revenue Service Commissioner John Koskinen, another holdover still in place is Federal Housing Finance Agency (FHFA) Director Mel Watt.

Watt was appointed by former President Barack Obama, took office in Jan. 2014, and is presently serving a five-year term in office.

But according to 12 U.S. Code § 4512(b)(2), an FHFA director can only be “removed before the end of such term for cause by the President.” The clause “for cause” means that, presumably, some form of malfeasance would have to occur to get rid of Watt.

A similar clause in Dodd-Frank protects Cordray as well from outright removal. But a federal court recently found that to be unconstitutional, as it abrogates the President’s constitutional authority under Article II to staff the executive branch.

But how about urging lenders to make home loans to borrowers who may not be able to afford it, said to be one of the underlying causes of the financial crisis ten years ago?

That surely sounds like “cause” for removal to me.

As highlighted by the Paul Sperry in the New York Post, Watt is having Fannie Mae and Freddie Mac, under government conservatorship since 2008, continue to use weak underwriting guidelines. Per Sperry, “[B]orrowers need only put 3 percent down to get a Fannie-backed loan — even if the down payment is a gift. Fannie also has started up a new subprime lending program.”

To be fair, Fannie, Freddie and the FHA for that matter never really stopped providing low down payment loans since the financial crisis (disclosure: this author got one in 2011 prior to refinancing at a private bank a few years later), and one can argue about how impactful such policies were to causing the crisis. But they were a vital feature of the system leading up to the previous housing crash, and remain so, enabling the maximum number of borrowers to get mortgages — by design. But, by definition that does increase risk, especially for higher valued homes when borrowers might be right on the margins of qualifying.

The idea is to sell houses fast with a liquid lending market. The downside is when a big recession and unemployment wave hits, as in 2007 through 2009, followed by the foreclosures. While the lending conditions may or may not play a role in such a crash, they can enable the concentration of the risk, which banks like Fannie and Freddie are supposed to be prepared to manage.

Sounder guidelines might find realtors and lenders steering potential homebuyers into smaller, more affordable homes, instead of trying to make the biggest possible sale. Commissions might suffer, but the upside would be a more sustainable market. It shouldn’t be a game of musical chairs every time the economy takes a downturn.

Other things to look would also include overall debt to income ratios allowed by federally backed lenders when making loans, the concentration of high-risk stock on agency-issued mortgage-backed securities and perverse incentives under Gramm-Leach-Bliley for lenders to engage in riskier, “affordable” housing lending in return for mega bank mergers.

Overall, government guarantees of home loans, considering the portion of the mortgage market it controls, undoubtedly played a role in driving up prices during the housing boom. It led to overproduction. More homes were built than could be filled.

Ultimately, a stable economy with good-paying jobs that is growing solves most of these problems. There is much less of a call for government-backed lending programs when hard-working Americans can afford to go to a private lender.

But don’t expect Watt to look into any of that. Nor does he have any plan to unwind Fannie and Freddie. Watt, a former member of Congress, in Oct. 3 testimony to the House Financial Services Committee stated, “it is the role of Congress, not FHFA, to decide on housing finance reform.” Thanks for the helpful advice there, director. Now, do you have any real ideas for how to get the government out of the lending game? While surely Congress must enact a new law to take Fannie and Freddie out from under conservatorship, this type of punt by a bureaucrat who manages trillions of dollars of debt is inexcusable.

Government agencies including the GSEs own or guarantee $6.3 trillion of mortgages nationwide. This could be privatized, by selling those assets to private financial institutions, including locally to community banks. Unwinding Fannie and Freddie in an orderly fashion could take some time, but after a decade it’s about time the nation had a serious discussion about the financial crisis and how we can prevent another one.

A strong leader at the FHFA will be needed to prepare and evaluate that proposal, and to make recommendations. That is not Watt.

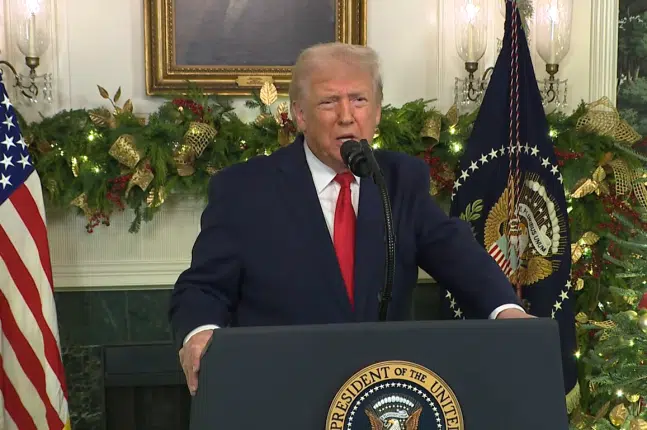

It’s not a question of whether anything can be done to reform housing finance. Lots can be done. But with politicians like Watt in charge of the nation’s leading mortgage lenders, that’s never going to happen. President Trump should do the entire industry and the nation a favor and find a new director of the FHFA before 2019. No need to wait for federal courts to adjudicate. He has the constitutional and legal authority, and there is “cause,” seeing as Watt has no idea how to reform the nation’s housing markets.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government.