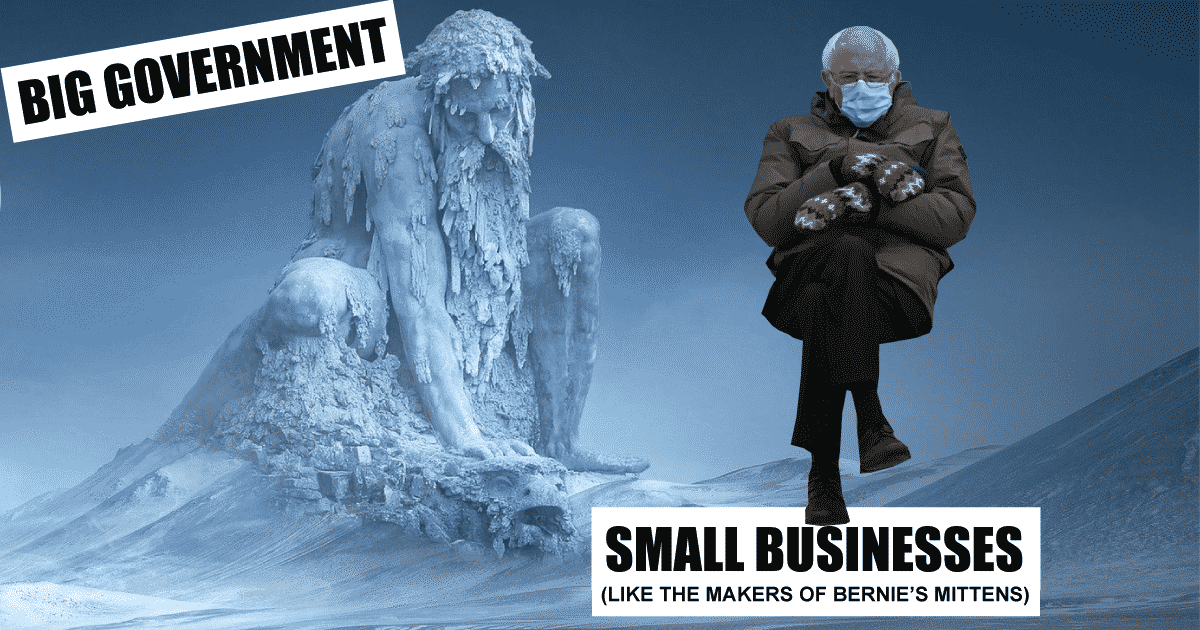

Behind the hilarious Bernie Sanders memes from the Biden Inauguration, is the story of a small business taxed to death by Sanders’ socialist tax policies.

According to Slate magazine, people on social media are obsessed with the mittens Bernie is wearing and have been wondering where they can buy them. Slate caught up with the mitten-maker herself, Jen Ellis, who lives in Essex Junction, Vermont. In between teaching her class of second graders, Ellis explained why her mittens are no longer available for purchase.

“People have been contacting me thinking that they can get mittens, and actually they can’t. I don’t have any more, and I don’t have much of a mitten business anymore because it really wasn’t worth it. Independent crafters get really taken for a ride by the federal government. We get taxed to the nth degree, and it wasn’t really worth it pursuing that as a business, even as a side hustle.”

That’s ironic, because Ellis said she is a supporter of Bernie Sanders and Joe Biden, both of whom embrace the big government taxes she said crushed her small business.

Like the Vermont mitten-maker, Colleen Martines, of Leonardtown, Maryland, is also an independent crafter. Martines makes jewelry out of repurposed glass and agrees that small businesses are taxed too much.

“Small business owners, crafters especially, put so much into their work,” explained Martines. “It can be very discouraging to see how much the government takes from you at the end of the year.”

Under former President Donald Trump, Martines, as a sole-proprietor, got a tax break as a result of the Trump tax cut, which lowered the top rate from 39.6 percent to 37 percent; the 33 percent bracket was lowered to 32 percent; the 28 percent bracket to 24 percent; the 25 percent bracket to 22 percent, and the 15 percent bracket to 12 percent. The 10 percent and 35 percent brackets were unchanged.

Those provisions alone saved individual taxpayers including sole proprietors $1.2 trillion over ten years, and then the deduction of 20 percent of net business income from income taxes saved another $414 billion for businessess including sole proprietors. Unlike the corporate tax that falls partly on workers in the form of lower pay, the individual income tax is paid by pass-through businesses, including sole proprietors.

During the campaign, Biden promised to roll back the Trump tax cuts on ‘day one,’ saying it won’t hurt businesses ability to hire. Biden’s plan would raise the top rate back to 39.6 percent on income above $1 million and phase out the business deduction for filers over $400,000.

According to the Committee for a Responsible Federal Budget, Biden will need to raise $2.25 trillion over the next decade to finance his socialist healthcare agenda. That’s not counting the cost of lowering Medicare’s eligibility age to 60.

But Biden has repeatedly promised voters who earn under $400,000 that his tax hikes will not affect them. Narrowly speaking, that is true. However, according to the independent analysis of the Penn Wharton Budget Model, those households would see lower investment returns and wages as a result of Biden’s corporate tax increases.

Economists at The Tax Foundation agree. Board member and former head of the Congressional Budget Office Doug Holtz-Eakin has pointed out, “it simply is not economically possible to segregate the impacts on the high-income from everyone else.” That’s because the rich purchase items from others, some not as rich, and from businesses that employ workers across the income spectrum.

Martines’ small business is one of those pass-through businesses that would be hurt by Bidens’ plan to raise taxes. “Democrats always say they are only going to tax ‘the rich,’ but everyone knows the money is in the middle class,” explained Martines. “Under Trump, I got a break. Under Biden, I am bracing for the worst.”

The Bernie mitten-maker clearly needs to be deprogrammed, or at the very least, take a basic math class. She has been brainwashed into voting for politicians who support policies harmful to her own self-interest. The chickens are voting for Col. Sanders.

Catherine Mortensen is Vice President of Communications at Americans for Limited Government.