Former President Donald Trump, Republican candidate for president in 2024, is proposing automatic reciprocal trade tariffs on goods from foreign trade partners in response to competitive currency devaluations including China, the trade in goods deficit which rose $30.4 billion to $382.9 billion in 2022, according to the latest data from the U.S. Census Bureau.

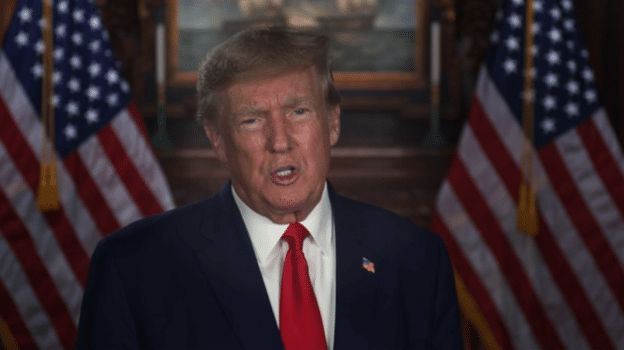

Describing his proposal in a video on Truth Social and Rumble, Trump stated, “we will phase in a system of universal, baseline tariffs on most foreign products. On top of this, higher tariffs will increase incrementally depending on how much individual foreign countries devalue their currency.”

Trump explained, “They devalue their currency to take advantage of the United States, and they subsidize their industries, or otherwise engage in trade cheating and abuse. And they do it now like never before, and we had it largely stopped and it was going to be stopped completely within less than a year.”

In addition, Trump promised that the more foreign trade partners devalued their currencies, resulting in reciprocal tariff increases, taxes on American producers would go down: “As tariffs on foreign producers go up, taxes on American producers will go down and go down very substantially. And that means a lot of jobs coming in.”

This is one of the most comprehensive approaches to reciprocity in trade and targeting competitive currency devaluations in American history, and comes atop historic first of its kind provisions against currency devaluation in the U.S.-Mexico-Canada (USMCA) trade agreement and the 2020 trade agreementwith China that Trump struck with Beijing right before Covid swept over the world.

On currency, the USMCA “address[es] unfair currency practices by requiring high-standard commitments to refrain from competitive devaluations and targeting exchange rates, while significantly increasing transparency and providing mechanisms for accountability,” according to the U.S. Trade Representative.

Since 2008, the Mexican peso has depreciated against the U.S. dollar by almost half, from $0.10 per $1 dollar to $0.055 per $1 dollar. Under USMCA, currency devaluation is an unfair trade practice.

As for China, from May 2020 to March 2022—right before a massive strengthening of the dollar following Russia’s invasion of Ukraine and Federal Reserve tightening—the Chinese yuan similar shrunk against the dollar, from 7.13 yuan per $1 dollar in May 2020 to 6.31 yuan per $1 dollar, a 12 percent currency devaluation. Since then, even as the dollar strengthened to historic highs to tame high inflation, the yuan also strengthened, as the exchange rate reached 7.3 yuan per $1 dollar in Oct. 2022, before dropping once again to 6.7 yuan per $1 dollar in Jan. 2023. Today, it stands at 6.9 yuan per $1 dollar.

Meaning, despite high inflation and a relatively stronger yuan year over year, China still expanded its advantage on trade over the U.S. in 2022 as the trade in goods deficit with China rose by 8.3 percent. In Jan. 2023, the 12-month increase in inflation stood at 6.3 percent. So, the gap is only widening.

Which, the Trump trade proposal on currency could finally address. As important as the historic agreements with Canada, Mexico and China on currency were at the time, as with any agreement there must be an enforcement mechanism. Reciprocal tariffs upon currency devaluations can do just that, whether they are implemented by a future President Trump, or the current President Joe Biden, or any other president. It’s time to get tough.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government.