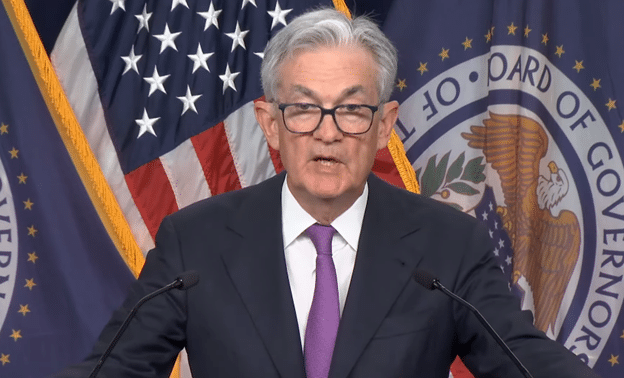

“This would be a PERFECT time for Fed Chairman Jerome Powell to cut Interest Rates. He is always ‘late,’ but he could now change his image, and quickly.”

That was President Donald Trump on Truth Social on April 4 urging Federal Reserve Chairman Jerome Powell to begin the process of cutting interest rates, something the central bank usually undertakes towards the end of the economic cycle after peak inflation and as unemployment is rising.

Trump said that inflation was in the rear-view mirror, noting recent drops in energy and food prices, and also interest rates, arguing, “Energy prices are down, Interest Rates are down, Inflation is down, even Eggs are down 69%, and Jobs are UP, all within two months – A BIG WIN for America. CUT INTEREST RATES, JEROME, AND STOP PLAYING POLITICS!”

Here, Trump has a point. Since his April 2 announcement of reciprocal tariffs against trade partners around the world, the price of oil has plummeted from $72 to about $57, a 22 percent drop.

Eggs are down, too, from more than $8 a dozen to just $3.26 a dozen, nearly a 60 percent drop, according to the latest data compiled by the Department of Agriculture.

On interest rates, at the time of the President’s April 4 post, it was certainly true that interest rates were dropping amid the flight to safety last week, with 10-year U.S. treasuries briefly dropping below 4 percent. However, the trend has reversed as certain institutional investors have been selling off bonds at the same time equities and commodities contracts were selling off, with 10-year treasuries hitting 4.44 percent as of this writing.

There is usually an inverse relationship between that of equities and commodities and that of bonds. When interest rates are high, it can discourage investment in the economy via traditional vehicles like stocks. The rationale is that investors can get a better rate of return by lending money than investing — that was certainly true in the 1970s amid high inflation and interest rates — but also because the cost of borrowing can become cost prohibitive.

However, when equities and commodities then take a hit, as they are now, the traditional response is for markets to buy bonds, particularly treasuries, a practice that usually has the near-term impact of lowering interest rates. It is therefore very curious to see stocks, commodities and bonds all selling off simultaneously.

Bloomberg.com’s Alice Atkins wrote on April 8 the bond selloff could in part be fueled by China selling treasuries in response to the U.S. tariffs. But also that hedge fund “basis trading” could be having a major impact: “[t]he basis trade — a popular hedge fund strategy that profits from the difference between cash Treasuries and futures — may be unwinding and causing yields to surge.”

Whatever the cause, foreigners dumping treasuries or hedge funds, the impact of higher interest rates when the economy is taking a hit could be a double whammy. Unemployment is already up since Jan. 2023 by about 1.3 million as inflation has slowed. When that starts happening, that is usually a signal for the Fed to begin cutting interest rates, as Trump has been suggesting.

In 2020, when a selloff in treasuries happened amid the Covid economic lockdowns and the basis trade unwinding — unemployment was also going to the moon — it was also a signal that the Fed needed to intervene in bond markets to purchase treasuries. That could very well be the case here as well.

As it is, Treasury Secretary Scott Bessent has articulated that the U.S. policy at the moment is for a strong dollar, which will help bring costs down for Main Street. And so it might be concerning that these movements in bond and currency markets have cause the dollar to temporarily weaken.

As it relates to China, if the U.S. were potentially skidding into kinetic conflict — certainly one hopes that can be avoided but the U.S. must prepare for the worst — one thing to anticipate would be an all-out assault on the dollar with higher rates being weaponized, which would undermine for example America’s ability to finance military production. It is certainly a national security risk that shouldn’t be discounted.

Powell may not be a wartime consigliere but for now, the U.S. is stuck with him, and we might need to get on a wartime footing very quickly. During the Civil War, Abraham Lincoln had to resort to self-financing with greenbacks when foreign lending dried up and was cost prohibitive. Trump clearly hopes to engage in peaceful trade negotiations to rebalance the U.S. economic relationship with the world, but Beijing might not see it that way.

The Fed doesn’t get to set fiscal and trade policy, which falls upon our elected leaders, any more so than it could have wished the Covid economic lockdowns away. Trump could be right, it might indeed be time for the Fed to begin cutting rates and buying bonds again. Whatever disagreement there is with the President’s policies, the treasuries market should be defended at all costs from any selloff, especially if the dollar is being attacked. Whatever prior schedule Powell was on might be out the window.

Robert Romano is the Executive Director of Americans for Limited Government Foundation.