“I wouldn’t think that we would have supply chain shocks, and I think retailers they have managed their inventory in… front of this… and they know that President Trump is committed to fair trade and have planned accordingly.”

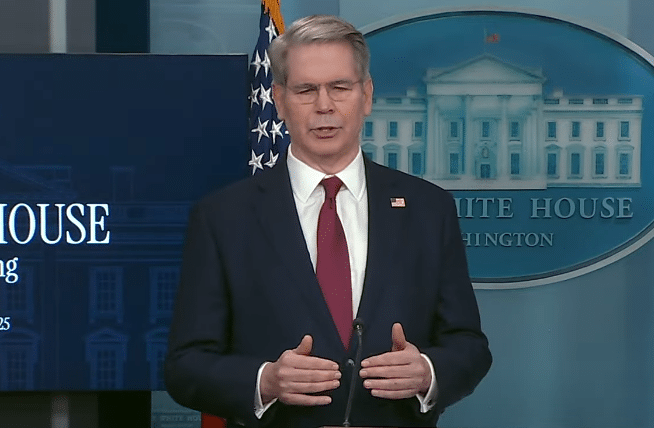

That was Treasury Secretary Scott Bessent at the White House on April 29 briefing reporters on what to expect over the coming months as the economy and companies adjust to the new reality on tariffs and U.S. trade policy.

It’s a really good question. As the U.S. shifts away from reliance on China, where will the offset be in terms of U.S. production?

Since 1979, almost 7 million manufacturing jobs have been lost in the U.S., from a peak of 19.5 million all the way down to its current level of 12.7 million, almost a 35 percent decrease, following the North American Free Trade Agreement (NAFTA), permanent normal trade relations and World Trade Organization induction for China.

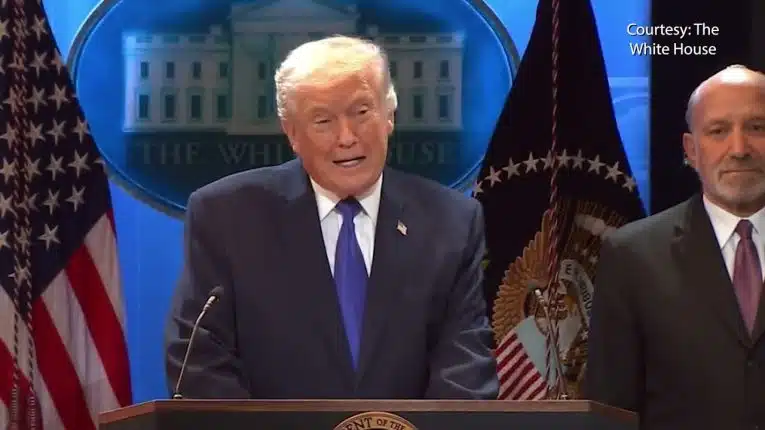

Now, the U.S. under President Trump’s leadership is making the conscious effort to bring production—especially industries critical to national security including auto manufacturing, chips and computers rare earth minerals and energy production—back to the United States.

Already there have been trillions of dollars of commitments made by companies like Apple, OpenAI, Nvidia and so forth to make investments in the U.S.

But leaving nothing to chance, Secretary Bessent said that in the budget reconciliation bill coming through Congress, besides the President’s signature no tax on tips, overtime and Social Security, one item being closely considered is factory expensing to incentivize the construction of new factories in the U.S.

Bessent said, “I think there’s a very good chance we’re going to get this tax bill done, and the tax bill is going to be very powerful for domestic U.S. investment. So, what we are going to do — one of the most powerful parts of President Trump’s 2017 tax bill was full expensing of equipment. We are going to make that as President Trump said in his speech to Congress that will be retroactive to January 20th. The other thing that we are looking to add is full expensing for factories, so bring your factory back, you can fully expense the equipment and the building.”

Bessent added, “We will couple that with deregulation, cheap energy and regulatory certainty and that will continue to make the U.S. the greatest destination for domestic and foreign investment.”

Factory expensing could be a game-changer and be just the incentive companies need to come back to the U.S. And so long as defense production needs remain unmet, in the event of if war we would be dependent on very long supply lines that lead back to our adversaries. And so, trust but verify could be an important rule of thumb.

One area that might provide a valuable lesson is the coal industry. Following the 2007 Massachusetts v. EPA Supreme Court decision that allowed the EPA to regulate carbon emissions under the Clean Air Act, followed by the Obama administration’s 2009 carbon endangerment finding. In 2017, the Trump administration began rolling back some of the Clean Power Plan regulations that incentivized coal power plants to switch over to natural gas, withdrew from the Paris climate accords and in 2022, the Supreme Court overturned them in the landmark West Virginia v. EPA ruling, but a lot of the damage by then was already done.

In 2008, the U.S. total electric power industry was producing 4.119 billion megawatt hours (MWh), including 1.985 billion MWh from coal, 882.4 million MWh from natural gas and 56.2 million MWh from solar and wind combined, data from the U.S. Energy Information Administration (EIA) shows.

And in 2022, total electricity output was up to 4.230 billion MWh, including 831 million MWh from coal, 1.687 billion MWh from natural gas and 578 million MWh from solar and wind combined.

In the meantime, the U.S. population has increased by more than 30 million to 334.9 million, a 10.1 percent increase. But overall electricity generation has only increased by 2.6 percent. Demand is up, but electricity production has not kept up — by design — and so prices skyrocketed, with electricity prices up 47 percent since Jan. 2009 since former President Barack Obama embarked upon this path.

The reason is since 2007, coal mining production has decreased by 53 percent, according to Federal Reserve data. Coal mining itself has decreased from 1.1 billion short tons in 2007 down to 577 million short tons in 2023 according to U.S. Energy Information data, a 49 percent drop. Even during the first Trump administration, despite the change in policies, there was a 26 percent from 2016 to 2020 drop once the Covid recession hit in 2020, and then the Biden administration kept production at that lower level from 2021 to 2024.

The point is, Trump had changed the policies thought to be hurting coal production, but production by and large kept falling all the same. That might change during the second Trump administration, but somebody has to look to see what the numbers are. Is coal production actually increasing?

Is oil production? You can look that up, too.

Besides eliminating money printing or lowering demand, the other sure-fire way to reduce inflation and prices is to boost production.

And so it will be when it comes to shifting manufacturing back to the U.S. The President, Congress and his team are putting together the policies they think will bring back big investments into the U.S. and restore American manufacturing dominance. A lot of companies have made commitments. And there is a major tax incentive, factory expensing, being contemplated so companies have a reason to break ground here and make new manufacturing.

Congress needs to make sure it’s big enough to create the incentive—and then somebody needs to check to make sure the factories are really getting built. Trust but verify, Mr. President.

Robert Romano is the Executive Director at Americans for Limited Government.