Federal spending outlays will increase a whopping $3.38 trillion from their 2024 level of $6.87 trillion to $10.2 trillion by 2034, according to former President Joe Biden’s last budget submitted to the White House Office of Management and Budget (OMB).

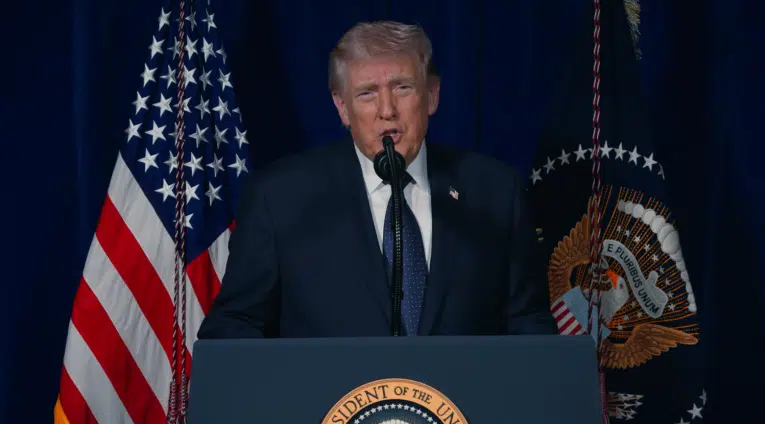

The estimates are a year old, and we still await President Donald Trump’s first full budget that will adjust the baseline, hopefully taking into account the impacts of the One Big Beautiful Bill Act, but it is still instructive about the dire fiscal trajectory the American people find themselves on.

By this metric, it is very easy to see where the cost drivers of the budget and therefore the deficit are — posing a challenge for professional handwringers in Congress who profess they wish to eliminate the deficit or balance the budget. They’re not really serious.

Social Security will increase from $1.45 trillion to $2.43 trillion, a $980 billion jump, 28.99 percent of the $3.38 trillion increase, as 1.3 million Americans turn 65 every single year.

Medicare similarly will increase from $839 billion to $1.76 trillion, an $927 billion increase, or 27.9 percent of the increased spending.

Medicaid will increase from $567 billion to $996 billion, a $429 billion increase, or 12.6 percent of the increased spending. It is worth noting that this program too has a senior citizen cost driver included, as many seniors might require nursing homes or home attendants that Medicaid covers when their assets are all gone.

Other mandatory spending, including items like food stamps, federal financial aid for education and so forth will increase from $1 trillion to $1.291 trillion, a $291 billion increase, or 8.6 percent of the increased spending.

Net interest owed on the debt will increase from $889 billion to $1.57 trillion, a $612 billion increase, or 20.1 percent of the increased spending.

That’s all the mandatory spending that occurs because eligibility for programs like Social Security, Medicare and Medicaid are written directly into law. To change those laws requires 60 votes in the Senate usually under traditional filibuster rules, which would require a bipartisan consensus.

Then there’s the so-called discretionary spending Congress votes on every year, which is making up a smaller and smaller portion of overall spending, making it difficult to eke any savings from there.

There, defense spending will increase from $884 billion to $1.07 trillion, a $218 billion jump, and just 6.4 percent of the increased spending in the baseline.

And non-defense spending will increase from $1 trillion to $1.13 trillion, a $171 billion increase, and just 5 percent of the increased spending.

So, right off the bat, 56.8 percent of all the increased spending is Social Security and Medicare. Add Medicaid to mix — why not since seniors use that too? — and you wind up with 69 percent of the increased spending is just from those three programs.

Conservatively, OMB estimates the national debt will rise to $52 trillion by 2034. But the truth is the debt has grown on average 8 percent a year since 1980 once wars and recessions are factored in. Another recession here, a war there, and the baseline debt will continue its nearly doubling trajectory it has been on the past several decades, surpassing perhaps $76 trillion by 2035 and $100 trillion not too long after that. By then, the debt to GDP ratio will be well north of 200 percent.

And yet there’s very little that is being done about it currently. Because there is no cure for aging.

Does anyone seriously think that either a bipartisan consensus to cut benefits would ever emerge? It’s a fantasy. Currently there are 61.8 million seniors. There’s also another 41.1 million 55-to 64 year olds will similarly be added to the Social Security and Medicare rolls by 2035, while many current beneficiaries sadly pass away.

And yet on the current trajectory, both the Social Security and Medicare trust funds will be exhausted by 2033 according to the trustees, at which point there might only be enough revenue to pay 80 percent of benefits. At that point: Will Congress A) Let the cuts happen or B) Just borrow the money from the general fund?

Certainly there are other structural reforms that should be considered. For example, the federal government owns about $7.2 trillion of non-marketable treasuries. Could the government get a better rate of return by investing in the economy instead?

And there’s our fertility deficit, the true reason why we’re going broke, since 1960 the number of babies per woman has plummeted from 3.6 to 1.6, accounting for millions of potential taxpayers who were never born. In the meantime, more than two out of three women today are going to college, delaying marriage and child rearing. It’s a vicious cycle.

Apparently, the nation would rather the country goes broke than have an uncomfortable conversation with single women. But you never know, there could be additional financial incentives provided to foster a baby boom, but it would have to compete with the more than $60,000 subsidy that comes up front for college educations, not to mention the higher incomes and lower unemployment that come from women possessing degrees. It won’t be cheap.

As for the current drivers of the debt, Social Security, Medicare and Medicaid, suffice to say, there will be overwhelming political pressure to keep benefits as they are, especially since seniors paid for it. The alternative is likely a political buzzsaw that many fools, including Elon Musk’s newly minted America Party, will insist it is safe to walk under. Good luck with that.

Robert Romano is the Executive Director of Americans for Limited Government Foundation.