Consumer inflation grew by 0.2 percent in July and is 2.7 percent above last year’s level according to the latest data from the Bureau of Labor Statistics, relatively flat from the prior month as food and energy prices continue cooling amid boosted production globally, down from 2.9 percent when President Donald Trump took office in January.

Food at home was down 0.1 percent.

Gasoline was down 2.2 percent.

Electricity was down 0.1 percent, a welcome change.

And piped gas service was down 0.9 percent. All great news.

Inflation is continuing its three-year downward journey from peak inflation in June 2022, which usually is a great time to cut interest rates for the Federal Reserve, especially when couple with labor market signals favoring higher unemployment, which has increased 1.489 million since January 2023, most of which occurred during former President Joe Biden’s tenure of office. The rest, 387,000 comes since January, continuing the slow upward trend.

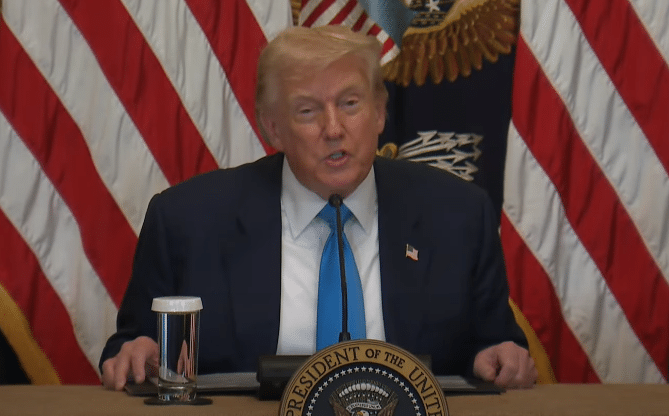

Where that stops is an interesting question, and so far, President Trump has called for easing interest rates into that softening of labor markets, while Federal Reserve Chairman Jerome Powell has stated he wants to wait to see if tariffs cause general inflation to rise first.

Now, Trump’s tariffs are largely in place with China one of the few countries still figuring out their full status, with another 90 days of talks scheduled to hammer out details between the all-important trade relationship.

Spacing out the negotiations has allowed a lot of the tariffs around the world to already take effect, and August will be the first full month of the reciprocal tariffs. So if there were to be a short-term import price increase perhaps August will see something — because so far there has not be spiraling inflation predicted by the President’s tariff opponents.

In fact, import prices have been trailing the full consumer price index since August 2022 after outpacing it in 2021 and the first half of 2022 according to Bureau of Labor Statistics data, as it has historically following peak inflation in prior cycles.

With so much downward pressure on inflation globally, perhaps it’s just the case that President Trump chose an excellent time to raise tariffs during the cooling prices. To compete, importers will have to keep cutting prices while that goes on, especially if there’s a slowdown economically.

Historically, the Fed tends to also wait for more significant increases in unemployment before proceeding with rate cuts. But right now the unemployment rate is still only 4.2 percent, although notably above its low of 3.4 percent in April 2023.

With more than 900,000 Baby Boomers leaving the labor force every year, labor shortages could mean that unemployment does not go as high as in prior recessions or slowdowns.

The central bank will also usually leave the federal funds rate above the consumer price index until the next recession. Even then the Fe has more than full point to move as inflation continues its cooling cycle. There’s room to go down.

As for the tariffs, most of them have already been in effect for months, judging by the billions of new tariff revenue coming in, up more than $20 billion a month since the April tariffs began. Why aren’t we seeing a big jump since April in consumer prices? After the August tariffs take effect, it might just be because they’re not coming.

Robert Romano is the Executive Director of Americans for Limited Government Foundation.