“It’s tough to do a lot of specific things but… you’re going to see some substantial announcements over the next couple of days in terms of things we don’t grow here in the United States: coffee being one of them, bananas, other fruits, things like that, so, that will bring the prices down very quickly…”

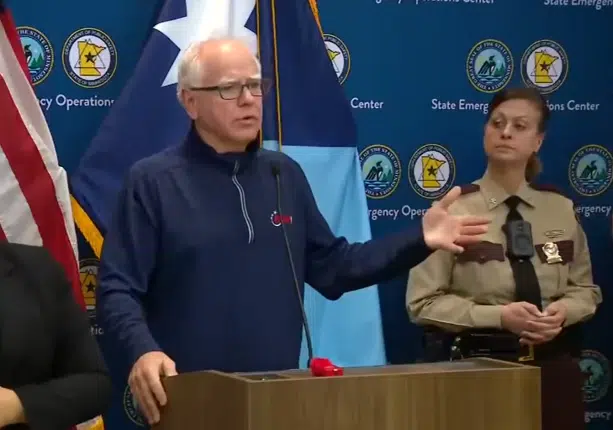

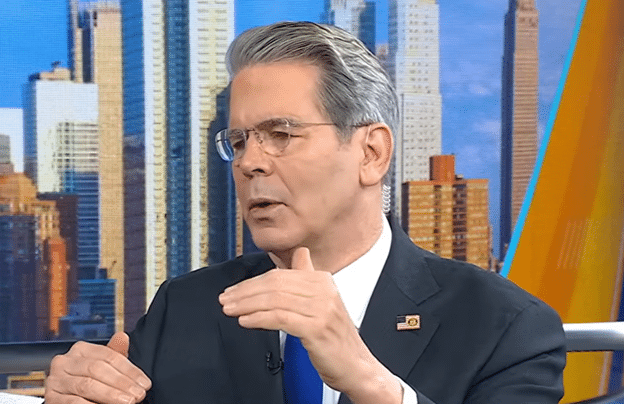

That was Treasury Secretary Scott Bessent on Fox and Friends on Nov. 12 outlining next steps that President Donald Trump is taking to fight food inflation in the U.S., which sat at 3.1 percent growth over the past twelve months, by flooding supermarkets with “things we don’t grow”, using the President’s art of deal to lower tariffs significantly on those items and get them here quickly.

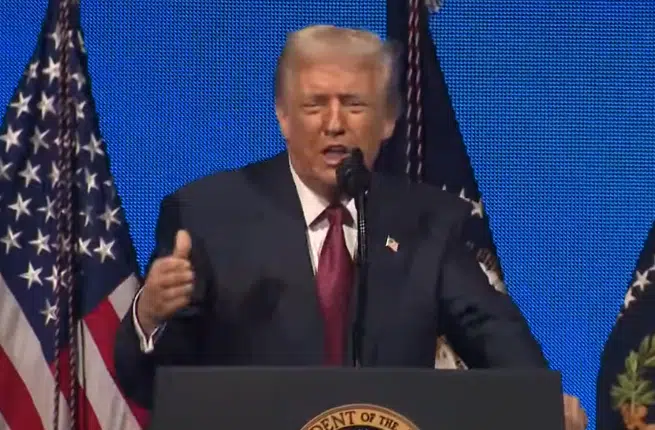

Bessent’s appearance followed President Trump on Fox News’ Laura Ingraham Show on October 10 stating, “Coffee, we’re going to lower some tariffs… We’re going to have some coffee come in… We’re going to take care of this stuff very quickly, very easily.”

Trump also said “beef is a little high” in the interview and has already stated he plans on importing more beef from Argentina. The President is rightly concerned with the price of beef. The last time Trump was President, right before Covid, steaks were $7.70 per pound in Dec. 2019, now they’re $12.26, the highest ever, according to Bureau of Labor Statistics data. That’s a 59 percent increase, far above average weekly earnings, which are only up 28 percent since that time.

More than anything including immigration if you were reading the polls in 2024, inflation was the number one reason Joe Biden and Kamala Harris were thrown out of office, and cost Democrats the House and Senate. It’s a majority killer. No party is immune.

And so, besides boosting electricity, oil, gas, industrial and agriculture production longer term, the President wants to help lower prices immediately by importing more where needed. You could say President Trump and his team are leading a Manhattan Project of sorts to get prices down. It’s a race against time.

One could say there was a trial run on this idea earlier in 2025, when to bring down the price of eggs, the U.S. imported lots of eggs, according to the U.S. Department of Agriculture in June: “USDA’s continued efforts to supplement domestic shell and egg products have resulted in an increase in imports to help bolster our domestic supply. Since January 2025, more than 26 million dozen shell eggs have been imported from Brazil, Honduras, Mexico, Turkey, and South Korea for breaking and pasteurization, increasing the quantity of eggs available to consumers. An additional 14 million egg products have been imported this year, bringing total egg imports to over 40 million. To compare, in 2024, U.S. egg production totaled 109 billion eggs. To more smoothly facilitate these imports, USDA has inspected and approved three new facilities—one in Arkansas and two in New York—to receive imported shell/table eggs for breaking and pasteurization, bringing the total number of approved facilities in the United States to six.”

Egg prices peaked at $6.27 a dozen in March and are now down 43.9 percent to $3.48 per dozen in September, according to U.S. Bureau of Labor Statistics data, while U.S. producers recovered their chicken populations from Avian flu slaughter of what the Texas Department of Agriculture has estimated is 166 million chickens since 2022 that caused the shortages to begin with.

The plan worked. What else does the President need to know about it? It’s hard to argue with success. And now the Trump administration is looking to increase other food imports. What’s the President got to lose? Inflation targeted tariff reductions on goods the United States lacks, particularly foods, can speed along disinflation in U.S. consumer markets, bringing down costs for households when they go to the grocery store. That’s immediate relief.

This also reflects non-ideological thinking about trade, with the President showing himself to be flexible when there are shortages. That should be welcome although it might also be fun for the President to play favorites when it just so happens key Trump ally Javier Milei in Argentina, also an inflation warrior, whose country has over 50 million head of cattle in addition to America’s 94 million, although both producing nations are seeing herd depletion, including U.S. based heads of cattle decreasing more than 6 percent since 2020. Biden killed the cows.

Still, with more imports, beef prices can be offset, which is the function of trade: To import more of what you need. Ranchers won’t like it but you know who likes high prices even less? Voters. If nothing else, the imports could be serendipitous to those who choose to take the time to recover herds after years of culling.

A key commodity is land. The U.S. Department of Agriculture in July announced President Trump and Agriculture Secretary Brooke Rollins’ expansion of grazing lands available to ranchers, with over 24 million acres of grazing lands vacant that calls for “rebuild[ing] herds”: “Together, the agencies [Bureau of Land Management and U.S. Forest Service] administer approximately 240 million acres of rangelands across 28 states, supporting over 23,000 permittees and lessees. There are roughly 29,000 grazing allotments nationwide—about 10% (24 million acres) are currently vacant. Grazing on federal lands sustains rural economies, supporting 14,200 jobs and $645 million in GDP on USFS lands, and 35,000 jobs and $2.7 billion in output on BLM lands.”

Sounds like there’s more land than there are cows to stand on it.

Fortunately, President Trump’s Big Beautiful Bill that expenses up to 100 percent of costs for qualified property for any firms undergoing expansion. Sounds like a good time for ranchers to invest more in breeding and to leverage the vacant federal lands towards those ends. If prices are coming down, that means they’re going to need to sell more cows to get a good return in the coming years. The President is thinking about this the right way.

Besides eggs, now we’ll be bringing in more beef, coffee, bananas and other foods that we need so that a year from now, the American people can be feeling real relief right away. The inflation crisis was years in the making, it jeopardizes any political administration and so now is the time to be working on it hard until prices come down and it’s going to take a lot to get out of it. Flood markets now, or be flooded by voters very soon with the Congressional midterms looming. That makes it as much a political problem as an economic problem. And so for the President it’s an easy decision.

As Bessent noted in his Fox interview, “[W]e inherited this affordability mess, it was the worst inflation in 40 or 50 years, one of the worst in the nation’s history—and affordability has two components: So, there’s the price level and then there’s income level and what happened under Biden was the cumulative inflation, stated inflation, CPI, was 28 to 23 percent, but what happened, was their basket of goods and services, food, insurance, auto payments, was up in the 30s. So they felt a real gigantic differential there…”

Over the course of the next few years, Secretary Bessent said Americans could expect the appreciation of real wages , which is always the true antidote long term to inflation, as America reindustrializes and rebuilds its manufacturing base: “[W]hat we’re going to do is by bringing back high paying manufacturing jobs, President Trump is going to do what he did in his first term and that is for hourly workers and working Americans to have real wage increases. So… imagine two lines, there is the inflation line, we’ve got that under control, it’s leveled out, that is going to start turning down, then there’s the income line, which under Biden, because so many of the jobs were government jobs, you can’t get real wage growth from a government job, real wages are going to increase and I would expect in the first quarter, second quarter of next year, those two lines are going to cross and the American people are going to start feeling better. Look, this has been a tough period.”

And that households will feel the relief very soon and that the manufacturing renaissance in America will play a big role in boosting wages in the U.S.: “[Y]ou are going to feel it. I was just down in my hometown of Charleston, South Carolina, on Friday, and this new Boeing plant is opening up. That’s a thousand new jobs that the President has brought back… I went to a rare earth plant up in Sumpter, South Carolina, 800 construction jobs, 300 permanent jobs that they think could become 3,000 permanent jobs. The great part of the story there is those are Caterpillar workers who’ve been laid off. Thanks to President Trump, a new factory has moved in. So as we bring these trillions of dollars of investment into the U.S. they’re all starting to break ground now, and look, I would’ve loved to be able to snap my fingers, have these facilities going, it takes time, we got the tax bill passed on July 4th, which gives huge incentives to companies to come into the U.S., build your factory, expense it immediately, and create American jobs and 2026 I think is going to be a blockbuster year.”

It’s a two-pronged approach. Increase supplies in the short term and over the medium and longer term, invest in high paying jobs in America to boost wages and incomes as Americans become wealthier.

From the President’s perspective, he is already almost 25 percent of the way through his second and final term, and job number one for any President when it come to inflation is to get prices down as fast as possible and then, over the longer term, get incomes and wages up. So far, so good — and now the President is getting the word out that he expects prices to come down and if they don’t, he’ll import where needed until they do.

Robert Romano is the Executive Director at Americans for Limited Government Foundation.