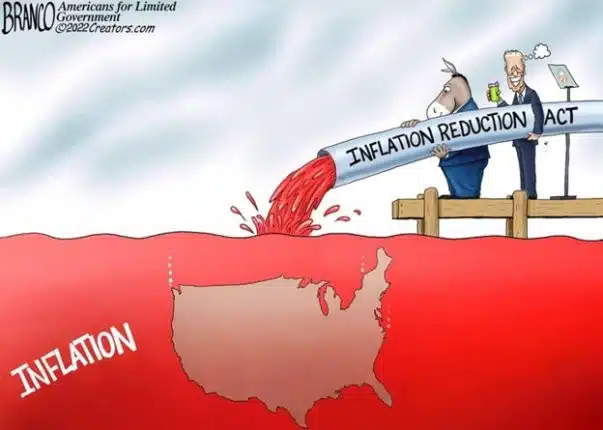

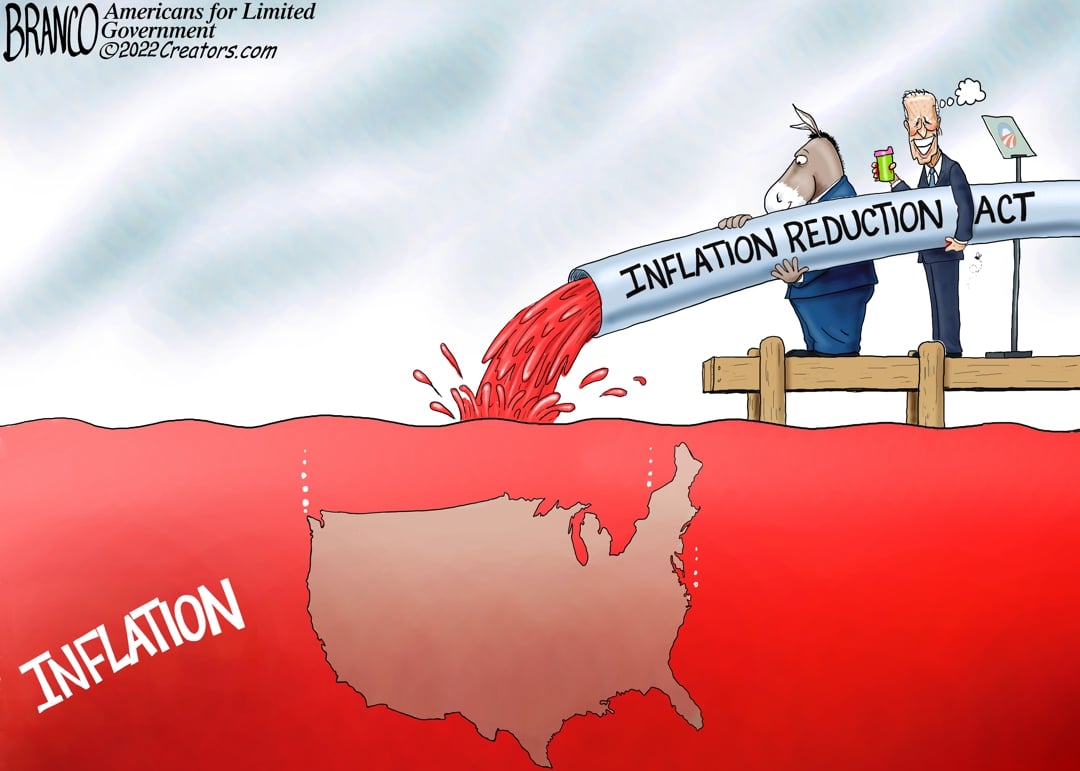

Producer inflation for goods was unchanged in December, according to the latest data compiled by the U.S. Bureau of Labor Statistics (BLS), including food and energy, which decreased 0.3 percent and 1.4 percent respectively.

That is fairly good news, but it is somewhat overshadowed by overall producer prices increasing 0.5 percent, more than expected, including goods besides food and energy increasing 0.4 percent and services increasing 0.7 percent.

That unfortunately is a continuation of what the American people have been seeing for the past five years of sticky inflation that began in 2021. Since inflation peaked in 2022, voters have generally been treated with some good news and some bad news. It’s been two steps forward, one step back. It was so bad it made Joe Biden a one-term president just like Gerald Ford, Jimmy Carter and George H.W. Bush, who all saw inflation outpacing incomes for significant portions of their presidencies.

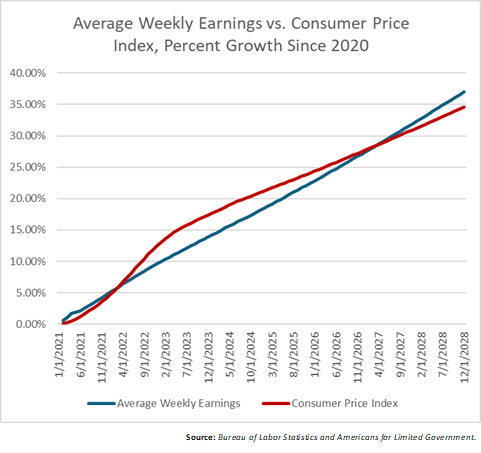

Overall, if consumer inflation at its current level growing 2.7 percent the last twelve months and nominal average weekly earnings growing 3.75 percent — earnings have been outpacing prices since mid-2023 — then break-even from the Biden-era inflation will not occur until about mid-2027, according to an Americans for Limited Government Foundation analysis of BLS data.

This is likely weighing on President Donald Trump’s approval among voters, who is still upside down on independents, especially as it relates to inflation and the economy. He’s basically inherited Biden’s numbers on the economy as inflation is still registering as the top issue in polls. It’s about 25 percent and jobs and economy 12 percent in the latest Economist-YouGov poll taken Jan. 23 to Jan. 26.

Low approval generally weighs on members of the President’s party in Congress in midterms regardless of party or majority status and so low approval on the top issues has to be concerning for Republicans in 2026 as it was for Democrats in the presidential election in 2024, particularly since with inflation, long term, the only thing that gets wages keep ahead of prices is time and a good economy.

Anything below 50 percent approval and with the exception of 2022 the incumbents are usually looking at double-digit losses in the House — a very common outcome for almost every president. Again, the equation on wages versus inflation began to right itself in 2023, it was just too late to help Biden in 2024, and now the current trend, which is positive news, almost certainly seems to also be too late to help Republicans in Congress in 2026.

Looking to mid-2027, when U.S. households finally hit break even from the inflation, one might expect to see the President’s numbers on the economy to improve somewhat. By that time, Democrats might be wrangling up their next impeachment post-2026, while the GOP can start to benefit from the positive economic long-term trends.

At a recent press briefing, the President claimed that he had bad public relations people while acknowledging the messaging gap Republicans definitely have on the economy right now. But the more relevant factor is simply time.

Just as bad numbers hurt, good numbers ultimately help incumbent parties, but it does take time. In the short term, time might not benefit Republicans this year, there is more than enough of it for people to really “feel” wealth creation aspects certainly by the time 2028 rolls around, likely benefiting Vice President J.D. Vance or whosoever Republicans nominate that year.

But in Congressional midterms, the economy has a tendency to hurt the incumbents when voters feel bad about it. Taking a closer look at 1958, the year Democrats picked up 15 Senate seats, going from 49 to 64, with a majority that would last until 1980. That year, Republicans also lost 48 House seats. It’s also when Eisenhower’s approval rating measured by Gallup was the worst.

That year there were two major factors headed into the midterms: The Little Rock Crisis of 1957, when Dwight Eisenhower had to put the military into Arkansas to desegregate public schools, and there was a recession in 1958. With the exception of West Virginia, all of the Senate seats lost in 1958 were Union states in the Civil War. It was the recession, not deploying troops domestically, that gave Democrats their supermajority.

Usually, the economy as a factor analyses look at presidential years when it comes to elections during or immediately after a recession: 1976, 1980, 1992, 2008 and 2020. The incumbents lost every one of those elections. They also lost in 2024 with bad inflation, although the Bureau of Economic Analysis has yet to acknowledge there was a recession coming out of the post-Covid inflation.

As hard as it is to swallow, economic dissatisfaction should be worrisome for any administration. A silver lining for the President is a recent New York Times poll taken Jan. 12 to Jan. 17 shows voters blame Biden at 35 percent to Trump at 31 percent for the current economic situation, including 30 percent of independents who blame Biden and 29 percent who blame Trump. Meaning, independents might be receptive to a message that realistically projects where they should expect to be in a relatively short amount of time.

Break-even from the Biden era inflation won’t be until mid-2027, which is better than nothing, but it also shows why people are still feeling the inflation. The American people are not yet satisfied with inflation picture, and neither should the President. It’s getting better. Now, assuming the President’s economic team doesn’t have anything else up their sleeves to boost production, strengthen the dollar or anything else that might help cool prices, then it’s just a matter of time.

Robert Romano is the Executive Director of Americans for Limited Government Foundation.