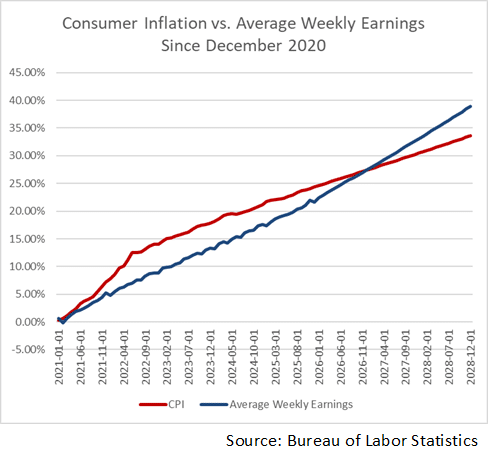

Consumer prices grew 2.4 percent the past 12 months in January and average weekly earnings grew 4.3 percent, according to the latest data from the U.S. Bureau of Labor Statistics. Last month, it was inflation at 2.7 percent and earnings at 3.7 percent.

That’s a significant improvement and certainly great news for the U.S. economy and households that are still struggling to break even from the inflation that began in 2021 and peaked in June 2022 but still outpacing incomes until about June 2023.

It’s a hole Americans are still digging their way out of. Since December 2020, prices have increased 24.6 percent but average weekly earnings have only increased 22.48 percent.

As a result, last month, the break-even date from the inflation was not going to be until mid-2027. But now, with the latest improved numbers, that is, if the current rate of increase for average weekly earnings and consumer prices hold at their current rates — with earnings growing almost 2 points faster than prices when last month is it was 1 point — break-even from the inflation that began during former President Joe Biden’s term will be by the end of 2026, according to an Americans for Limited Government Foundation analysis of U.S. Bureau of Labor Statistics data.

By then, again, if the current numbers hold, by December, prices will have increased 27.38 percent from December 2020 levels and earnings will have increased 27.43 percent. From there, it’s all gravy. By December 2027, prices will have increased 30.46 percent and earnings 33 percent, a widening, healthy distance that Americans are accustomed to — the kind that builds wealth.

Which is the way to think about it. Since the 1960s, for the most part, incomes were staying way ahead of inflation, but there were hiccups a few times in the 1970s, the early 1980s, the early 1990s and again in the 2020s. Every time, these maladies have healed themselves over time because the U.S. economy just keeps chugging along, wealth is created and households ultimately benefit. But it took a lot of time.

And sometimes you get a much-needed boost. Just think, in one month, the Trump economy bought about six months of time with wages speeding up and prices slowing down. It’s exactly the formula to help American families to get ahead and start building wealth once again — and it’s happening faster than anyone could have predicted.

It’s much needed relief, and long overdue. The trouble started after the brief but steep Covid recession of 2020 after the economy reopened sooner than expected, production did not catch up and in the meantime Congress and the Federal Reserve ensured more than $6 trillion would be printed and borrowed into existence for the pandemic.

Technically, earnings have been outpacing inflation, again, since mid-2023 but without breaking even, it was no help for former President Biden and former Vice President Kamala Harris, who went on to lose the 2024 election to President Trump, largely on account of the inflation.

President Trump has gone on to inherit Biden’s approval numbers on the economy and inflation, for which he is upside down on, according to Economist-YouGov data. When Biden left office, 61 percent disapproved of him on inflation, and very similarly, as of Feb. 6 to Feb. 9, 59 percent disapprove of Trump on inflation. Because the American people still haven’t broken even yet on the inflation.

But now it’s finally coming. President Trump and Treasury Secretary Scott Bessent promised that in 2026, the American people would begin to feel the relief as the economy righted itself. So, you can just mark it in real-time, by this time in 2027, and then again in 2028 — if the earnings keep outpacing inflation — the reality of getting wealthier will be realized by the American people, and so public attitudes about the economy should dramatically improve. Because they always do, eventually.

The question for Trump and Vice President J.D. Vance or whoever runs for the Republican nomination 2028 will be whether they catch up in time for the presidential election, let alone the 2026 Congressional midterms. Right now, politically there’s a lot of ground to make up even as the economy continues improving. Remember, by mid-2023, earnings began outpacing inflation again, but it wasn’t enough to help Democrats in 2024. Don’t expect instant results politically.

Going forward, the Trump administration will want to stay focused, stay on message, and be able to set expectations accordingly for the American people about where we are and about what they’re doing to bring prices down, which is, boost production, increase earnings, facilitate investment — and get out of the way. Promises made, promises kept. But don’t act satisfied until the American people say they’re satisfied. Keep hustling. There’s still a ways to go.

Robert Romano is the Executive Director of Americans for Limited Government Foundation.