By Robert Romano — Ever since the U.S. gold standard was weakened in 1913 with the creation of the Federal Reserve system, then again during the Great Depression, when the domestic supply of gold was confiscated in 1933, and finally eliminated all together by Richard Nixon in 1971, when international convertibility was suspended, debate has raged over whether we are better off with the system that replaced it: The dollar standard.

By Robert Romano — Ever since the U.S. gold standard was weakened in 1913 with the creation of the Federal Reserve system, then again during the Great Depression, when the domestic supply of gold was confiscated in 1933, and finally eliminated all together by Richard Nixon in 1971, when international convertibility was suspended, debate has raged over whether we are better off with the system that replaced it: The dollar standard.

Or, more specifically, the debt standard.

The debt standard

Now, instead of the expansion of gold stocks, the contraction of new debt — by governments, financial institutions, businesses, and consumers — is the primary mechanism by which new dollars are created. Conversely, debt repayment decreases the money supply, leading to deflation, an economic malady policymakers have ever since the Depression era sought to avoid.

For that reason, politicians have almost always sought to avoid repayment at any cost, instead causing a perpetual expansion of debt on all fronts to fund everything imaginable — war, entitlements, corporate and social welfare, you name it. This has been used as a means of facilitating inflation — incentivizing deficit-spending by government, credit expansion by financial institutions, and excessive leveraging by households, all in order to expand purchasing power.

This has led to the explosion of the national debt to over $14.7 trillion, helped facilitate the uncontrolled credit bubble of the 1990’s and 2000’s that finally wrecked the global economy in 2008, and today, still haunts us in the form of Europe’s sovereign debt crisis. It has caused a 95 percent devaluation of the dollar from its levels in the 1910’s, eroding the purchasing power of American families, furthering incentivizing the contraction of yet more debt.

Restoration of value

Now, 40 years later, after the gold standard’s demise, the nation is coming to a moment of reflection — to examine the fallout of that decision, and the chaos that has reigned ever since.

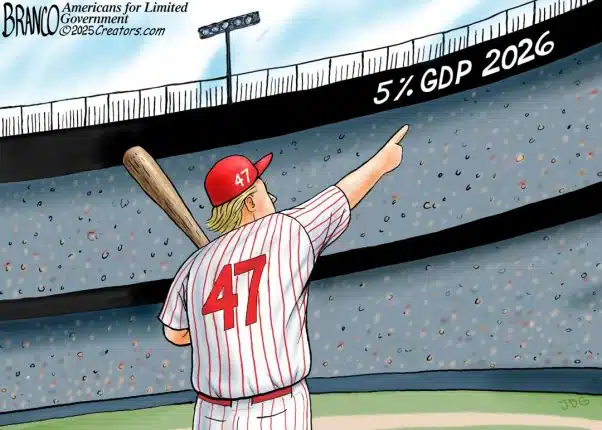

“The problem is that we have severed money from value,” Americans for Limited Government (ALG) President Bill Wilson observed recently, adding, “To get back to price stability and robust economic growth, we must restore money as a reliable store of value.” But how?

One author may have an answer. Lewis Lehrman of The Lehrman Institute has penned a new book, The True Gold Standard, to provide a basis for restoring convertibility — both at home and abroad — of dollars into a fixed weight of gold, defined by law.

Today, dollars, and dollar-denominated assets — such as U.S. treasuries — are held in reserve by foreign governments and financial institutions all over the world. That system, writes Lehrman, must come to an end.

Lehrman points to the explosion of the nation’s balance of payments deficit with foreign nations — the trade deficit plus financial transfers — and extreme budget deficits as primary evidence that the world’s dollar standard system is a failure. By establishing the dollar as the word’s reserve currency, other nations were incentivized to depreciate their own currencies, cheapening the value of their exports.

Writes Lehrman, “since World War II, free trade has often been at the expense of United States businesses, manufacturing, and labor,” adding, “In the long run, free trade without stable exchange rates is a fantasy.” Harsh words, but they are not without basis. After all, the U.S. cannot control the value of foreign currencies, leaving the nation vulnerable to what Lehrman termed “mercantilists” who know how to game the system to their advantage.

He writes, “Under the world dollar standard, other nations gain desired reserves only as the U.S. becomes an increasingly leveraged debtor through balance-of-payment deficits.”

Instead, under an international gold standard, trade could be facilitated without these structural imbalances with a single, agreed-upon unit of measurement to the mutual benefit of all who participate.

‘Natural money’

Lehrman begins his analysis by examining the properties of gold itself, down to its atomic structure revealing “perfect integrity, homogeneity, and fungibility,” making it “imperishable, indestructible, and malleable”. These characteristics, combined with its relative scarcity and portability, has led to its use as money over the past few millennia. He calls it “natural money.”

For those who have insisted that there would not be enough gold to reinstate a gold standard, Lehrman has an answer: Over the centuries, its stocks have grown in proportion to population and productive output. In other words, there is as much gold today per capita as there was at the height of the U.S. gold standard.

He compares gold to the uniform standards of weights and measures, noting that Congress’ power to coin money is in the same exact clause of the U.S. Constitution.

Moreover, Lehrman credits the classical gold standard with being “the stable institutional monetary foundation associated with the extraordinary economic and population growth of the vast Industrial Revolution of the nineteenth century.” Hard to argue with success.

The true gold standard versus the ‘modern gold standard’

Lehrman’s plan differs from other proposals, such as the “modern gold standard” — a price-fixing scheme wherein the price of gold would affixed to, say, $500 an ounce, and the Federal Reserve would conduct its open market operations with an eye to keeping the price there.

The problem with this approach, and other similar proposals, is that since the current excess supply of dollars is the result of credit expansion, the only way to reduce the price of gold — as in a price-targeting mechanism — would be a substantial reduction of U.S. debt. But, the Fed cannot do anything about that. Only our fiscal authorities can engage in debt repayment.

So, the price target, naturally being set too low, would simply result in a run on gold assets — i.e. a severe misallocation of resources — since it would do nothing to reduce the money supply.

Moreover, without convertibility, a “modern gold standard” would be practically useless as a limiting mechanism on credit expansion. Thus, it would do nothing to achieve price stability.

Lehrman rejects this approach, instead insisting on full, unrestricted convertibility of dollars into a fixed weight of gold. To get there, he lays out a systematic plan to be enacted into law.

The plan

Although Lehrman supports the establishment of gold as the international monetary standard of choice, he contends that the U.S. could — and should — proceed unilaterally to dollar-gold convertibility.

In the event of unilateral resumption by the U.S., Lehrman sets forth specific guidelines for financial institutions to follow, with an aim to replacing government securities held at banks with gold and short-term corporate securities. This would reduce bank credit to the government, opening up credit to the private sector.

He writes, “By means of statutory convertibility, the plan disciplines and limits the contemporary, unrestrained, credit-creating banking system, thus limiting the increase in government spending.”

A balanced budget, whether by constitutional amendment or statute, would work in tandem with the gold standard to reduce government spending.

The new standard would occur on a date certain based on the “pre-resumption market-price discovery period,” after which “the gold value of the dollar should be established at a level, depending on economic circumstances, not less than the weighted average of the marginal costs of worldwide gold production, measured in dollar terms, such that the level of wages would not fall.”

After convertibility is re-established, then Lehrman calls for a domestic currency exchange at a ten-to-one ratio. In short, a new currency would be issued to represent claims on gold — a revaluation of the dollar. So, if the market value of gold was $2,000 an ounce at the time of convertibility, this would be converted into $200. A half-ounce would be $100, and so forth.

Far-reaching benefits

For Lehrman, the benefits of reestablishing the gold standard would far-reaching. He promises that its restoration internationally would 1) discipline government by limiting government spending, 2) all but eliminate the balance of payments deficit, 3) roll back debt leverage in the financial system, 4) halt currency instability, and 5) bring to an end to the boom-to-bust economic cycle characterized by periods of severe inflation followed by deflation.

And that it would restore sustained economic growth by incentivizing private investment in productive capacities, creating millions of jobs, instead of today’s flight to safety in gold and treasuries.

With all these advantages, Lehrman’s plan could very well be the means to restoring value to money, and ending the destructive debt standard that has left the global economy lost at sea. Call it a golden opportunity.

Robert Romano is the Senior Editor of Americans for Limited Government.