As originally published at Investor’s Business Daily.

By Howard Rich — The euro zone isn’t the only economy reeling from “failed states.” The United States has several of its own — most notably California and Illinois.

By Howard Rich — The euro zone isn’t the only economy reeling from “failed states.” The United States has several of its own — most notably California and Illinois.

According to the CIA’s world factbook, California’s economy is the ninth largest in the world with a gross state product of $1.9 trillion. Illinois’ economy is the world’s 23rd largest economy with a gross state product of nearly $630 billion.

These are impressive figures, to be sure, but both states have seen their global position slip in recent years — and further erosion is likely thanks to poor fiscal stewardship and anti-competitive tax increases.

Both California and Illinois are hoping that tax hikes will bridge gaping deficits created by politicians’ failure to rein in government growth — including expanded entitlements and exorbitant public sector pensions.

Does any of this sound familiar? It should. This is precisely the sort of unchecked public sector growth that has landed Greece in its current predicament — a worsening crisis that has pushed the entire euro zone to the brink of collapse.

“Public payroll expenses (salaries and pensions of civil servants) rose in Greece from 38 percent of state revenue in 2000 to 55 percent in 2009,” reports Antonis Kamaris of the Council on Foreign Relations. “Compounding this trend, local elites became hostile to any coherent national reform effort, precisely to preserve the system that now privileged them.”

Greece relied on international bailouts and numerous new tax hikes to try and extricate itself from this Keynesian-induced morass — but these measures only further weakened its economy.

Again, sound familiar? It should.

Earlier this month, California Gov. Jerry Brown revealed that his state’s budget deficit had swollen to $15.7 billion — a 70 percent increase from Brown’s own projections just five months earlier. Estimates from California’s nonpartisan Legislative Analyst’s Office indicate that the state’s deficit could be even higher — perhaps exceeding $17 billion.

Brown blamed this worsening fiscal prognosis on lower-than-expected tax collections (further evidence of the punitive nature of California’s high marginal income-tax rates). Of course Brown’s solution to this dilemma is to further weaken the Golden State’s deteriorating competitiveness by following the failed Greek model.

“This is not Europe,” Brown told CBS’ Charlie Rose recently. “This is still the Wild West, and we’re going to prove to the rest of this country and the world that we know how to do it.”

But does California really know “how to do it?”

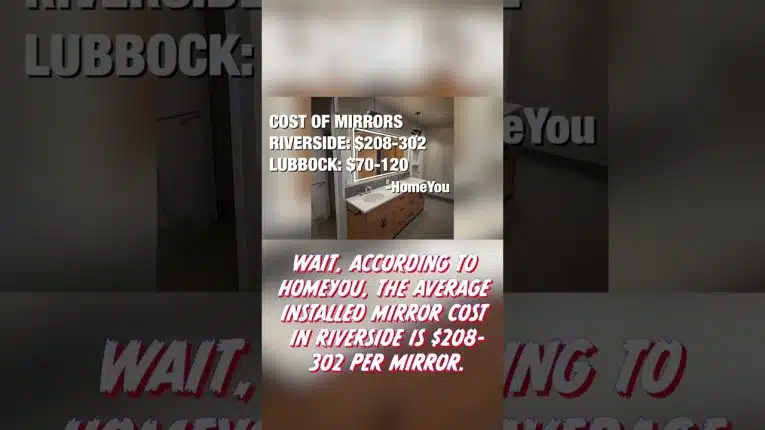

Brown is pushing to raise California’s sales tax (already the highest in the nation) from 7.25 percent to 7.5 percent. He also wants to slap higher income-tax rates on those making more than $250,000 — while raising the state’s marginal income-tax rate on millionaires from 10.3 percent to 13.3 percent (thus establishing the highest state income-tax rate in America).

Californians don’t have to look all the way across the Atlantic to see that this approach is destined to fail. They need only look halfway across their own continent.

In Illinois, income tax hikes haven’t solved the state’s budget crisis. That’s because most of the revenue generated by a 2011 marginal rate hike was earmarked for a $4.5 billion pension payment — not the state’s $5 billion deficit or its $9 billion backlog of unpaid bills.

Of course this $4.5 billion barely made a dent in the state’s long-term pension problem.

According to a 2011 report from the Pew Center on the States, Illinois’ total pension liability grew by 110 percent between 1999 and 2008 — leaving the state with a $119 billion unfunded liability.

The report found that just 54.3 percent of the state’s promised benefits were funded — the worst percentage in the entire nation. And that was before Illinois borrowed money to pay its pension costs in 2009 and 2010.

Not surprisingly, California and Illinois also have the nation’s two worst credit ratings — resulting in higher borrowing costs that further compromise their fiscal health.

Like the disaster in Greece — budget implosions in California and Illinois were completely avoidable. Politicians had years to right their respective fiscal ships, but chose instead to continue their “high time” spending. Once crisis hit, these same politicians then compounded their problems by relying on bailouts and tax hikes when they should have been undertaking long overdue reductions in the size and scope of government.

The lesson is clear: Raising taxes to support the unsustainable growth of an already bloated, debt-addled government is only going to make a bad situation worse. What’s required is a fundamental rethinking of what government should — and shouldn’t — be doing in the first place.

Rich is chairman of Americans for Limited Government.