On April 2, the Washington Post published an article entitled, “Obama administration pushes banks to make home loans to people with weaker credit.” The report cites a recent speech made by Federal Reserve Board Governor Elizabeth Duke advocating that more home loans be made to people with fragile credit scores.

“The drop in purchase mortgage originations, although widespread, has been most pronounced among borrowers with low credit scores,” Duke noted. She suggested the drop in originations was leading to depressed household formation (i.e. the amount of new homebuyers entering the market), which was down 59 percent in 2006 to 2011 versus the five years prior. This, in turn, is slowing down the economic recovery.

The solution, says Duke, is to start giving them loans. “I think the ability of newly formed households, which are more likely to have lower incomes or weaker credit scores, to access the mortgage market will make a big difference in the shape of the recovery,” she declared.

Duke further predicted, “I expect the strongest impetus to recovery to come from pent-up demand for housing in the form of household formation.”

So, there you have it. In order to foster a faster economic “recovery,” you, I, and everyone else need to take out more loans on houses we cannot afford. Never mind that the financial crisis, the ensuing credit contraction and recession were all caused by banks making loans to people who could not afford to repay.

“To suggest that lowering credit standards is the solution to the financial crisis is to ignore the past 20 years of history,” Americans for Limited Government President Bill Wilson said, pointing to previous episodes of government intrusion into the housing market.

“The same thing happened after the 1991 recession when credit slowed down. By 1992, Congress had agreed to institute and expand the GSE ‘affordable’ housing goals, which required an increasing percent of government-backed mortgages to be of lower quality,” Wilson noted.

“By 2007, when the bubble popped, those goals had expanded from 30 percent of Fannie and Freddie’s portfolios to 55 percent,” Wilson added. Meaning, by the time it all came crashing down, the government was requiring that more than half of the mortgages purchased by Fannie Mae and Freddie Mac, government sponsored enterprises (GSEs), needed to be to individuals with lower incomes, which tend to have a higher risk of default.

But why would the government do that? Wilson answers, “Since the economy is addicted to credit expansion, in order to grow, the incentive is for lending standards to become progressively weaker over time.”

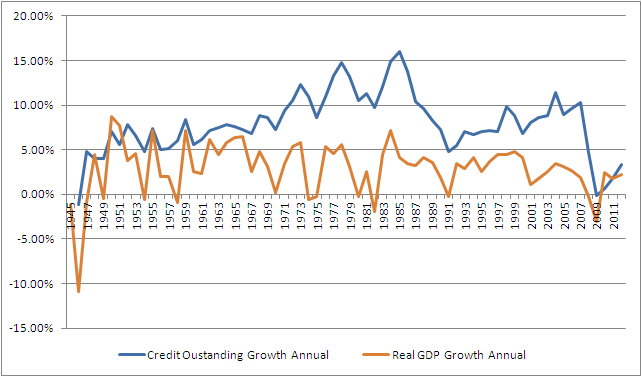

That is because whenever credit contracts or even slows down its expansion, as Americans for Limited Government has previously noted from data by the Bureau of Economic Analysis and the Federal Reserve, the economy tends to follow suit.

In 1946, 1949, 1954, 1974, 1975, 1980, 1982, 1991, 2008, and 2009, real Gross Domestic Product (GDP) contracted. And in each one of those years, credit outstanding nationwide had either contracted or slowed down. Conversely, when credit expands, so too does the economy tend to grow.

This feature of economic growth is slightly misleading, however, since GDP measures consumption. It does not measure whether such spending by individuals was borrowed or income-driven. Affordability is not included in the measure.

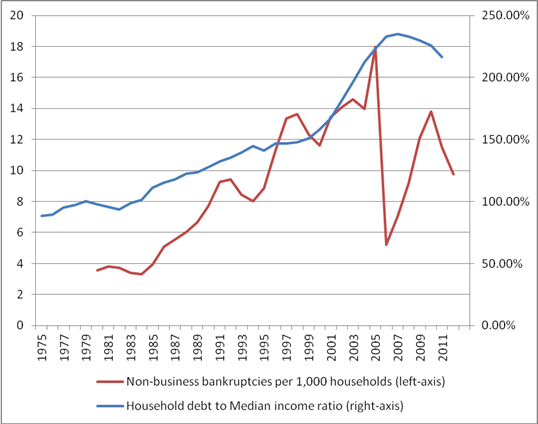

The trouble is, the more debt borrowers take on, the more likely they are to default. In fact, as the percent of debt per household to median income rose from 93.5 percent in 1981 to 223 percent in 2005, so did non-business bankruptcies per 1,000 households, from 3.5 to 18, according to data from the Federal Reserve, the U.S. Census Bureau, and uscourts.gov.

The outlier years are 2006 and 2007, when debt was still rising but the level of bankruptcies dropped, but these followed a record high year for bankruptcy filings.

Nonetheless, the data shows that higher levels of debt versus income result in higher numbers of bankruptcies. So, if the Obama Administration gets what it wants, which are more loans for those with lower incomes, it will destroy more lives, leaving more people ruined. If too many defaults occur, it could get banks in trouble again, too, risk a credit contraction and put the economy right back into the tank.

Wilson condemned the practice, saying, “This is what happens every time the government wants to facilitate credit expansion to bolster asset prices. After the stock of available borrowers based on current credit standards is exhausted, the only recourse left to policy makers is to weaken credit standards.”

He concluded, “When this leads to asset bubbles and credit collapses, as it already has, then the American people are told that the banks that made the loans must be made whole through bailouts whether from Congress or the Federal Reserve. We’ve seen this movie before. It is a fraud and it will only lead to a repeat of the 2008 meltdown.”

But at least the economy will “grow” for a little while, right?

Robert Romano is the Senior Editor of Americans for Limited Government.