Are we nearing the end of the business cycle?

The third quarter Gross Domestic Product remained unchanged at an inflation-adjusted, annualized 3.5 percent growth in the latest estimate from the Bureau of Economic Analysis.

And although growth may be slowing down — the second quarter had 4.2 percent growth — the economy could still be a ways off from its next recession.

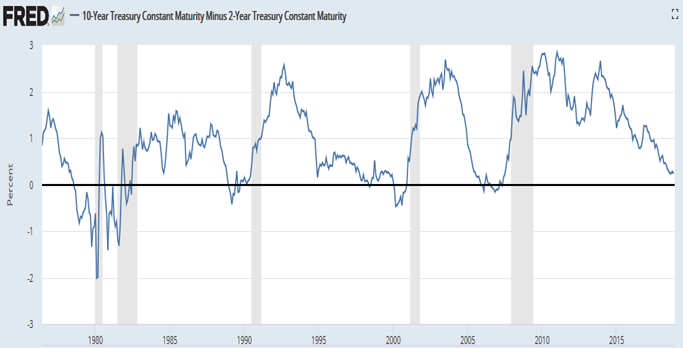

For example, if you look at the spread between 10-year treasuries and 2-year treasuries, according to data by the U.S. Treasury and St. Louis Federal Reserve, you can see that the interest rates tend to invert several months prior to recessions.

But right now, the spread is still positive at 0.23 percent. That’s low but still not negative.

And even when it does go negative, that does not yet signal the recession. The five last recessions in the data — Jan. 1980, July 1981, July 1990, March 2001 and Dec. 2007 — occurred 17 months, 10 months, 16 months, 13 months and 24 months after the interest rates inverted. That’s an average period of 16 months between the month of the inversion and the onset of the recession.

It’s a reliable predicter, and very much a forward-looking leading indicator.

Politically, if one has their sights on 2020, for there to be a recession prior to the next election — which some analysts are in fact predicting — one would expect the yield curve to invert about 16 months prior to the onset, assuming the relationship holds up.

So, for a recession to start prior to November 2020, the 10-year, 2-year would need to invert by about June 2019 for the recession to begin and for anybody to notice in time for the election.

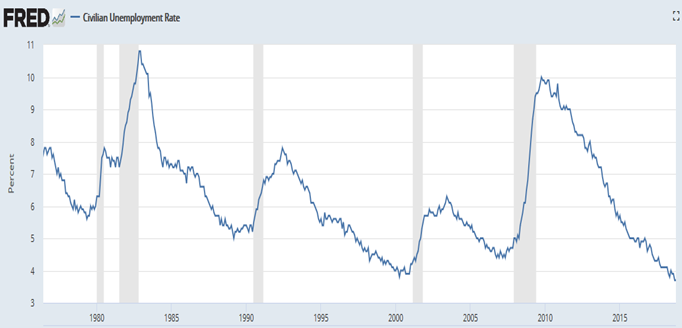

Another reliable indicator is the unemployment rate, which remains at historic lows of 3.7 percent.

When peak employment is reached — when unemployment reached its lowest point for the first time in the cycle — recessions have happened 8 months, 7 months, 16 months, 11 months and 14 months later, respectively.

There the average is 11 months from peak employment to the onset of the recession. If that’s the case then if peak employment were reached by Nov. 2019 then it might be in time for the next election.

In any event, you’d see the unemployment rate steadily rising from its low. If it continues going down — it’s already really, really low but okay — then you might move forward your forecast for at least another 11 months.

But once the unemployment rate starts going up, it needs to keep rising, and then, if the model holds, then you might predict a recession is on the way. If you believe that we’ve already reached peak employment then a recession could well be on its way. They’re fairly cyclical in that regard.

On the other hand, the 10-year, 2-year remains positive, although near zero. And usually, it goes back positive prior to the onset of the recession.

So, there’s two recession prediction models that tell two slightly different tales.

How far away are we really from the next recession?

Certainly, the U.S. economy is long overdue for another recession. It’s been 11 years since the last one started. And we know nothing lasts forever. Usually recessions average once every six to seven years. And in the least, it looks like we could be nearing the end of the cycle. As usual, stay tuned.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government.