“Don’t say we didn’t warn you!”

That was a People’s Daily commentary threatening that China will cut the U.S. off from rare earth minerals used to make high tech components for computers, smart phones and military weapons systems.

The People’s Daily is an official newspaper for Central Committee of the Communist Party of China and the largest newspaper group in the nation, and the threat comes as U.S. and Chinese trade officials attempt to find a way forward from their current impasse in negotiations.

The commentary was headlined “United States, don’t underestimate China’s ability to strike back” and spoke of America’s “uncomfortable” reliance on rare earth minerals from China.

That part is at least true. We do rely on rare earths from China (and elsewhere). The U.S. consumed about 9,500 metric tons of rare earths in 2018, according to the U.S. Geological Survey, and we are 100 percent reliant on imports of rare earth metals.

Most of it, 80 percent, does come from China.

But left out of the analysis is that China has been losing global market share since its high-water mark of 95 percent of global production in 2010, down to 80 percent global market share now, mostly thanks to Australia ramping up production, which is now the number two producer in the world at 20,000 metric tons in 2018. Australia also has all of the elements we would be looking for, according to Geoscience Australia.

According to the U.S. Geological Survey, “The estimated value of rare-earth compounds and metals imported by the United States in 2018 was $160 million, an increase from $137 million in 2017.”

These numbers do not account for rare earths used in manufacturing in China and then exported. But what’s China going to do, stop making computers and exporting them?

With all of that context, it does not seem like China blocking exports of rare earths may be much of a threat. Certainly not worthy of the hysteria we’re seeing.

Fortune’s Eamon Barrett writes, “China’s Rare Earth Metals Aren’t the Trade War Weapon Beijing Makes Them Out to Be,” citing an example in 2010 when “China and Japan clashed over ownership of islands in the East China Sea, Beijing halted shipments of rare earths to its rival, disrupting supply lines for major manufacturers like Toyota and Panasonic. But Beijing emerged weaker for it. The blockade was enough to alert the rest of the world to China’s unchecked power over the precious minerals. A coalition of countries led by the U.S. appealed to the WTO which, in 2014, ruled that China can’t put limits on rare earth exports.” Nothing much came of it and since then global production has been rising.

What the U.S. has lacked is a domestic source. But that is changing. We have about 1.4 million metric tons of reserves in the U.S., and after years of not mining rare earths, in 2018 the U.S. ramped up production to 15,000 tons of compounds according to the U.S. Geological Survey. Barrett reports the Mountain Pass site has reopened in California’s San Bernardino County, and is currently exporting to China for processing but, as Barrett happily notes, MP Materials, the company that owns it, “says it will re-open the mothballed processing facilities at Mountain Pass next year so that the mine can extract rare earth metals at home.”

So, China can do whatever it wants. What would happen is prices would go up, for a little while, and other countries including the U.S. would just fill in the gaps, not unlike the Arab oil embargo of the 1970s that simply encouraged the rest of the world to drill.

China could similarly embargo high-tech goods exports, but we would just make them here or buy them from somewhere else.

Or like China’s feckless threat to dump U.S. treasuries, which might result in interest rates temporarily rising, but other countries and investors could again fill in the blanks. In the meantime, if China dumped U.S. treasuries, it might cause the yuan to appreciate, hurting China’s trade advantage on currency that makes its exports cheaper.

While U.S. and Western media outlets breathlessly report China’s party line, the reality is far less formidable. If China stops shipping rare earth metals or using them in production, it won’t be the end of the world. What do we care?

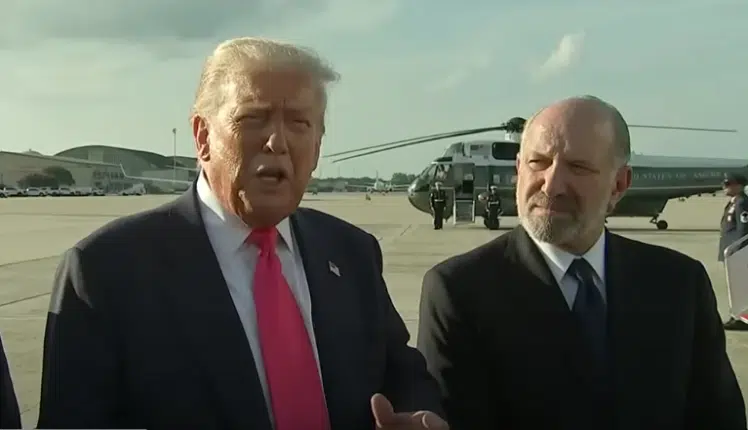

U.S. and global markets are resilient and more than possess the capacity to respond to price shocks that might be seen via rare earth embargoes, halting computer production or dumping treasuries. We underestimate our own strength, and I don’t think President Donald Trump is losing any sleep over this empty threat.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government.

Correction: MP Materials, not MP Minerals, owns the Mountain Pass facility.