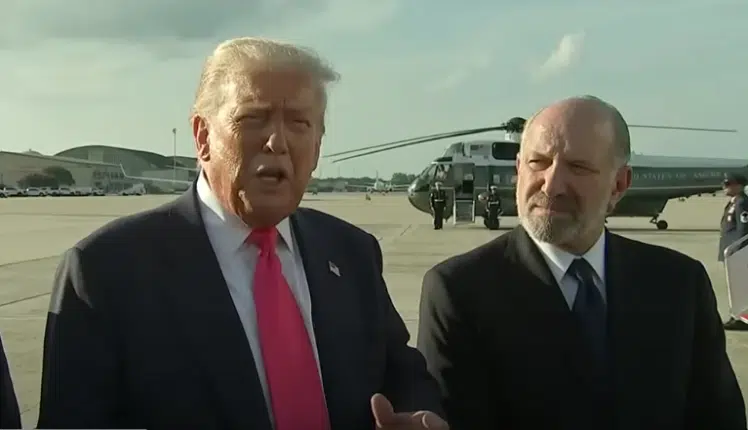

President Donald Trump is broadening his trade message to foreign economies to include currency ahead of the G-20 meetings in Japan next week, blasting both China and Europe for competitive devaluations of the yuan and euro, respectively.

On June 18, Trump tweeted, “Mario Draghi just announced more stimulus could come, which immediately dropped the Euro against the Dollar, making it unfairly easier for them to compete against the USA. They have been getting away with this for years, along with China and others.”

Here, Trump is referring to European Central Bank Chairman (ECB) Mario Draghi’s statement at the ECB Forum in Sintra, Portugal on June 18 where he announced potential interest rate cuts could be on the horizon if the economy deteriorates.

Besides tariffs and subsidies, the greatest weapons that economies wield against each other on the trade front are competitive devaluations, which make exports cheaper and imports more expensive. It is simultaneously a move to increase domestic consumption and boost profits from overseas.

Draghi has responded that “we don’t target the exchange rate” in ECB operations, but it is worth noting that since its 2011 highs, the euro has depreciated almost 25 percent against the dollar following the sovereign debt crisis in Europe.

It is not uncommon for central banks to depreciate their currencies in the event of a recession or worse.

As for China, it remains artificially pegged below the dollar for decades. In response to Trump’s most recent tariff announcement, raises taxes on $250 billion of Chinese goods to 25 percent, the yuan depreciated another 3 percent against the dollar.

Because the dollar serves as the world’s reserve currency and one of its top consumer markets, it is particularly susceptible to these devaluations.

But under the Trump administration, that is beginning to change.

For example, the United States-Mexico-Canada Agreement trade deal makes provisions on currency enforceable in trade disputes. According to the U.S. Trade Representative, the agreement “address[es] unfair currency practices by requiring high-standard commitments to refrain from competitive devaluations and targeting exchange rates, while significantly increasing transparency and providing mechanisms for accountability.”

Since 2008, the Mexican peso has depreciated against the U.S. dollar by 50 percent, from $0.10 per dollar to about $0.05 per dollar. Now those industries harmed by this practice will have an avenue for redress when it comes to trade disputes once the agreement is adopted, which Mexico has already done.

The problem for the U.S. economy can come if the dollar becomes relatively too strong versus other currencies. If so, the U.S. could be forced to devalue as well. The S&P 500 hit a record high as the Federal Reserve hinted at an interest rate cut, so that may be starting to happen.

In the past such global depreciations have led to widening of trade gaps and can even cause a recession or for one to worsen.

A 1985 paper, “Exchange Rates and Economic Recovery in the 1930s,” by economists Barry Eichengreen and Jeffrey Sachs, looking at the competitive devaluations in the 1930s, found, “In all cases of unilateral devaluation, currency depreciation increases output and employment in the devaluing country. By raising the price of imports relative to domestic goods, depreciation switches expenditure toward domestic goods. The increased pressure of demand will tend to drive up domestic commodity prices, moderating the stimulus to aggregate demand and (by reducing real wages) stimulating aggregate supply, until the domestic commodity market clears. The same effect switches demand, of course, away from foreign goods, exerting deflationary pressure on the foreign economy.”

For example, in 1931 the UK coming off the interwar gold standard—my observation, not Eichengreen’s and Sachs’—saw a worsening of Great Depression in the U.S. as inflation went from -2.7 percent to -8.9 percent and unemployment went from 11.2 percent to 19.2 percent.

Looking at more modern history, a 2004 paper by Anne-Marie Brook, Franck Sédillot and Patrice Ollivaud looks at current account deficits from 1980 through 2004 and found that “In the United States, the observed historical relationship between the real exchange rate of the U.S. dollar and the current account balance is negative…” One such instance occurred in the 1980s, where the dollar appreciated about 50 percent versus the yen, pound, franc and deutschmark.

Both of these episodes were followed by international monetary accords, for example, Bretton Woods followed World War II and the competitive devaluations of the Great Depression.

The Plaza Accord came in the 1980s after Ronald Reagan negotiated a devaluation of the U.S. dollar with Japan, Germany, the UK and France after the dollar appreciated 50 percent versus their currencies from 1980 to 1985, resulting in massive trade deficits.

Looking past then, as China has kept the yuan pegged below the dollar, after China was granted permanent normal trade relations in 2000 and admitted to the World Trade Organization in 2001, U.S. global manufacturing market share has dropped from 13.4 percent to 7.5 percent in 2017, according to World Bank data. China has risen from 5.3 percent to 16.6 percent in 2017 as companies moved there, hollowing out the Rust Belt, although their percent of global manufacturing market share has peaked in 2015 at 18.8 percent.

Point is, we’ve seen this before in economic history — repeatedly. President Trump is not coming out of left field, he demonstrating a deep understanding of these trends and how currency has factored into countries attempting to achieve a competitive edge with their currencies. And the G-20 is the perfect place to discuss it.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government.