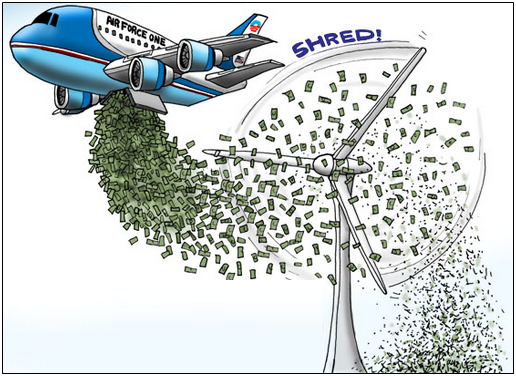

Congress created the production tax credit for wind energy in 1992. In other words, wind turbine owners receive a tax credit for each kilowatt hour of electricity their turbines create, whether the electricity is needed or not. The production tax credit was supposed to have expired in 1999; but, instead, Congress has repeatedly extended it. After nearly three decades of propping up the wind industry, it is past time to let the tax credit expire in 2020.

All Congress needs to do is nothing.

Addressing the issue of wind production tax credits, Americans for Limited Government President Rick Manning stated, “Wind energy development is no longer a nascent industry, having grown from 0.7 percent of the grid in 2007 to 6.6 percent in 2018 at 275 billion kWh. The rationale behind the wind production tax credit has always been that it is necessary to attract investors.”

Manning added, “wind energy development has matured to the point where government subsidization of billionaires like Warren Buffett cannot be justified, neither from an energy production standpoint nor a fiscal one. Americans for Limited Government strongly urges Congress to end the Wind Production Tax Credit. The best part is, they only need to do nothing as it expires at the end of the year.”

There are plenty of reasons for ending the tax credit. Here are some of them:

- Wind energy is unreliable. Wind turbines require winds of six to nine miles per hour to produce electricity; when winds speeds reach approximately 55 miles per hour, turbines shut down to prevent damage to the equipment. Wind turbines also shut down in extremely cold weather.

- Due to this unreliability, relatively large amounts of backup power capacity must be kept available.

- Wind energy often requires the construction of costly, new high-voltage transmission lines. This is because some of the best places to generate wind energy are in remote locations far from population centers or offshore.

- Generating electricity from wind requires much more land than does coal, natural gas, nuclear, or even solar power. According to a 2017 study, generating one megawatt of electricity from coal, natural gas, or nuclear power requires about 12 acres; producing one megawatt of electricity from solar energy requires 43.5 acres; and harnessing wind energy to generate one megawatt of electricity requires 70.6 acres.

- Wind turbines have a much shorter life span than other energy sources. According to the Department of Energy’s National Renewable Energy Laboratory, the useful life of a wind turbine is 20 years while coal, natural gas, nuclear, and hydroelectric power plants can remain in service for more than 50 years.

- Wind power’s inefficiencies lead to higher rates for customers.

- Higher electricity rates can have a chilling effect on the local economy. Increasing electricity rates for businesses makes them less competitive and can result in job losses or reduced investments in businesses.

- Increasing rates on poor consumers can have an even more negative impact sometimes forcing them to go without heat in the winter or air conditioning in the summer.

- Wind turbines are a threat to aviators. Wind turbines are a particular concern for crop dusters, who must fly close to the ground to spray crops. Earlier this summer, a crop dusting plane clipped a wind turbine tower and crashed.

- Wind turbines are deadly for birds and bats, which help control the pest population. Even if bats are not struck by the rotors, some evidence suggests that they may be injured or killed by the sudden drop in air pressure around wind turbines.

Large wind turbines endanger lives, the economy, and the environment. Even after decades of heavy subsidies, the wind industry has failed to solve these problems. For these and other reasons, Congress should finally allow the wind production tax credit to expire.

Richard McCarty is the Director of Research at Americans for Limited Government Foundation.