One of the key aspects of President Donald Trump and Congress’ $2.2 trillion coronavirus relief package are provisions for $350 billion for 30 million small businesses to cover payrolls for 60 million Americans for eight weeks to encourage people to stay home to wait out the Chinese coronavirus pandemic.

Along with the expanded unemployment and credit facilities covering critical industries and larger employers, the policy is designed to ensure that in saving as many lives as possible — the White House coronavirus task force has said as many as 2.2 million Americans could die without social distancing — we don’t find ourselves in a long, deep recession or depression as a result that might take a decade to recover from.

As President Trump keeps saying, the cure cannot be worse than the disease.

That is why we have to consider the very real possibility that $350 billion and eight weeks of loans will not be nearly enough to save these businesses, even if we have no new coronavirus cases come May or June. Why?

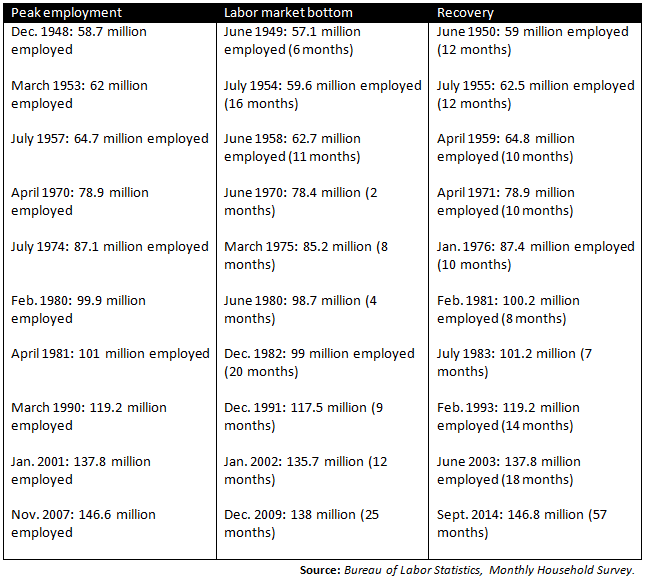

Looking back at the ten recessions that have occurred since 1948, it took on average 11 months for all the job losses to be realized to get to the labor market bottom, and another 16 months to recover. The entire ordeal lasts on average 27 months. See for yourself:

The worst of the bunch was the Great Recession, which from peak employment in Nov. 2007 to the bottom in Dec. 2009, saw 8.3 million jobs lost and the U.S. economy did not get them back until in Sept. 2014. The whole process took almost seven years. Let that sink in.

In the current recession, the job losses only began one month ago with the economic shutdown to fight the virus and they’ve already dwarfed the Great Recession with more than 10 million jobs lost and it may just be getting warmed up. Now, it is possible that Congress stuck the landing with its relief package, which can be expanded up to $6 trillion if the pandemic goes on longer than expected, but it could be unlikely to play out that way without certain adjustments. President Trump has said he will go back to Congress if necessary, but immediately here’s something he can do on the administrative side.

At Americans for Limited Government, we have run into a number of small businesses that believe a combination of Payroll Protection Plan (PPP) loans and COVID-19 Economic Injury Disaster Loans (EIDL) now being offered by will be necessary in order to weather this storm. The difference between the two is the PPP loans require no collateral and are forgivable if used for payroll, rent, mortgage and utilities at a small business, whereas the EIDL loans do require collateral and need to be repaid but are deferred for up to 12 months.

But these businesses believe applying for a PPP loan may preclude the ability to come back for an EIDL loan when the lockdown is ending because they say they are not being allowed to include downstream payroll expenses in the EIDL loan amount if they apply for both, and that given the emergency, the collateral requirements specifically for EIDL loans will present a significant barrier to a great number of businesses to qualify either because of underlying existing debt service or simply because those businesses will not have a real estate asset or any cash reserves to use as collateral.

It’s probably not a good bet to assume that these businesses have cash or assets on hand to offer up as collateral — especially right now.

These barriers likely mean a high percentage of small businesses will be unable to qualify for the EIDL loans, and will most likely mean millions of businesses that might have survived will certainly fail despite the best of intentions in constructing the CARES Act. It’s not that the PPP loans aren’t a great backstop, they are, and for a majority of businesses they may be adequate, however, in order to keep stability in overall operations during the recession anticipated for the next several months and be able to return, many of them will need both. Eight weeks will not be enough.

Particularly larger entities with more existing debt that was being perfectly serviced until the emergency will be the ones potentially most unduly affected if underwriters will not or cannot approve the application because the applicant lacked collateral. The primary reason for this is because revenue is unlikely to return to prior levels for several months during the recession.

A fix the administration should seriously consider is to waive the collateral requirements for the coronavirus EIDL program, just as has been done for the PPP loans.

For the same reason businesses only have enough cash on hand to do payroll, benefits, rent and utilities for a couple of weeks, they similarly lack cash reserves to utilize as collateral for the EIDL. The Small Business Administration program seems to assume that they do.

The consequence will be that those businesses that really needed both types of loans will likely take the PPP loan and then when the eight weeks are up, if they can’t qualify for the EIDL loan, that’ll be it. They’ll go out of business. Even if that were just 3 percent of small businesses, that would another 1 million small businesses that go away.

Right now, businesses are looking at the ledger and determining if the loans will help them survive or if it would be more advantageous to simply lay everyone off.

The administration needs to monitor who is qualifying for those loans and how many are being rejected, and how many are applying or wish to apply for both. The reason many of them want both is because EIDL gets deferred for a number of months, and then they have 30 years to repay. They believe the supports on both the employee side with PPP and then the employer side with EIDL will get them to 2021 safely.

Either way, the country really needs all 30 million of these small business entities or almost all of them to apply and keep those workers, or we’re going to have tens of millions more Americans on unemployment.

While it is admirable the President believes eight weeks will be enough and the economy will come roaring back, the program has to have a fallback in case the recovery is bumpier than expected. It took two years to lose 8.3 million jobs, and then almost five years to get all those jobs back, and then another six to get the 50 year low of 3.5 percent unemployment. If we can’t get these businesses to 2021, it could take a decade or more before we get that back.

We can hope that the economy comes roaring back this year when the national lockdown ends as pent up demand is unleashed, but we have to plan on the high probability that it will not do so immediately.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government.