“Homebuilders remain gloomy. A report yesterday from the National Association of Home Builders/Wells Fargo showed confidence among U.S. homebuilders this month held near the lowest level since records began in 1985… As home prices continue to fall, more and more Americans a forced into foreclosure as they owe more than their homes are worth. Stricter lending rules also limit opportunities to refinance out of adjustable-rate mortgages before they reset higher… Foreclosure filings rose to a record in August, RealtyTrac Inc. said Sept. 12. One in 416 U.S. households got a default notice, was warned of a pending auction or was foreclosed upon.”—Bob Willis, “U.S. Economy: Housing Starts Slide to Lowest Level Since 1991”, Bloomberg, September 17th, 2008.

Now what? The one thing that all the financial analysts and experts said the economy could not take—housing market continuing to decline, home values continue to fall, and foreclosures persisting—is exactly what has happened.

Everything that Big Government has thrown out in the way of bailouts—$300 billion for the Foreclosure “Prevention” Act, $200 billion (at least) to nationalize Fannie/Freddie, a $30 billion loan to JP Morgan to buy Bear Sterns, $150 billion economic “stimulus”, and now the $85 billion loan to AIG—all of this was supposed to prevent the housing market from further collapsing.

Indeed, we were told that the financial markets were depending on a housing market recovery in order for the overall economy to weather the current crisis. Well, it didn’t happen.

And, we hate to say it, but we told you so, in fact, that home values were going to continue decline because of the glut on the market. We say that not because we revel in decadence or hope for decline, but because we view market corrections as the inevitable result of an economic bubble.

The housing market was doomed for failure the day that Big Government decided that everybody—even those who couldn’t afford it—should be eligible for home loans. Then the loose lending standards followed, home builders responded to the uptick in demand, and built too many homes. Once the bubble popped, the consequences could only be dire.

But rather than letting the correction occur, no matter how ugly—and dealing with the economic and political consequences of the fallout—Big Government has instead sought to put the economy on steroids. Well, it looks like that this jet pack is almost out of fuel, as reported by Tony Blankley in yesterday’s Washington Times:

“About a year ago, the Fed held about $800 billion in securities to use to finance bailouts and for other purposes. As of this week they are down to about $475 billion assets. If things get worse and persist, they may not have enough securities to act in the future.”

The Wall Street Journal raises a similar concern in “Are We Running Out of Rescue Cash”:

“Here’s a discomfiting thought: All along, one assumption has animated the Fannie and Freddie bailout: If their debt is seen as Treasury debt, all will be well with their mortgage funding.

“What if the assumption is wrong? What if the world’s investors, seeing the federal government willy nilly expanding its commitments in all directions, begins to lose appetite for Treasury debt itself?”

That is the risk, isn’t it? Having spent nearly half of its securities—about $325 billion out of $800 billion—in large part to take on bad debt, certainly one has to wonder how what the effects on the credit-worthiness and the balance sheet of the central bank itself will ultimately be.

So, now what? Some have suggested fixing accounting standards and cleaning up the rating system so that investors have accurate data about the solvency of companies, firms, and banks. To which, we would add: 1) establishing a strong dollar pegged to a modern gold standard; 2) elimination of the dual mandate at the Federal Reserve; 3) a balanced budget with a substantial reduction of the federal bureaucracy; 4) a low-rate flat tax; and 5) the political will to allow the market to correct itself (i.e. no more bailouts).

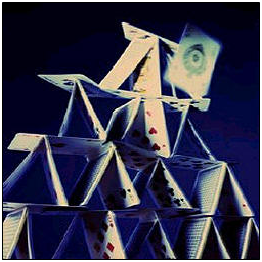

The fifth item—no more bailouts—may mean that things get worse before they get better. However, if there ever was an economy that needed the cleansing power of a correction—however hard in the short-term—this economy was it. After all, one can prop up a house of cards so many times before the foundation crumbles and the roof caves in—for good.