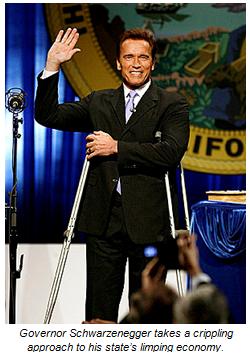

ALG Editor’s Note: In the following featured editorial, the Wall Street Journal examines how California Governor Arnold Schwarzenegger has taken the wrong approach to solving his state’s severe financial dilemmas.

As big budget flops go, “Ishtar” became a Hollywood icon. But that movie bust has nothing on Governor Arnold Schwarzenegger’s rolling budget fiasco in California. The Golden State is facing a $40 billion deficit over the next two years and its balance sheet looks worse than those of the Detroit auto companies. So on Monday the Governor declared a “fiscal emergency” giving him the authority to hold the legislature in session until it passes a balanced budget.

A big part of the problem is the Terminator himself. When Mr. Schwarzenegger ran for Governor in 2003 amid the last California fiscal crisis, he promised a new ethic of spending restraint, no new taxes and less debt financing. Six years later none of that has happened. Once California crawled out of that last fiscal emergency, Mr. Schwarzenegger made one more stab at budget reform, got clobbered at the ballot box, and has since given in and let the budget grow to $144.5 billion — a 40% hike over four years.

This go-around Mr. Schwarzenegger and Democrats who run the legislature believe they can tax California back to prosperity. Last month the Governor called for a 1.5-percentage-point increase in the state sales tax rate for three years. This would bring the state and local sales tax rate in many localities, like populous Orange County, to 9.25%. Arnold also wants to triple the car tax, which is the same reviled tax that got the previous Governor, Gray Davis, recalled from office.

Two years ago Mr. Schwarzenegger won re-election by pounding Democratic challenger Phil Angelides as a taxaholic, but the Governor has now proposed more tax hikes than Mr. Angelides ever did. Mr. Schwarzenegger even boasts that his tax plan will “invigorate our economy and generate jobs.” Well, perhaps jobs for moving van companies to help people flee to better tax climes. The sales tax could not be more poorly timed: Golden State retailers have already seen a rapid slowdown in sales. The last time the sales tax was raised, in 1991, California’s retail sales slumped to their lowest ebb in 30 years.

The only politicians standing against the media-political consensus for higher taxes are Republicans in the Assembly. Under California law, a two-thirds vote by the legislature is needed to pass a tax increase. Assembly leader Mike Villines has it right when he says that “We just believe that higher taxes will lead to more businesses leaving the state and encourage even more spending.”

Democrats refuse even to trim the budget. Neither they nor the Governor have proposed shutting down a single government program. Many California voters also seem to live under this delusion that government is free. The state has a debt of $60 billion and the worst credit rating among the 50 states. But in November Californians approved a $10 billion bond for a high-speed rail system that will add $600 million in annual debt servicing costs to the state budget every year until the middle of the century.

So how does California get out of its fiscal crisis? We’d suggest Mr. Schwarzenegger and the rest of the Sacramento establishment take a field trip to New Hampshire. That state maintains better schools, roads and general public services than California, though the Live Free or Die state has no sales or income tax. Meanwhile, California labors under the second highest income tax rates, and the politicians now want to impose the fourth highest sales tax. And the state still has the largest budget deficit in the nation.

The real crisis isn’t a lack of tax dollars. It’s a political class that is spending that beautiful state to ruin.