House Majority Leader Steny Hoyer (D-MD) has now announced that it is time for the bankrupt federal government to bail out the various bankrupt states. In the real world, this would be known as absurd. In Washington, it is known as politics as usual.

So, before getting to the more arcane matter of what the various states really need, a quick lesson in Economics 101 is in order.

When recessions hit, Americans all across the country tighten their belts, giving up not only luxury items, but necessities as well. Not only their wants, but often their needs. And millions of hardworking Americans lose their jobs – especially in the case of the current recession, which has been one of the longest and deepest in history.

Less consumer spending plus more lost jobs equals bad news for the proponents of Big Government. Since government raises revenue by taxing the very things Americans cut back on, when consumer spending falls and job losses rise, tax revenues plummet.

Big Government types like Rahm Emanuel, who famously stated “Rule One: Never allow a crisis to go to waste,” do not let decreasing revenues impair their propensity to spend. Instead, they turn to the Federal Reserve to print money to bailout corporations, without having to noticeably raise taxes on most of the electorate—at least, not immediately.

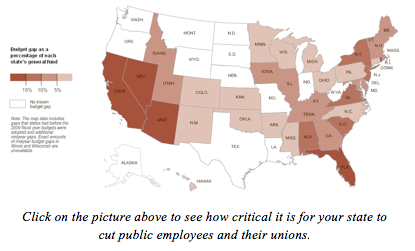

But there is one area, in which, Big Government proponents are stifled, and that is state tax revenues. Unlike the Federal Government, states can only raise revenue with taxes, because most have standing balanced budget amendments. This means that in order for states to grow government, state politicians must appeal to the electorate and explain why an increase in taxes will justify the increase in spending.

This may sound simple, but politicians have run into one very serious problem: the vast majority of people understand that they can spend their own money better than the government can.

Sadly, however, the story does not stop there – not when Big Government types in Washington consider the U.S. Treasury a playpen filled with Monopoly money they can hand out willy-nilly to win friends and influence elections.

And that’s why Steny Hoyer announced this week that Democratic leaders are working on a “new job bill” (not a “stimulus,” he hastens to add, knowing that the American people have caught on to the charade). This time, significantly, it includes “state assistance” by the end of the year.

This comes, not surprisingly, on the heels of a trial balloon report from the Center on Budget and Policy Priorities (CBPP) — whose founder has represented in court radical leftist groups like Students for a Democratic Society (SDS) — calling on “fiscal relief to help states.”

In other words: since states can’t print money, CBPP decided that the federal government should do it for them. And, Steny, of course, right on cue, jumped through the hoop.

The Center’s claim is that “without it, states’ steps to balance their budgets could cost [the] economy 900,000 jobs next year.” CBPP claims that balanced budget amendments are the enemy.

The truth, however, is that such amendments have actually prevented profligate states — like California, for example — from falling even more heavily into debt, raising taxes, driving off more industry, and drying up more jobs. Only when faced with a $42 billion dollar deficit did California’s politicians finally pass a balanced budget.

And what of the 900,000 jobs the CBPP claims could now be lost. Well the CBPP, itself, doesn’t really know. They state that the estimate comes from another economic study from the President’s Council of Economic Advisers “that each percentage point of GDP translates roughly into 1 million jobs.” And, through some convoluted formula that only they know, they translate this into an argument for fiscal responsibility.

But, of course, the exact opposite is true. There is a direct negative correlation between federal, state, and local government jobs and economic growth. Meaning that this is now a good time for state and local government to reorganize and drastically cut the government jobs that pay twice as much private jobs and bankrupt state economies.

In short: it’s time for wayward states to fire public employees.

It’s time for Big Government – at all levels – to stop telling everyone else to tighten their belts while it allows its own employees to gorge themselves at the public trough. Rather than demand that taxpayers nationwide bail them out for their own profligacy, bankrupt states need to bite the bullet and jettison the flotsam.

In California, for example, public sector employees make 46 percent more than private sector counterparts. If the government passed a 12.1 percent pay cut it would save the state $3.1 billion dollars annually. If the government simply cut 10 percent of the current jobs then they would save about $5.4 billion dollars annually.

Do both and an overburdened state like California would be able to put a serious dent in their $42 billion dollar deficit. Not to mention, increase productivity growth.

Another area of reform is to eliminate public employee unions. When recessions hit, private businesses usually have to cut back on pension payments and employees in general. Not so in the public sector. Their unions point to state laws for protection and, as Richard Epstein at Forbes puts it, they believe “the downturn is everyone else’s problem.”

Well, there is one good, sound way to make “everyone else’s problem” the public employee’s problem, too.

Responsible state governments need to help their employees understand that, just as “a rising tide lifts all boats,” a sinking ship sucks everyone down. And since out-of-work private sector workers can no longer afford to employ public sector drones, the only just and equitable solution is for government to reduce the public sector payroll by precisely the amount the private sector is being culled.

In short, with unemployment now at 10.2% in the private sector, the public sector should be reduced by precisely the same figure. Then, Steny, Nancy, and their fellow wastrels can forget about bailing out the bankrupt states and apply the money towards balancing the budget of the bankrupt federal government.

Justin Williams is the Senior Commentary Editor of ALG News Bureau.