By Robert Romano –

Yesterday, Congressman Barney Frank (D-MA) is attempting to defend Fannie Mae and Freddie from a bombardment of criticism over its primary role in contributing to the housing bubble that, when it popped, nearly brought down the financial system, reports Politico.

Frank, one of the GSE’s greatest defenders over the years, said the White House was not responding quickly enough to “misrepresentations” by Republicans.

In a two-page memo to Obama Administration officials, Frank wrote, “This is an important point that has to be repeated – as Fannie and Freddie operate today, going forward, there is no loss. The losses are the losses that occurred before we took the first step towards reforming them – we the Democrats – and nothing we could do today will diminish those losses.”

Frank’s timing was ill-advised, however. As reported by the AP yesterday, “Freddie Mac is asking for $10.6 billion in additional federal aid after posting a big loss in the first three months of the year.”

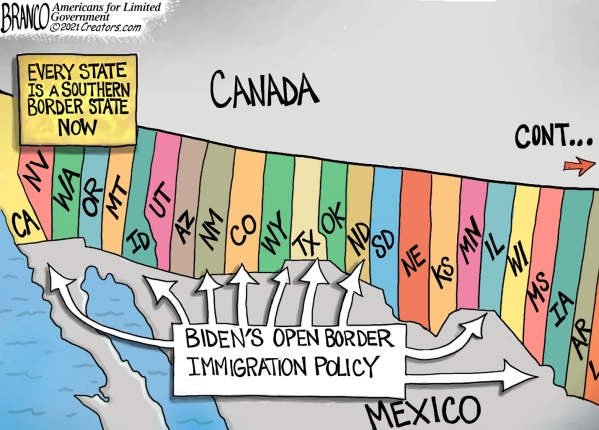

It’s really no wonder. Since the government takeover in 2008, Fannie and Freddie have increased their market share. As reported by the Wall Street Journal last week, “Government-related entities backed 96.5% of all home loans during the first quarter, up from 90% in 2009, according to Inside Mortgage Finance. The increase was driven by a jump in the share of loans backed by Fannie Mae and Freddie Mac, the government-owned housing-finance giants.”

If Frank was correct, and today’s losses were based upon decisions made prior to the government takeover of Fannie and Freddie, then why in the world are the GSE’s increasing their stakes in the mortgage market instead of unwinding their positions since Obama and Geithner took control?

According to American Enterprise Institute’s Peter Wallison, “Since 2008, under government control, the two agencies have continued to buy dicey mortgages in order to stabilize housing prices.” In other words, Fannie and Freddie are expanding their exposure to mortgages solely to prop up housing prices.

Therefore, Fannie and Freddie are not at all attempting to return to profitability. They are merely a conduit for government to subsidize the housing market. Therefore, losses by the GSE’s since 2008 can most certainly be attributed to decisions made by the federal government under the Bush and Obama Administrations, and can be expected to continue so long as they are the primary source of housing finance.

Making matters worse, the weak underwriting standards that Fannie and Freddie helped to foster have not been repealed. The reduced down payments on home loans that the Federal Housing Administration brought upon the system have not ended. The Department of Housing and Urban Development’s Community Reinvestment Act regulations that forced banks to make loans that could not be paid back, and that imposed “affordable housing goals” on the GSE’s have not been rolled back.

In short, nothing at all has changed since the GSE’s were nationalized, despite Frank’s claims that “The losses are the losses that occurred before we took the first step towards reforming them.”

You read that right. In fact, Frank thinks Fannie and Freddie have already been “reformed” by Congress, and that their nationalization justifies not addressing the GSE’s in the current financial sector legislation. In his letter, he wrote, “the argument that we have ignored the need to change the operation of Fannie and Freddie in our rush to do financial reform is of course exactly backwards. We did Fannie and Freddie first.”

Apparently, Frank’s definition of “reform” means doubling down on a losing bet.

Further, he contends that “It is the unanimous view of every profit and nonprofit entity concerned with the housing market in the United States that simply to abolish Fannie and Freddie, as the Republicans are proposing in the House bill, and not do anything to replace the functions they are now performing with a conservatorship, would be a disaster for housing, and therefore for the economy as a whole.”

The view supporting endless government housing finance is hardly universal however. Writes Dave Oedel and Edward Pinto for the National Law Journal, “Government funding, and the elaborate legal regime enabling it, is the problem in housing finance, not the solution. That’s true for all Americans, rich or poor. Although many properties are vacant, inflated values make homes hard for low-income Americans to afford.”

To be certain, housing prices would most certainly come down if government were to unwind its housing finance regime. For new homebuyers that would actually be a good thing. If government would have just let housing prices fall, without the bailouts, new capital would have already flooded the markets, buying up cheap homes, and prices would eventually have recovered on their own to levels that the market can sustain.

What would happen if there was no Fannie and Freddie? The nation would actually have affordable housing, and the need to get a 30-year mortgage on a single family home would be mitigated in large part.

Writes Oedel and Pinto, “Americans love their homes, but what has traditionally made home ownership so culturally special is that it represents a consummation of the American dream of self-reliance and stability. By keeping housing prices artificially high, especially at the lower regions of the housing market, through the surging nationalization of housing finance, the government has turned this classic equation on its head. Now home ‘ownership’ for many Americans amounts to reliance on the dole. Record rates of foreclosure challenge classic notions of stability.”

Indeed, with 3.9 million foreclosures last year, and some mortgage experts projecting another 4 million foreclosure filings this year, the evidence overwhelmingly suggests that unlimited government housing finance does not an ownership society create. Instead, it has created a society of debts that cannot be repaid, and Fannie and Freddie are doing nothing to reverse this trend.

Which is sad, because until that trend is reversed, the losses for taxpayers on the GSE’s will continue to mount, jeopardizing the Treasury with a national debt that now threatens the nation’s credit rating.

Barney Frank, meet the facts.

Robert Romano is the Senior Editor of ALG News Bureau.