By Rebekah Rast –

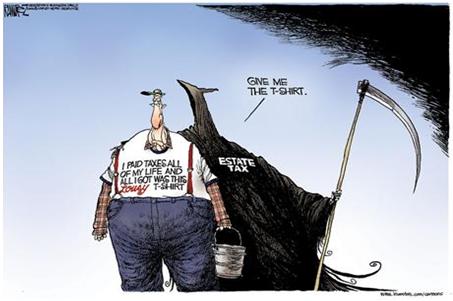

“In this world nothing can be said to be certain, except death and taxes.” –Benjamin Franklin

Franklin was right. There is nothing more certain in this life as death and taxes, but I don’t think he ever intended one to encourage the other.

Come December 2010 the estate tax might just drive some people to their deaths if not abolished.

On January 1, 2011, the estate tax may reach 2001 levels with a top rate of 55 percent and a $1 million exemption that existed before President George W. Bush took office and set new restrictions on the tax.

A severe consequence of reinstating the estate tax to its 2001 levels is looking at what the tax encourages. It gives incentive to elderly wealthy Americans to die before January 1, 2011, so their families aren’t indebted to the government. The tax sits completely repealed for this year. Meaning if wealthy family members die before the end of this year, their families will have their entire estate tax free.

By Congress not taking action on this tax, they are giving the message to our greatest generation that they either die now so their wealth can be passed down, or take the gamble and possibly be forced to give their children’s inheritance to the government. This is morally reprehensible.

New York Times columnist Paul Krugman dubbed the bill the “Throw Mama from the Train Act of 2001” when finding out it would expire come Dec. 30, 2010. “So in the law as now written, heirs to great wealth face the following situation: If your ailing mother passes away on Dec. 30, 2010, you inherit her estate tax-free. But if she makes it to Jan. 1, 2011, half the estate will be taxed away. That creates some interesting incentives,” he said.

Never should a tax provide incentive for one to end their life.

“A government tax policy should never motivate grandma to end her life,” says Bill Wilson, president of Americans for Limited Government (ALG). “Our greatest generation should not face the choice of whether to make the ultimate sacrifice to ensure their wealth is given to their families and not the government. It is abhorrent that Congress hasn’t made the elimination of the death tax permanent.”

If the estate tax were to go back to 2001 levels, possible assisted suicide wouldn’t be the only consequence.

The impact of this tax on the American people would be devastating. Family-owned businesses would have to be sold, destroying family legacies. People would lose their land and farms—being forced to sell them only to companies that could afford them.

The majority in Congress like the estate tax because it is an easy way for the federal government to make money. Under the Bush tax cuts in 2009, The Tax Policy Center, a think tank in Washington, D.C., states that only about one in 460 deaths result in a taxable estate and 99.8 percent of deaths trigger no estate tax. The estate tax will raise almost $14 billion from 5,500 estates from the same year. To some, this isn’t enough.

The majority of democrats would like to see the estate tax back at its 2001 levels, as stated in an article in the Washington Post. The article goes on to say that by keeping the estate tax levels where they are is costing the federal government an estimated $234 billion in revenue over the next 10 years.

In the same article, Rep. Steny Hoyer (D-MD) was reported as saying, “abolishing the estate tax would add billions and billions to our deficit—and while a small number of wealthy families would benefit, the growth of our economy as a whole would suffer.”

In other words, several in Congress would like to see the wealth of Americans be given to a wasteful and irresponsible federal government instead of to the American families of those who earned it.

Land and farm owners would also be in jeopardy of losing their livelihood if the estate tax was reinstated to high levels. A briefing by the American Farm Bureau Federation (AFBF) states, “The return of estate taxes will strike a blow to farm and ranch operations trying to transition from one generation to the next. A $1 million exemption is not high enough to protect a typical farm or ranch able to support a family and when coupled with a top rate of 55 percent can be especially difficult for farm and ranch businesses.”

When forcing such extreme taxes on farmers and ranchers, it not only hurts them but also hurts the communities and businesses they serve.

In an article in The Hill, Chris Walters, manager of legislative affairs at the National Federation of Independent Business stated, “We still believe that full repeal is where we need to go.”

It is time for Congress to stop the nonsense and make the repeal of the death tax permanent. If Congress fails to act and lets the death tax skyrocket to 2001 levels, the government could have a lot of blood on its hands—not to mention closed businesses, empty farmland and higher unemployment.

Rebekah Rast is a contributing editor to ALG News Bureau.