By Bill Wilson

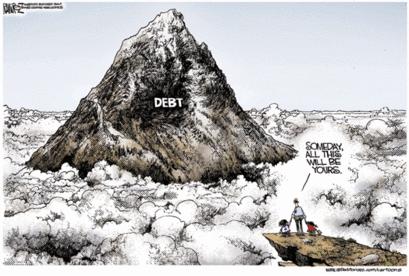

Last week, FOX Business host Neil Cavuto came forward with a dire prediction: Thanks to the rising $13.375 trillion national debt, a downgrade of the United States’ triple-A credit rating is imminent.

“For the first time in the history of the United States, our credit rating will get a nick,” Cavuto declared. “Let me be clear, in the next few months — you heard me right, months, not years — a credit ratings agency will downgrade U.S. debt.”

Is Cavuto merely being provocative, or was he telling the truth? I’m inclined to think the latter.

Cavuto cited a recent Dow Jones Newswires interview with the head of the sovereign debt rating committee of Standard & Poor’s (S&P), one of the international credit ratings agencies that has granted the U.S. its gold-plated, Triple-A bond rating. Currently, the U.S. has the highest possible credit rating from Moody’s, S&P, and Fitch, which relates to the nation’s ability to repay its debt. A lower rating would mean higher borrowing costs (i.e. higher interest rates).

According to the Dow Jones report, “The U.S. will need to address its ballooning budget deficit to protect its triple-A credit rating, Standard & Poor’s Ratings Services’ sovereign-ratings committee chief said Thursday, urging U.S. lawmakers to consider ‘very carefully’ recommendations from President Barack Obama’s commission on fiscal responsibility.”

The report ominously warns, “How Congress responds to the commission’s proposals, which are due by December, will be critical in shaping S&P’s thinking on the outlook for the credit rating of the world’s biggest economy, John Chambers told Dow Jones Newswires.”

The fiscal commission, amongst other things, is expected to recommend raising the retirement age to 70, implementing steep tax increases to keep the revenue-to-debt ratios low, executing deep cuts in the federal budget, and a list of other politically unlikely proposals.

This reminds one of parents who tell their children that they can go out later that night, but they have to have the house painted, the attic cleaned, the grass cut, the lawn raked, and their homework done — all by 5PM.

It just isn’t going to happen. The fiscal responsibility commission will offer a set of nearly impossible criteria to follow. Moreover, today’s policymakers continue to downplay the risks posed by the sovereign debt crisis, describing it as either a medium or long term problem. So, S&P is issuing an ultimatum that it must acknowledge is unlikely to be heeded.

Cavuto indicated that a credit downgrade was long overdue: “We have long been the beneficiary of a grade curve that would make my most lenient college professor,” citing “friends in high places” who have been “covering up for us, inflating our grades, and buying our crap.”

This level of criticism against the U.S. bond rating by serious commentators just three years ago would have been unheard of. But now it’s being openly mocked. Said Cavuto, “Sometimes you have to call a joke a joke… I’m sorry to say it, but we are a joke, a financial laughing stock.”

Certainly, that is true. The sovereign debt crisis is, after all, nothing new, and yet nobody is convinced Congress will take the threat of a downgrade seriously. Treasury Secretary Timothy Geithner so boldly declared that the U.S. would “never” lose its triple-A rating. Who can blame Congress for its complacency when the Treasury Secretary is out there making such proclamations?

Why ever reduce spending at all if the credit ratings agencies would “never” downgrade us? What a joke.

The fact is we should be downgraded. It seems to be the only way to shock the political class into taking the problem seriously. There comes a point when the credit rating attached to Treasury bonds is only as credible as the agency issuing the rating.

A Chinese credit rating agency, Dagong, has already downgraded U.S. debt to double-A, indicating that the Western monopoly on sovereign ratings is coming to an end. “The reason for the global financial crisis and debt crisis in Europe is that the current international credit rating system does not correctly reveal the debtor’s repayment ability,” said Guan Jianzhong, Dagong’s chairman, after the new ratings were issued.

S&P’s notice comes on the heels of a similar warning by Moody’s, which cautioned that if interest owed on the national debt rises above 18 to 20 percent of revenue, that a downgrade would be in order, as reported by Investors Business Daily. According to the Congressional Budget Office, that threshold will be reached in 2018, and even as soon as 2013 under an adverse scenario.

That report barely caused Congress to bat an eye. Less than two weeks later, it passed the Dodd-Frank financial takeover bill, complete with an unlimited bailout fund. In July, it passed another unpaid-for $34 billion extension of unemployment welfare benefits. In August, it ratified another $26.1 billion bailout of bankrupt states like New York and California.

Now, even as economic growth is slowing down and unemployment remains persistently high, despite trillions of dollars spent and printed as “stimulus,” the Keynesians are proposing fresh rounds of fiscal stimulus and “quantitative easing.” For example, Obama Economic Recovery Advisory Board member, University of California Professor Laura Tyson, has proposed another $1 trillion over five years in fiscal “stimulus”.

On the monetary side of the equation, the Federal Reserve has been increasing its own stake in the national debt, which has risen to $784 billion in recent months, making it the third-top holder of U.S. debt behind China and Japan.

Also, despite the happy talk last week that Bernanke was not ready to engage in another round of easing through more treasuries purchases, the Fed is continuing its new policy to sell its $1.25 trillion of mortgage-backed securities and buy U.S. debt in their place, at a pace of about $5 billion a week.

So, more debt, more spending. That’s Washington’s ever-present solution to everything. Which is why everyone laughed when Obama unveiled his fiscal responsibility commission and said, “For far too long, Washington has avoided the tough choices necessary to solve our fiscal problems — and they won’t be solved overnight.”

This from the same Administration that just a few weeks prior to announcing the commission had proposed adding $1.06 trillion to the national debt every year for the next ten years. He should have said that the national debt won’t be solved at all. We deserve to be downgraded.

Bill Wilson is the President of Americans for Limited Government.