It was not so long ago, in 2008, that the commodities bubble was rocking the American economy. Oil marched upward almost every day, peaking at close to $150 a barrel. Right before that, gold had proceeded to over $1,000 an ounce. The American people were getting killed at the pump, with gasoline peaking at over $4 a gallon.

There was much speculation at the time as to the cause for the price spikes, which can be boiled down to two arguments: 1) those who maintained that demand had peaked for oil, and that new supplies were needed; and 2) those who believed the surge was due to the devaluation of the dollar.

That summer, the oil bubble popped, and prices came crashing down, right in time for the financial system meltdown of Fall 2008. So, was there suddenly a new supply of oil that had been tapped? Or a commensurate decline in demand that justified the sudden drop in prices?

It was neither. We now know that investors were hedging against inflation. It created a bubble, it peaked, and investors cashed in. It ultimately popped, because like all economic bubbles, it was unsustainable.

So, now it appears that oil is marching upward again, rising to above $80 a barrel last week. Gold is maintaining its new highs at over $1,300 an ounce. Grain and other commodities are surging, too. To be fair, these could just be temporary fluctuations that are not indicative of commodities again experiencing inflation.

Certainly, one can hope. But hope is not a strategy, and it is not at all comforting based on experience. It could be that $4 a gallon for gasoline is very well threatening to slay American consumers at the pump once again.

These rising prices could indeed be another inflationary trend. Why?

Speculation is abounding that the Federal Reserve is once again preparing to engage in “quantitative easing,” which means printing more money and injecting it into the economy and to finance government’s voracious spending. Keep in mind that the Fed has already blown up its balance sheet from about $900 billion in August 2007 when the financial crisis began to well over $2.3 trillion today.

Federal interest rates, which were historically low throughout the 2000’s, were taken to near-zero in December 2008, where they have remained ever since. They cannot go any lower lest they become negative. So, the only other way to ease is for the Fed to print more money for new assets, in this case treasuries.

Of course, any new treasuries purchases would come atop what has been the loosest, easiest monetary policy in American history.

Predictably, the dollar has been getting creamed on global currency markets under the assumption that more easy money is on the way. The reason is simple: The U.S. is increasing its money supply faster than other currencies, resulting in relative declines versus other currencies.

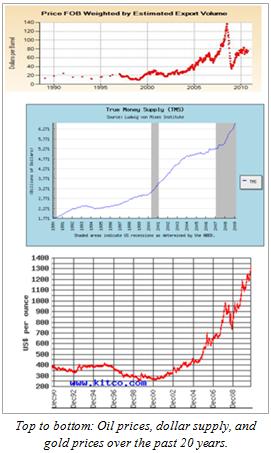

On the commodities side of the equation, since oil and gold are traded in dollars, there is a very strong correlation between the supply of dollars and the prices of these commodities (see chart).

Pretty much, the supply of dollars has been growing faster than the supplies of gold and oil. So, commodities prices are behaving predictably. Too many dollars chasing too few resources equals inflation.

In fact, commodities are very sensitive to the value of the dollar because of the dollar’s status as the world’s reserve currency. This gives U.S. policymakers a special responsibility to maintain price stability, or risk losing possession of the reserve currency.

Unfortunately, the Fed appears committed to more inflation. In its most recent statement it said that “measures of underlying inflation are currently at levels somewhat below those the Committee judges most consistent, over the longer run, with its mandate to promote maximum employment.”

So, presently surging oil and gold are not strong enough indicators of dollar devaluation for the Fed. It wants more inflation.

An easy prediction to make, therefore, is that should the Fed follow through with another round of printing money, the increased supply of dollars will cause commodities to spike upwards eventually. The only questions are that of magnitude and timing.

Robert Romano is the Senior Editor of Americans for Limited Government (ALG) News Bureau.