By Rebekah Rast –

Elizabeth Marshall Maybee would be the first to tell you that ranching is a lifestyle. Not a pastime, not a hobby for retirement, but a lifestyle.

She is a ranch owner in Southern Humboldt in northern California. The Marshall Ranch has been in her family since the 1880s. Maybee has fond memories working the ranch as a young girl with her grandfather and grandmother.

“My heart was in agriculture,” Maybee says. “That’s why I ended up being the one at the ranch close to my grandma. We both had a natural love for livestock and horses.”

When her grandmother passed in 2005, the ranch was passed down to her. Shortly after, Maybee received a bill from the Internal Revenue Service (IRS) for $2,005,389.00. The amount she owed the government for the federal estate tax.

Maybee works the ranch day and night. No profit is gained from the ranch any longer, as it all goes to pay the property taxes and liability insurance for the land. The ranch used to support the timber industry, but with the downturn in the real estate market in California, her ranch sits stocked full of trees, waiting for lumber to be needed again. She also has horses, cattle and other wildlife roaming the 3,000-acre ranch.

You see, her grandmother passed and her land appraised during the height of the real estate boom in California and when all was steady with the American economy. It doesn’t matter that California’s property values have greatly decreased since then; she owes more than $2 million now, regardless.

Her first installment including interest has been estimated by her and her CPA to run about $156,000.00. That is due Sept. 13, 2011, and every year thereafter until 2020. The IRS has already placed a lien on her home and other parts of the ranch.

For a ranch that doesn’t make much of any income, that money will be nearly impossible to come by.

Maybee knows this, and is now faced with the realization that she is going to have to sell parts, if not all of her land in order to pay this tax. This is land that has been in her family for generations. This land was her gift from her grandparents to keep the American Dream alive for her and her family. But all that is gone now. All she is focused on is how to come up with $2 million and hopefully salvage at least part of the land for her daughter who also lives on the ranch.

* * *

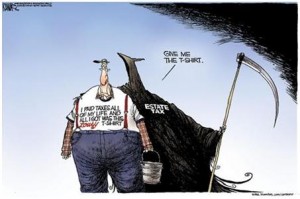

The estate tax is thought of as a tax on the very wealthy. But for those whose wealth is in their land, agriculture or cattle, the estate tax often leads to the selling of the ranch or farm, even if that land is simply being passed down and not changing hands.

“This really affects farmers and ranchers most because most their value is in their land,” says Paul Wenger, president of the California Farm Bureau. “They don’t have big savings or portfolios. Fifty percent of a farmer’s income has to come from agriculture.”

Therefore, this tax doesn’t hurt the big corporate farms or ranches. It hurts the family-owned farms and ranches whose food feeds a community and is sold at local farmers’ markets. It hurts the owners who live on the land they care so much about and are great stewards of it by protecting habitats, preserving wildlife and teaching the next generation to do the same.

“A lot of protected species live on the land,” Wenger says. “This land is better taken care of in the hands of the farmers.”

Farmers and ranchers didn’t have to deal with an estate tax in 2010. But if nothing is done by Congress during the lame-duck session, the estate tax will be reinstated to 55 percent with a $1 million exemption starting Jan. 1, 2011, its highest level in 10 years.

“The estate tax is nothing but a form of double taxation that kills family-owned farms and ranches,” says Bill Wilson, president of Americans for Limited Government (ALG). “This tax needs to be eliminated so farms and ranches can stay in the family and be passed down.”

Like the California Farm Bureau, a top issue for the American Farm Bureau Federation is estate tax relief during this lame-duck session. John Hart, director, News Services for the Bureau, says the tax should be eliminated completely, but the Bureau is supporting the Lincoln-Kyl legislation.

This legislation, introduced by Sens. Blanche Lincoln (D-AR) and Jon Kyl (R-AZ), would permanently fix the estate tax at a rate of 35 percent with a $5 million exemption.

The American Farm Bureau Federation President Bob Stallman sent a letter to Obama on Nov. 12 stating, “The return of estate tax unaltered will strike a blow to farm and ranch operations trying to transition from one generation to the next,” Stallman wrote. “In the late 1990s, twice the number of farm estates paid estate taxes compared to other estates, and it took two and half years of farm returns for a moderate-sized farm operation to pay estate taxes owed. A $1 million exemption is not high enough to protect a typical farm or ranch able to support a family. When coupled with a top rate of 55 percent, it can be especially difficult for farm and ranch businesses.”

Another stumbling block farmers and ranchers have to deal with after land is passed down is that the land is appraised based on what it could be used for, not necessarily what it is being used for at the current time, says Wenger.

“The land is appraised for what it could be used for,” says Wenger. “If you have a 100-acre piece of land full of tumbleweeds, but the land is in an area where vineyards can be grown, then your land could be appraised at the level of having grapes on it.”

Wenger goes on to say, “The estate tax messes up family farms.”

Though Elizabeth Marshall Maybee knows it is too late for an estate tax reform to help her, she is hoping Congress will make it so others don’t have to live her story.

“It’s important for policy setters to understand that we don’t need trickery and gimmicks to get us to want to save the land,” Maybee says. “Our hearts desire is to save this land and keep it going.”

Maybee hopes that if an estate tax remains than concerns like inflation, the real estate market and economic activity will be taken into consideration. She also hopes some sort of change happens in the estate tax code in that if the land is being passed down to the next generation and not sold, then an estate tax does not have to be paid.

Maybee’s life is ranching. It is her passion and her dream. For two years in a row she hosted a redwood planting event on her ranch, where the community came together and planted the trees. She knows that no one, the government, a businessman or a developer, will love and treasure this land more than she does.

“Ranchers and farmers are the protectors of America’s lands,” says ALG’s Wilson. “They are true environmentalists who cultivate and preserve the land’s offerings.”

Wenger agrees, and adds, “If you live on the land you should farm the land. It gives you a different perspective and the land is better taken care of.”

Maybee hopes that if she has to sell the land, that it will at least remain a ranch. But with each knock on her door inquiring about her land and with each sales pitch offering to buy her land, she knows that is doubtful.

“Grandpa didn’t give up,” Maybee says. “He pulled himself up by his bootstraps and kept the ranch going. But, I think even Grandpa wouldn’t know how to handle the problem that I am saddled with.”

The Marshall Ranch, which survived the Great Depression and survived a case of eminent domain for the building of a water treatment plant, according to Maybee, faces its biggest hurdle yet. The federal estate tax.

And it looks like it might lose this battle.

Maybee isn’t alone in her plight against the IRS. Other family-owned ranches and farms have faced similar circumstances, while others wait to see what is to come of the estate tax in the next few weeks during the lame-duck session of Congress.

But one thing is certain, no farmer or rancher ever wants to see a letter from the IRS stating that they owe $2,005,389.00 for the federal estate tax.

Rebekah Rast is a contributing editor to the Americans for Limited Government (ALG) News Bureau.