It may not be long before the wonks over at the Fed come to the same conclusion, under pressure from the Obama Administration and its allies at the Times. So far, the central bank has said it is not considering such a move, but that could change if the bad economic data continues to come in, with growth at a dismal 1.8 percent in the first quarter.

The Times also calls for unemployment welfare to be extended yet again, for an easing of rules for refinancing, “bolstered foreclosure relief and more fiscal aid to states,” job “retraining,” and even tax increases to, it says, “help cover needed spending.” You know, all of the stuff government has already been doing without any success to facilitate this so-called “recovery”.

Times columnist Paul Krugman too jumps into the fray for his part. He wants “W.P.A.-type programs putting the unemployed to work doing useful things like repairing roads… a serious program of mortgage modification, reducing the debts of troubled homeowners… [and] [w]e could try to get inflation back up to the 4 percent rate”.

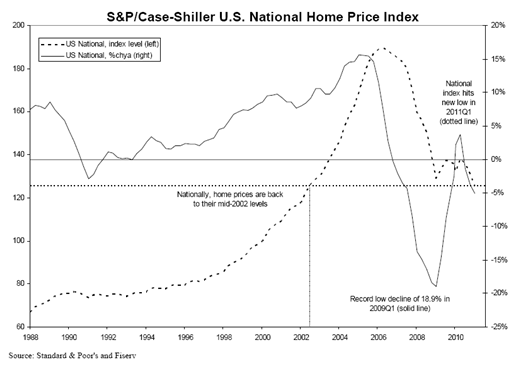

Basically, the Left wants more of the same — more “stimulus”—which has already failed. We know that because of the 4.2 percent decline in home values in the first quarter as measured by the S&P/Case Shiller home price index.

We are now officially in a double dip downturn in housing. Home values are now at their lowest point in the current recession — lower than even April 2009. The Obama Administration promised that if trillions of dollars in fiscal and monetary “stimulus” were injected into the economy, that it would turn the housing market around.

Specifically, when Barack Obama signed the $826 billion “stimulus” into law he promised to “stem the spread of foreclosures and falling home values for all Americans”. So much for that.

Zillow reported last month that 28.4 percent of homeowners are underwater, a number that is likely to keep rising the more overall home values continue to plunge. The problem of negative equity has likely been compounded, ironically, by the $22 billion homebuyers tax incentive program.

3.3 million people utilized the program, which temporarily juiced the market, and have now seen prices depreciate again just as the government was saying the recovery was at hand. Whoops.

Coupled with rising foreclosures and persistently high unemployment at 9 percent, including a youth unemployment rate (i.e. those under 25) over 17.2 percent, Keynesians like Krugman, the Times editorial board and those at the Obama Administration can only come to one conclusion: Not enough money was spent, borrowed, and printed by the government. They can’t believe their lying eyes.

That is because their ideology does not allow for another possibility: That the financial crisis caused by government “stimulus,” too low interest rates by the Fed, and loose underwriting policies by Fannie Mae, Freddie Mac, and the Federal Housing Administration, not to mention the Community Reinvestment Act regulations that weakened lending policies, lowered down payments, and otherwise pushed risky loans on individuals who could not afford them.

Government created the bubble. And when it popped, the resultant correction was unavoidable.

Obama has simply prolonged the recession he swore to pull us out of, as shown by Case-Shiller’s data. After the “stimulus” programs ended, the temporary spike in home values did too. Under the theory, the “recovery” should have been self-sustaining. Instead, values went down anyway.

We should have just let prices hit the bottom in the first place. Instead of bailing out banks, it would have been better to let investors that bet poorly on housing to fail. If government had just gotten out of the way, we would already be in recovery. That is the path Iceland has followed, and compared to Ireland, which did bail out its banks, is speeding more rapidly into recovery, and without the burdensome, excessive public debt accrued.

The American people have wasted over $2 trillion on a lie. Obama has been given everything he wanted — everything he said would turn the economy around. The “stimulus”’ has failed. He has failed.

Now is the time for a new direction for America, and that will only come with new leadership on the economy, before we go bankrupt trying to “stimulate” it. It is also time for Fed head Ben Bernanke not to heed the calls to throw another trillion dollars from a helicopter. But based upon the past three years of experience, there is little reason to doubt that under pressure he won’t cave.

Bill Wilson is the President of Americans for Limited Government. You can follow Bill on Twitter at @BillWilsonALG.