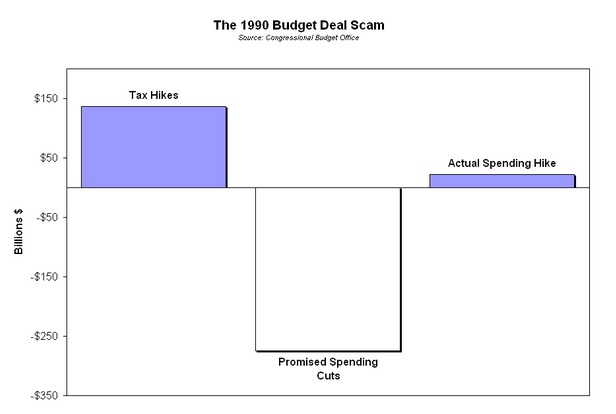

This is one of the best charts that explains why the GOP should reject tax increases, and shows why taking $1 in tax hikes for every $2 in spending cuts is a bad deal:

In 1990, President George H.W. Bush was promised $2 in spending cuts for every $1 in tax hikes by Congressional Democrats. That’s not what happened.

All $137 billion in tax hikes went through. Most notable was raising the top marginal tax rate from 28 percent (the Reagan low) to 31 percent (itself a setup for the 1993 Clinton tax hike of this rate all the way up to 39.6 percent). There were also increases in “sin” taxes and the Medicare payroll tax, as well as the yacht “luxury tax” that President Obama seems so intent on re-visiting on the jet plane manufacturers.

Not only did the $274 billion in promised baseline spending cuts never materialize–baseline spending was actually $22 billion higher than what CBO projected it would be before the deal. This despite another tax hike/baseline spending cut deal in 1993 (the Clinton tax hike) and the GOP takeover of Congress in 1995.

The lesson here is that no politician can be trusted to make spending cuts when they are asking for tax increases. Politicians in D.C. have a spending addiction–taking more of our money will not help them kick the habit.