This time, the bailout totals $140 billion.

This comes atop $145 billion states got out of the original Obama “stimulus”, and $26.1 billion in Aug. 2010 — all attempts to forestall necessary budget cuts in states that were hard hit by the recession. After the financial crisis hit, the combination of high unemployment and depressed property values has led to record shortfalls in state budgets.

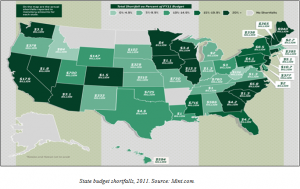

Despite the prior bailouts, data compiled by Center on Budget and Policy Priorities (CBPP) finds that the states’ consolidated shortfall for the current fiscal year totals still totals $103 billion, indicating the “stimulus” has merely had the effect of postponing cuts that were inevitable.

CBPP also finds that the “stimulus” has finally run out. Only now are the states finally making the full range of cuts that one would have anticipated when the recession originally hit, which explains governments shedding 143,000 jobs in the past three months alone, according to the Bureau of Labor Statistics.

According to the National Association of State Budget Officers (NASBO), state spending grew from $945.3 billion in 2000 to more than $1.5 trillion 2008, almost a 58.7 percent increase during the 2000’s, where because of inflated property values revenues were generally rising.

In hindsight, the run-up in spending over the last decade was entirely unsustainable. When the housing bubble popped, those revenues dropped — big time. It has led to trillions of dollars of unfunded liabilities in health care and pension benefits to public sector unions arrived at through collective bargaining arrangements.

With the housing market expected to remain depressed for many years to come, it makes little sense for states to attempt to maintain expanded levels of spending. Yet that is precisely the path that the Obama Administration has committed itself to.

Members of Congress need look no further than the deteriorating situation in Europe for clear proof that kicking the can from making tough decisions is only exacerbating the fiscal crisis there.

Consider the example of Ireland, which rather than let its banks that bet poorly on housing fail, it guaranteed their debts — a move that precipitated the sovereign debt crisis there. But, the Irish are hardly the only ones in trouble. Greece faces similar problems as California and Illinois, with unfunded state-funded pension and health care benefits.

Rather than letting troubled sovereigns to fail and go into default, the European Union appears committed to taking on the bad bets of its weaker members. But Germany and France should be forewarned of assuming these risks — the consolidated debts of Portugal, Italy, Ireland, Greece, and Spain (PIIGS) total more than €3 trillion.

This is the idea of a collective destiny — the centralization impulse. It requires increased consolidation of power in the national, or in the case of Europe, continental government. It is nothing more than hubris — a belief that central planners are just so smart, that somehow they can fine tune everything to maximize growth.

But based on the evidence, it appears that this centralization is leading to less growth and even systemic risk in the financial system.

Historically, increased centralization usually leads to authoritarianism. Sometimes it’s the soft authoritarianism of bureaucrats. But other times it’s the hard jackboot variety, and it can happen here. Don’t think so? Ask Gibson Guitar, which was raided by gun-toting federal agents for allegedly using the wrong kind of wood to make their guitars, a charge Gibson has debunked.

There is another way.

The answer, of course, is the decentralization of power. It is to allow states like California and Illinois that spent beyond their means to scale back to more sustainable levels and reduce taxes, which might help them to compete with Texas for job creation. It is to let nations like Greece to restructure their debts.

Essentially, it is to let failure be an option again. Our nation’s bankruptcy laws, which only impact the private sector, are built on the concept that institutions can recover from such failures. It should be no different with state governments.

Congress should consider a fix to those laws to create a mechanism for the restructuring the debts of troubled states. It must include provision for overriding collectively bargained arrangements that are no longer affordable, and a reevaluation of job-killing state regulations. Before the economy can start growing again, it must first stop bleeding.

Bill Wilson is the President of Americans for Limited Government. You can follow Bill on Twitter at @BillWilsonALG.