In the Orwellian world we live in, “growth” means more spending, and “austerity” means painful cuts which destroy economies.

One would think that a simple survey of the U.S. economic shambles would put an end to the government spending = growth myth. CBS News reports that Obama has accumulated almost $5 trillion in new debt, exceeding the total of his predecessor’s eight years in office in just over three.

If growth followed massive government spending, then the U.S. economy should be humming along rather than the current anemic 2.2 percent in the first quarter of 2012. When adjusted for inflation in commodities, the real GDP for the first quarter stood at 1.7 percent, a far cry from the Obama predicted 3 percent rate for the year.

Our economy has an 8.1 percent unemployment rate that has dropped not due to job creation, but due to people dropping out of the workforce. In fact, 319,000 fewer Americans are employed today than when Obama took office — quite a record of growth for Europe to follow.

Obama’s “growth” agenda has been fueled by about $3 trillion in stimulus including the failed $800 billion fiscal stimulus and more than $2.5 trillion in monetary stimulus courtesy of Ben Bernanke and the Federal Reserve Bank.

Now, Obama is working on the European leaders to push them toward policies that would push down the accelerator on sovereign debt creation which has been proven to only make the overall debt crisis worse.

Ironically, the so-called “austerity” alternative that Obama is urging to be rejected has not even been tried as countries like Greece have not made the choice to cut their budgets enough to staunch the flow of red ink, so there is no baseline in the current crisis to show that budget balancing doesn’t generate growth.

The sad fact is that those who cling to the failed socialist policies of the past will not give up the illusion that Keynesian economics is anything more than a theory designed to gradually slip free people into the bondage of ever growing government debt.

As the world watches these leaders of the largest “democracies” on the planet engage in meetings designed to save the crumbling European socialist infrastructure and the banks that lent the money to enable it, we see the clash of national histories and cultures.

Germany, with its collective memory of the hyperinflationary despair caused by massive deficit spending after WWI which led to the rise of Adolph Hitler, chooses the route of fiscal responsibility. Even with this history, the German debt to gross domestic product has risen from 58.8 percent in 2002 to 81.2 percent in 2012.

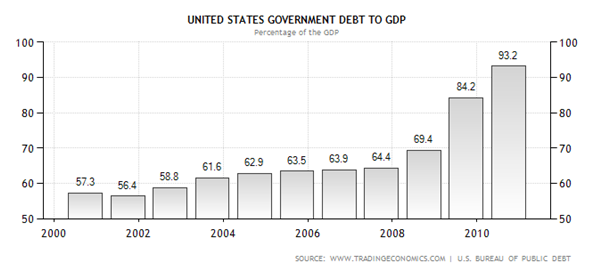

The United States under Obama, has embraced fiscal recklessness under the mantle of “growth” and has seen our debt to GDP increase from 64.4 percent in 2008 to crashing the 100 percent mark in 2012.

Just so the U.S. doesn’t feel too lonely having our national debt exceed our total annual economic production, fellow G-8 member Italy has a GDP to debt ratio of 120 percent. Of course, Italy is considered a prime candidate for needing a bailout to prevent them from defaulting on their debts, so one wonders how wise it is to include them in the room when discussing whether the prudent economic policy is politically difficult budget cuts or an Alice in Wonderland spending spree. Not to be outdone, Japan has beaten everyone in the race toward fiscal insanity having blown past the 200 percent threshold and having twenty years of economic stagnation.

So, now Obama wants to try to sell the world on the concept of additional spending being the key to future economic prosperity. Hopefully, the rest of the world treats his economic prescriptions with the same respect that the U.S. Senate treated his budget and just says no.

No matter how hard Obama and the world’s creditors try to redefine the meaning of growth and turn common sense on its head, more government deficit spending can only further stagnate economic growth. After all, if deficit spending created economic growth, the U.S. debt to GDP would be shrinking in response to our unprecedented deficits, and not even Obama can argue that red ink is actually black.

NOTE: This chart does not include 2012 data which shows the debt to GDP ratio in the United States exceeding the 100 percent level.

Rick Manning is the communications director of Americans for Limited Government