And then at the end of the year, to top it all off, taxes are set to automatically rise across the board for every single American.

As problematic as these events are for the immediate future, the causes that underlie the economic crisis we face are even worse. Namely, the insolvency of individuals, as in the foreclosure crisis, banks that engaged in risky lending, and then governments with debts that cannot be repaid, only reserviced.

But it’s even worse than that. Without fundamental reforms to rein in this looming debt bomb, it threatens to take out advanced economies all over the world, including the U.S.

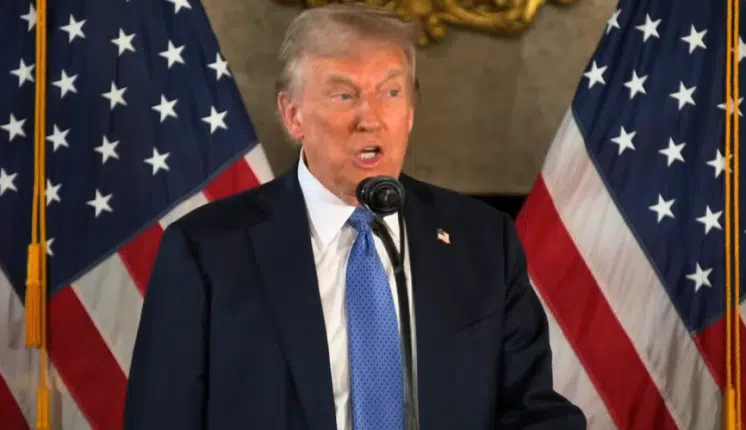

Politically, as the situation continues to deteriorate, it at least becomes increasingly unlikely that Barack Obama will be reelected. If so, that means Mitt Romney will certainly have his work cut out for him should he assume office in 2013 to deal with Obama’s debt overhang.

Obama may think the economy’s doing just fine, but everyone else knows we’re in big trouble. Does Romney get it?

To be certain, mere tinkering around the edges of fiscal and regulatory policy will not address the fundamental insolvency crisis that has been plaguing the world financial system for five years now.

For decades, Keynesian policies have sought to use credit expansion to fuel economic growth. And from 1945 to 1970, for every dollar of debt created public and private combined, there was an equal or greater sum of economic growth.

But once Richard Nixon severed the dollar’s ties to gold in 1971, that relationship broke down. Now, like Europe, it takes 2 dollars of debt for every dollar of growth — and unsustainable proposition. Today, it amounts to one step forward, two steps back as these debts reach catastrophic levels.

Now it is the gargantuan debts, both public and private totaling more than $54 trillion, including some $15.7 trillion of gross federal debt, that are holding back the economy.

Federal Reserve Chairman Ben Bernanke acknowledged as much in his June 7 testimony to the Joint Economic Committee in Congress, saying, “At best, rapidly rising levels of debt will lead to reduced rates of capital formation, slower economic growth, and increased foreign indebtedness. At worst, they will provoke a fiscal crisis that could have severe consequences for the economy.”

Bernanke warned, “To avoid such outcomes, fiscal policy must be placed on a sustainable path that eventually results in a stable or declining ratio of federal debt to GDP.”

But, Bernanke speaks with forked tongue.

In the same breath, he warned against any immediate spending reductions that might actually get the situation under control, saying “a severe tightening of fiscal policy at the beginning of next year that is built into current law — the so-called fiscal cliff — would, if allowed to occur, pose a significant threat to the recovery”.

There, Bernanke is referring to the mere $62 billion net reduction of spending set for 2013 under the “sequestration” option from last summer’s debt deal. So, we’re to believe that a tiny, less than 2 percent reduction in spending poses “a significant threat to the recovery”?

This is the same Keynesian double-talk that we get from the likes of New York Times columnist and economist Paul Krugman, who in Feb. wrote, “yes, debt matters. But right now, other things matter more. We need more, not less, government spending to get us out of our unemployment trap. And the wrongheaded, ill-informed obsession with debt is standing in the way.”

To Krugman, it is not the insolvency of individuals, banks, and then governments that is currently holding back the recovery. Instead, it is those who attempt to avoid or prevent the ensuing bankruptcy by restoring fiscal sanity and sound money.

Should Romney assume office, he must reject the false comfort offered by those who, like Krugman, believe we never really need to repay the $15.7 trillion debt. For, if Romney buys this lie, he may very well be presiding over a Greek-like fiscal crisis that turns into the tragedy of a national default, the end of the dollar as the world’s reserve currency, and a general economic collapse all over the world.

Earth to Romney: the economy cannot be merely tweaked. The debt overhang must be dealt with, or else it will deal with him in short order once elected.

Bill Wilson is the President of Americans for Limited Government. You can follow Bill on Twitter at @BillWilsonALG.