In its statement, the central bank promised to purchase $40 billion mortgage-backed securities a month and will continue to do so “[i]f the outlook for the labor market does not improve substantially”. In addition it will “undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved”.

CNBC senior editor John Carney notes that “no other central bank has launched a quantitative easing program with such an explicit link to jobs.”

Maybe the reason for that is because quantitative easing actually has nothing to do with creating jobs. The major problem with this justification is that there has been no discernible jobs effect brought about by QE1 and QE2.

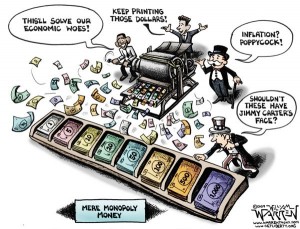

How can $1.5 trillion in a vault create jobs?

Lest there be any doubt, deposits held by Federal Reserve banks on behalf of financial institutions have exploded from $13.4 billion in 2007 to more than $1.5 trillion today. If QE1 and QE2 were responsible for creating jobs, then why is most of it still sitting in a vault?

But, if one wanted to give the Fed the benefit of the doubt that this quantitative easing might have had a job-creating effect, let us examine the impact of QE1 and QE2. Since Aug. 2007 when the financial crisis is thought to have begun, the Fed has increased its balance sheet from $897 billion to $2.805 trillion today, more than tripling it.

But since that time, the economy has lost 3.5 million jobs according to data compiled by the Bureau of Labor Statistics. Overall, in this recession, a net 4.3 million jobs have been lost. To be fair, the quantitative easing portion of the Fed’s program did not begin in earnest until Sept. 2008. Up until that point the Fed had mostly been slashing interest rates. But even from that point forward, the economy still has lost 2.9 million jobs.

In fact, the economy kept shedding jobs until Jan. 2010. By that time, some 8 million jobs had been lost, and the Fed was already $908 billion deep into its $1.25 trillion of mortgage-backed securities purchases. Overall it was 69 percent of its way through its entire round of quantitative easing, or $1.3 trillion out of $1.9 trillion of total monetary expansion measured to date.

QE2 was still 11 months away, when the central bank decided to purchase another $600 billion of U.S. treasuries.

If you measure from the bottom of the jobs market in Dec. 2009 through Nov. 2010 when QE2 was announced, a mere 969,000 jobs were added off of the bottom. So at best, the $1.3 trillion of quantitative easing at that point had created less than 1 million jobs. That’s a cost of $1.3 million per job created.

Since QE2, the economy has added another 3.1 million jobs. But that was from only $600 billion. Why did $600 billion create that many jobs when the prior $1.3 trillion had supposedly created a fraction of that many? Why was there a 17-month lag in creating jobs in QE1 and seemingly none for the much smaller QE2?

Probably because there is in fact no correlation whatsoever between central bank asset purchases and job creation.

How did buying mortgage debt create jobs for doctors?

Going deeper into the numbers, let us examine the sectors that should have most benefited from QE1’s purchase of mortgage-backed securities: construction and financial services. From Sept. 2008 to Nov. 2010 (the entire period of QE1), 450,000 jobs were lost from financial services, and 1.5 million were lost from construction.

In the jobs recovery off of the bottom, the financial services sector has added back just 103,000, and construction has only added 59,000. If either QE1 or QE2 were supposed to have helped the housing or financial services sectors, by every measure they failed.

Meanwhile, the tepid jobs growth the economy has seen has been in completely unrelated sectors like health, mining and logging, and education. How did mortgage-backed securities or U.S. treasuries repurchases by the Fed from banks help create jobs for doctors, lumberjacks, miners, and teachers?

Simply put, they didn’t. Those jobs would have been created regardless of the balance sheets of the banks that sold these assets to the Fed. It is therefore nothing more than a big lie to claim the central bank created them.

Bailing out banks and government

But none of that matters, since 78 percent of QE1 and QE2 — $1.5 trillion — is simply sitting in a vault. It couldn’t have been creating jobs.

So, there must be a more plausible explanation for the Fed’s various rounds of quantitative easing. To which, just look at what has been primarily purchased by the central bank: $840 billion of mortgage-backed debt and $860 billion of government debt. The primary beneficiaries of these purchases are not job-seekers, but banks and the federal government.

The federal government has a borrowing need of about $1.45 trillion annually right now. That money has got to come from somewhere.

In short, the central bank will be supplying funding to its primary dealers — a fresh $480 billion of mortgage-backed securities from banks a year — freeing up money for those banks to lend to Uncle Sam.

But one need not take such a domestic view of the Fed’s actions. In fact, of the $1.25 trillion of mortgage-backed securities it bought last time, $442.7 billion of those went to banks overseas.

$415.3 billion of that went to European banks: $127.5 billion given to Credit Suisse (Switzerland) for the junky securities, $117.8 billion to Deutsche Bank (Germany), $63.1 billion to Barclays Capital (UK), $55.5 billion to UBS Securities (Switzerland), $27 billion to BNP Paribas (France), and $24.4 billion to the Royal Bank of Scotland (UK).

So, exactly one-third of all purchases the Fed made of mortgage-backed securities in QE1 went to Europe. If the same pattern holds true for its $480 billion annual dose of QE3, another $158 billion will be transferred to these European banks — every year.

In that respect, QE3 is just another backdoor bailout for European banks so they can afford to continue purchasing their own countries’ debts.

That is the real truth. Whether it is funding U.S. deficit spending through treasuries purchases or propping up foreign banks to do the same, the public should understand that QE3 has nothing to do with creating jobs, and everything to do with financing failed big government experiments all over the world.

Bill Wilson is the President of Americans for Limited Government. You can follow Bill on Twitter at @BillWilsonALG.