Barack Obama need only do nothing, and everyone’s taxes will go up on Jan. 1.

Specifically, personal income tax rates will increase from 10 to 15 percent, 25 to 28 percent, 28 to 31 percent, 33 to 36 percent, and 35 to 39.6 percent. Capital gains taxes would increase from rates of 5 and 15 percent to 8, 10, and 20 percent.

Payroll taxes too will increase, from 4.2 to 6.2 percent for individuals, and from 10.4 to 12.4 percent for those self-employed.

Estate taxes also are set to increase, from the current 35 percent rate with a $5 million exclusion to the old 55 percent rate and $1 million exemption. And the alternative minimum tax patch will similarly expire.

Other provisions of tax law including expenditures and certain credits will be affected, too. However, the tax provisions only compose one portion of the fiscal cliff. In addition, members of Congress and Obama will be deliberating on the sequestration cuts, the doc-fix in Medicare, and the $16.394 trillion debt ceiling will be hit to boot.

Obama’s leverage is two-pronged. If House Republicans refuse to give him what he wants — which includes tax increases for top salary-earners — then everyone’s taxes will go up. Using the bully pulpit, Obama would then exploit the situation as a proof point that Republicans only care about protecting the rich at the expense of everyone else.

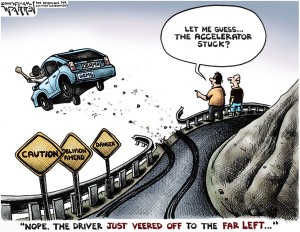

Such is the game of chicken being played.

Effectively, that leaves House Republicans with a choice to either take Obama’s proposed legislation or leave it. That is, unless they feel they can get a better deal through negotiation — or through the application of some leverage of their own.

For their part, it appears Republicans’ leverage includes the possibility that it will be Obama who actually gets blamed if taxes increase across the board. After all, raising taxes on job creators into the teeth of a slowing economy, when unemployment is already really high, will likely only make the recession worse.

But can Republicans get that message out?

Alternately, Obama’s government cannot function at all really unless the national debt ceiling is increased. Perhaps House Republicans could work out a deal that addresses all facets of the fiscal cliff — if they’re willing to use the debt ceiling as leverage.

Obama wants the debt ceiling increased. The House wants to deal with all the tax rates and defense sequester cuts.

However, we now know that the U.S. Treasury has no real contingency plan in the event the debt ceiling is reached, as revealed in a recent inspector general’s report. As a matter of policy, the Treasury would simply postpone payments in lieu of a legislative resolution. It would not prioritize payments of principal and interest to our creditors.

In other words, the administration would effectively default on our debts until Congress caves and gives the White House what it wants — and use the bully pulpit and a complicit media to cast the blame.

Based on the above, we are led to believe that if Republicans do not give in to Obama’s demands to raise taxes on job creators, he will let everyone’s taxes go up. And that if they do not meet his demands for another blank check to borrow and print trillions of more dollars, he will let the nation default on its obligations.

Already, House Speaker John Boehner has offered that he is “willing to accept new revenue, under the right conditions.”

Boehner can try negotiating, but if Obama proves intransigent in his insistence on raising taxes into the teeth of this recession, they might try calling his bluff. See if Obama is really willing to fly off the cliff.

Robert Romano is the Senior Editor of Americans for Limited Government.