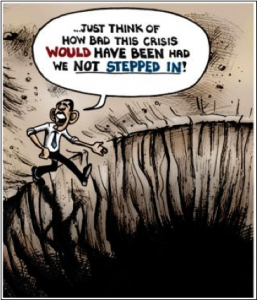

By Bill Wilson — The ultimate leverage in the game of chicken now being played in the upcoming fiscal cliff is who will get blamed politically if everyone’s taxes go up at year’s end.

By Bill Wilson — The ultimate leverage in the game of chicken now being played in the upcoming fiscal cliff is who will get blamed politically if everyone’s taxes go up at year’s end.

Because, unless House Republicans can come to some sort of an arrangement with the White House before Dec. 31, that is exactly what is going to happen. The Obama Administration is insisting that rates for the top two brackets be allowed to increase from 33 to 36 percent, and 35 to 39.6 percent.

And if he doesn’t get what he wants, everyone else’s taxes will go up.

That includes personal income tax rates going up from 10 to 15 percent, 25 to 28 percent, and 28 to 31 percent. Payroll taxes will increase from 4.2 to 6.2 percent for individuals, and from 10.4 to 12.4 percent for those self-employed. Capital gains taxes will rise from rates of 5 and 15 percent to 8, 10, and 20 percent. Estate taxes will jump dramatically and the alternative minimum tax patch will expire.

Obama is betting Republicans will get blamed for this outcome, and declare it proof positive that the GOP only cares about the top 1 percent.

In the Nov. 8 edition of the New York Times, pundit Paul Krugman warns that flying off the fiscal cliff could “easily” put the nation back into recession.

And he thinks “Mr. Obama has to be willing to let it happen if necessary.” He’s betting Republicans will be blamed.

There are several ways to counter this. And to survive the fiscal cliff, Republicans must make the case for permanent tax relief to get us out of the economic jam we are in.

This year the economy is only growing at an annual rate of 1.76 percent, unemployment is still too high at 7.9 percent, and raising taxes on job creators will not make things any better. Obama wants Americans to bite the hand that feeds them.

The GOP should also note that allowing capital gains taxes to rise per the Buffett rule at the end of the year will likely trigger a major selloff on stock markets as top investors seek to lock in the lower rate. They can point to recent turbulence in markets after the election as merely the tip of the iceberg.

If markets crash at the end of the year, it will hurt everyone’s retirement accounts.

Congressional Republicans would also be wise to point out that even if rates increase on couples making $250,000, and individual filers making $200,000 and above, it would only raise an additional $42 billion of revenue in 2013 according to the Congressional Budget Office.

That would reduce the $1.2 trillion deficit by just 3.5 percent. We would come nowhere near balancing the budget, let alone being able to retire any portion of the $16.1 trillion national debt — which has grown every single year since 1957.

All of which makes raising rates on top salary earners nothing more than a punitive measure.

They need to say that they are not going to turn the American people against one another for the sake of class envy, that permanent tax relief for everyone is the only fair solution.

Besides clearly messaging its position on a daily basis, the House should pass permanent extensions of current tax rates every single day during the lame duck session and send it to the Senate.

When Harry Reid sits on the legislation, it becomes his fault for not acting on the only legislation that can end this crisis — and avert future ones.

And at the end of the day, if Obama is comfortable flying off the cliff because he couldn’t stick it to the rich, he’s ultimately the petty one who deserves all of the blame when everyone’s taxes go up.

Bill Wilson is the President of Americans for Limited Government. You can follow Bill on Twitter at @BillWilsonALG.