By Bill Wilson — Despite higher-than-expected inventories giving the Gross Domestic Product (GDP) a seeming boost in the third quarter — being revised upward to 2.7 percent even as consumer spending was revised down — it may still be premature to pop the bottle of champagne.

Average growth for the entire year is still only just 2 percent, and the impact of Hurricane Sandy has yet to be measured for the fourth quarter.

Meanwhile, the embattled housing market — which typically leads recoveries — continues to remain in a depressed state, with just an annualized rate of 368,000 new home sales in Oct. The prior month’s numbers were revised down by 20,000.

That compares with new home sales annualized was more than 1.1 million in Sept. 2003 — when home values were roughly where they are today.

Put another way, new home sales are about 66 percent below what one would consider healthy in a robust recovery. Home values are still 31 percent below their April 2006 highs.

All of which could spell rough times ahead, if Nobel Laureate Professor Vernon Smith of Chapman University is to be believed.

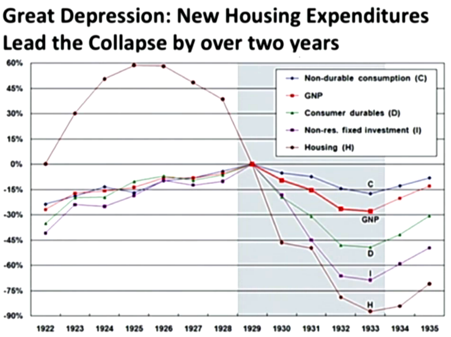

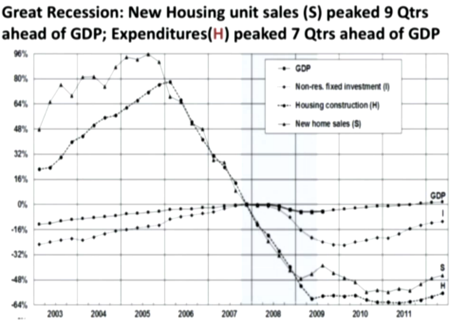

At the Cato Institute’s 30th Annual Monetary Conference, Smith showed very convincingly in the keynote address how depressed home sales lead to decreases in GDP and investment, charting similar behavior of indicators at the start of Great Depression and today:

Smith explains the correlation: “In 11 of the past 14 recessions, you’re having a decline in housing leading that recession. And all recoveries with the exception of — if you want to call this a recovery we’re in — with the exception of this recovery, housing has always come back after a recession.”

In other words, no one should really expect a robust economic recovery until a commensurate recovery is seen in the housing market and, more broadly, in credit markets. And so that is how we should measure the strength of this recovery, or lack thereof.

Since 2008, credit has remained virtually frozen — having only grown at an annual pace of just $300 billion. To get back to its prior decades-long trend of doubling every ten years, credit would need to grow by about $5 trillion every year.

We’re nowhere near that now.

The root cause of the problem, according to Smith, is negative equity. In Smith’s view, both the Depression and the current recession were “disequilibating housing mortgage market booms fueled by massive flows of mortgage credit.” In both cases, the busts following the booms were fatal.

And so long as prices remain depressed, new home sales will not pick up the way they will need to in order to improve other parts of the economy. In other words, until financial institutions actually clean up their balance sheets — or as the CEO of Pimco, the world’s largest bond trader, Mohammed El-Erian puts it, until they “find a way to safely ‘deleverage’” — we should expect the ongoing economic doldrums to continue.

That is why it is time to just let the deleveraging to occur without any more bailouts, and get it over with as soon as possible. The sooner balance sheet repair occurs, the sooner robust economic growth can be restored.

Bill Wilson is the President of Americans for Limited Government. You can follow Bill on Twitter at @BillWilsonALG.