After the hopeful press releases surrounding Black Friday, retailers are faced with having to sharply discount their overstocked inventory in after-Christmas sales as consumers did not bite on the relatively limited sales offered in advance of the nation’s holiday spending spree.

Anecdotally, one astute shopper was able to nab a $66 sweater for his sweetie for under $18 including tax at Macy’s on Dec. 26 in just one example of the deep price cutting being offered to clear inventory off of the shelves.

With the Christmas season retail sales figures dropping to their lowest growth level since the financial crisis hit in 2008, consumers have given two big thumbs down on how they feel about the economy and their personal economic future.

This slow retail sales season combines with the latest report that more Americans are on food stamps now than at any time in history to create legitimate questions as to whether the economy is already falling into recession.

The Federal Reserve has demonstrated its concern that the economy is sinking through their little noticed move to inject even more money into the economy through an additional round of Quantitative Easing (QE4) in a desperate attempt to ignite the economic growth engine.

The current slogging economy is a mystery to those who believe that government spending creates a multiplier effect on the economy and with trillion dollar deficits that multiplier effect should be causing the economy to go through the roof.

The only problem is, that it isn’t.

Perhaps, economists Carmen Reinhart of the University of Maryland and Kenneth Rogoff of Harvard University have the answer to the problem.

Reinhard and Rogoff recently argued that the larger government debt becomes, the slower the economy grows. Reinhart and Rogoff concluded that when an economy reaches a debt to GDP ratio of more than 90 percent, the economy grows 1 percent slower than when it is below that level.

A separate study entitled, “The real effects of debt” by Stephen G. Cecchetti, M.S. Mohanty and Fabrizio Zampolli published by the Bank for International Settlements in Basil, Switzerland came to a similar if not more dire conclusion stating, “Our results support the view that, beyond a certain level, debt is a drag on growth. For government debt, the threshold is around 85 percent of GDP. The immediate implication is that countries with high debt must act quickly and decisively to address their fiscal problems.”

For those playing at home, the United States’ current debt to GDP level stands at 103 percent, which provides the explanation for the stagnant Obama “recovery.”

And the prescription is clear. For the U.S. economy to return to the robust levels of performance that were witnessed before our current president took office, our nation has to rebalance the amount of government borrowing compared to the overall size of the economy.

To show how difficult the task of getting our debt to GDP below 85 percent will be, in order to get back to 100 percent of Debt to GDP which most analysts classified as being a point of no return, the economy next year would need to grow by a larger than projected 3 percent, and the budget would have to be balanced.

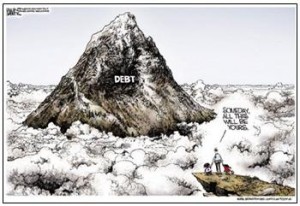

Instead, with our debt projected to increase by well over a trillion dollars again, the debt to GDP will grow even larger and the problem will become even more intractable as the debt itself continues to crush the ability of the economy to grow out of the crisis.

That’s why Ceccetti’s study demands that countries with their economies drowning in debt “act quickly and decisively” because to do otherwise is to make it impossible to resolve without a wholesale economic meltdown.

This is what is at stake as the “smart” people in Washington, D.C. continue to battle over various fiscal issues that make most of America’s eyes roll to the back of their heads as they change the channel to the latest vapid reality show.

Perhaps if Fox or CNN introduced reports on the battle for fiscal sanity in D.C. with an ominous drumbeat as they did for the Iraq war, America would sit up and take notice.

While they are sleeping, there is a battle over whether middle class America will ever again have a rosy economic future being waged, and it is winner take all.

Rick Manning (@rmanning957) is the Communications Director of Americans for Limited Government.