But according to estimates by the Joint Committee on Taxation, they will raise just $30 billion this year, doing almost nothing to pay for the $1.2 trillion of new debt the government expects to incur in 2013.

To put that pitiful sum into perspective, 88 cents of every new tax dollar will be spent paying new interest on the debt in 2013.

Meanwhile, the money will come directly out of the pockets of job creators as the U.S. economy braces for what promises to be yet another rocky year.

But as if things could not get any worse, the $16.394 trillion debt ceiling will be reached sometime in February, reports the U.S. Treasury. In fact, it would have been hit already if not for shenanigans by Treasury Secretary Timothy Geithner to underfund federal pensions and to delay other payments.

Just one more showdown in Washington, D.C. that promises to imperil the economy, this time with the threat of default, which will be used as leverage by the Obama Administration to coerce Congress into giving it another blank check.

Why default?

Despite having ample revenue to pay principal and interest to our creditors on time and in full, a recent Inspector General’s report on the Aug. 2011 debt ceiling debacle revealed that the Treasury views it lacks the statutory authority to do so.

“While Congress enacted these expenditures, it did not prioritize them, nor did it direct the President or the Treasury to pay some expenses and not pay others,” the report states. “As a result, Treasury officials determined that there is no fair or sensible way to pick and choose among the many bills that come due every day. Furthermore, because Congress has never provided guidance to the contrary, Treasury’s systems are designed to make each payment in the order it comes due.”

As such, if the debt ceiling is reached, the White House would effectively hold our creditors hostage, defaulting on our obligations until Congress capitulates on the issue.

That is why Congress should instead call Obama’s bluff.

The fact is, the debt ceiling represents the last meaningful semblance of Congress’ constitutional power of the purse — the only means for elected representatives to hold money back from a government that automatically spends more than $2 trillion every year without any vote.

At least one senator thinks we should go in that direction. Appearing on the nationally syndicated Sean Hannity radio program, Sen. Lindsey Graham recently warned the Obama Administration that congressional Republicans are “not going to raise the debt ceiling ever again until we address what got us in debt, and that’s government spending and entitlement growth.”

In addition, it may give the House of Representatives in particular the leverage it needs to enact permanent tax relief for the American people. While they’re at it, members should also tie in a balanced budget, entitlement reform, defund Obamacare, and include the “Full Faith and Credit Act” — legislation that would require the Treasury to prioritize payments to our creditors in the event the debt ceiling is reached — to a catch-all vote on the debt limit.

And then dare the Senate to sit on it, or Obama to veto it. Or to even default on the debt.

The fact is, if Obama wants any financing at all for his Administration’s second term, he would be forced to sign the legislation. Perhaps, sensing this vulnerability, that is why Treasury Secretary Geithner recently proposed that Congress eliminate the debt ceiling all together.

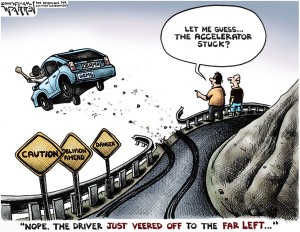

The only alternative for Republicans may be to accept political responsibility for having raised taxes on job creators across the country without having achieved significant spending concessions — the exact outcome Obama envisioned all along.

This failure ironically positions Republicans to now demand the level of cuts needed to avert a Soviet-like economic collapse later on, but only if they’re willing to tell the truth about the budget and finally play to win by refusing to go along with the “everything’s okay” charade any longer.

Robert Romano is the Senior Editor for Americans for Limited Government.