According to the World Federation of Exchanges, a trade association of 58 publicly regulated stock, futures and options exchanges, the value of equities all over the world in March was approximately $57.4 trillion.

This is almost $30 trillion of stock market gains globally since the financial crisis, about 97 percent above its Feb. 2009 low of $29.1 trillion.

To look at it from the perspective of the Dow Jones Industrial Average, it hit a low of 6,594 in March 2009, and has risen to about 15,000 today. It’s nearly 127 percent off its low.

Typically, that might mean that the stock market was due for a correction. That was about the gain stock market had in 1987 when it crashed. Much higher than the gains posted afterward through 1990, when it corrected again. It’s also higher than the gain posted from 2002 through 2007.

A doubling of equities, therefore, is an exceptional occurrence in recent market history. Even more exceptional is the 1990’s rally that saw almost a 400 percent gain. For investors, perhaps the question is, is this a typical market rally? Or is it the 1990’s again?

One thing that may be supporting stock prices are central banks around the world purchasing equities. “In a survey of 60 central bankers this month by Central Banking Publications and Royal Bank of Scotland Group Plc, 23 percent said they own shares or plan to buy them,” reports Bloomberg News.

It is hard to say how much has been bought at this stage. Two major central banks, the U.S. and the UK, are barred by law from purchasing equities. But Bank of Japan is involved, as are the Banks of Israel, South Korea, Czech Republic, and Switzerland.

Combined with standard quantitative easing plus the near-zero interest rate policies, are the moves to purchase stock by central banks designed to support global equity prices — or drive them even higher?

In 2000, none other than current Federal Reserve Chairman Ben Bernanke — then a professor — commenting on Japanese policies after their housing bubble popped in 1989, included corporate bond and equity purchases in his menu of options that might be pursued in an environment with near-zero interest rates.

Bernanke left no mistake that behind the move would be to raise prices: “The object of such purchases would be to raise asset prices, which in turn would stimulate spending.”

Vince Reinhart, then Fed Director of its Division of Monetary Affairs, at Federal Open Market Committee (FOMC) meeting in June 2004 described the circumstances under which a central bank might engage in such purchases: “if the policymakers believed that deflationary forces were severe.”

Reinhart also dismissed the possibility at the time, saying, “These options would change how we are viewed in financial markets, involve credit judgments of a form we are not used to, perhaps smack of desperation, and pull us into a tighter relationship with other parts of government.”

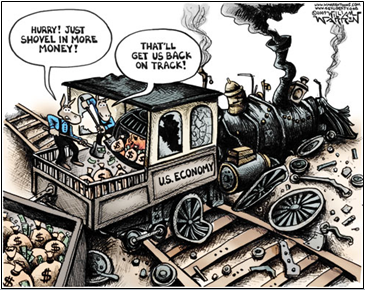

But, central banks are so far in bed with government nowadays, maybe they no longer care about such quaint concerns. But perhaps this explains how the U.S. stock market deemed by some to hold some of the safest stocks in the world has become completely untethered from economic realities.

After printing trillions to support mortgage and government debt markets, what’s some stock to institutions with virtually unlimited potential capital to spend? What do they care?

You will know the world has changed when companies start hiring lobbyists to handle their IPO’s and to encourage foreign central banks to get in on the ground floor. It’s a brave new world.

Robert Romano is the Senior Editor of Americans for Limited Government.