Absolutely no connection whatsoever.

That is what one must conclude from a recent Americans for Limited Government (ALG) study asking the questions: Does increased government spending spur private sector growth, and do spending cuts cause private sector recessions?

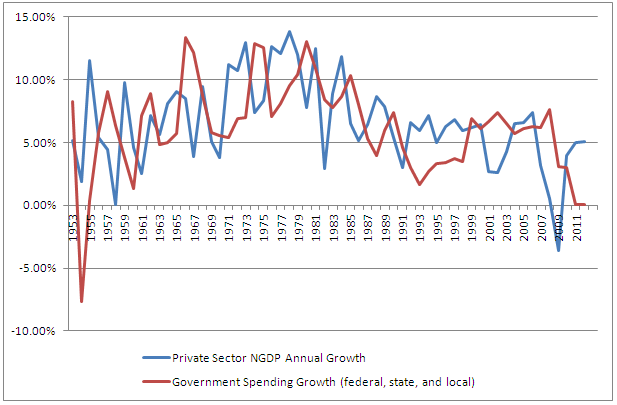

The study, based on data compiled by the Bureau of Economic Analysis from 1945 to 2012, separates government spending out as a component of the Gross Domestic Product (GDP). This is to measure the effects of government consumption and investment on the private sector.

This is usually problematic when viewing data from the Bureau, because government spending is in fact included as a part of the GDP. This makes it difficult to gauge how well the private sector is actually doing based on the reported headline number, because one cannot be certain how much government spending is biasing the GDP measure.

By separating the two in the study, that is no longer a problem.

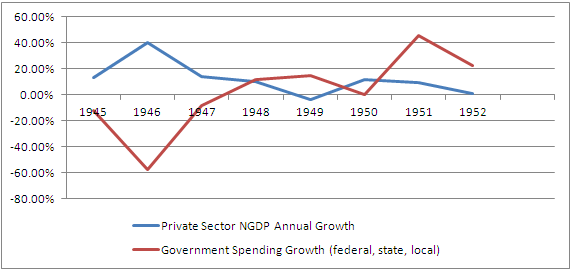

Included here are two charts, the first showing nominal private sector GDP growth versus government spending from 1945 to 1952. Note these figures are not adjusted for inflation.

If anything, what one finds is little connection at all between government spending and the private sector — except for perhaps an inverse relationship. For example, in 1945, government spending at all levels contracted nominally by 11.7 percent, but the private sector increased by 13.4 percent.

In 1946, as World War II ended, spending dropped by a whopping 57.4 percent. If the Keynesians were right, that should have killed the economy. What happened? Instead, private sector growth jumped by a staggering 40.5 percent as the country came off its war footing, servicemen and women returned home, and private domestic investment was restored.

Same thing in 1947. Spending dropped by 8.3 percent, and yet the private sector grew nominally by 13.8 percent.

One can find similar examples throughout the dataset, particularly after recent spending cuts have been implemented. For example in 2011, spending at all levels of government was practically frozen, only growing 0.08 percent, a slowdown from its 3 percent level in 2010. Yet the private sector grew nominally by 5.02 percent in 2011, faster than the prior year’s 3.9 percent.

In 2012, spending only grew 0.1 percent, but the private sector expanded by 5.04 percent.

So, why was government spending ever included as a part of the GDP?

That decision was made by Simon Kuznets, who in his 1934 report “Report on National Income” to Congress, acknowledged there might be skepticism over its inclusion in the measure.

“There may be some doubt as to the propriety of classifying government (Federal, State, county and city) as a branch of the country’s economic system, and of treating its activity as an economic pursuit,” Kuznets wrote, adding, “the motive of immediate profit, which characterizes private industry, is conspicuously absent from the activity of the government.”

On the other hand, he wrote, “purely governmental functions are of real value in the economic life of the nation, and that they give rise to income which should be taken into account.”

Essentially, because the government spends money, generating income for government employees and contractors, which results in further consumption, it affects the economy. As such, Kuznets included it as a component of the GDP.

Simple enough. Fast forward eighty years, however, and it appears this inclusion by Kuznets has had some unintended consequences.

Namely, it has led to the development of the view, largely in the Keynesian school of economics, that government spending, because it nominally boosts GDP when it is increased, should therefore always be increased.

But what if that spending apparently takes away resources from the private sector? Is government spending then truly a measure of economic health?

The findings from the ALG study have important implications from a public policy standpoint, as it appears the private sector grows independently of any “stimulus” from government spending, and in spite of any spending cuts.

Particularly, when one considers the private sector employs 84 percent of the nation’s workforce, according to data compiled by the Bureau of Labor Statistics, one cannot talk about fostering an economic recovery without focusing on the real conditions for growth.

Government spending on the other hand, is a sideshow. It is something for Keynesian politicians and do-nothing bureaucrats to wave about to pretend like they’re “responding” to hard economic times and “helping” Americans get back to work. They are not.

And it’s time for this sacred cow to be sent to the slaughterhouse. It is based on a false god, built using a bogus religion of broken promises and government waste.

Robert Romano is the Senior Editor of Americans for Limited Government.