Congressional Democrats continued with a common theme focusing on whether 501(c)(4) organizations, which do not have to disclose donors publicly, should be allowed to engage in any political activity at a May 22 House oversight hearing on the Internal Revenue Service (IRS) targeting of tea party and other groups.

Over and over, Democrats have repeatedly — and erroneously — complained that section 501(c)(4) of the Internal Revenue Code bars organizations from engaging in electioneering. And that, somehow, the regulation had “lifted” this prohibition.

For example, House Oversight Committee Ranking Member Rep. Elijah Cummings (D-MD) stated, “The original statute passed by Congress requires 501(c)(4) organizations engage ‘exclusively’ in social welfare activities but [then] the Treasury Department issued a regulation that requires these entities only to be ‘primarily’ engaged in social welfare activities.”

But the limitation on 501(c)(4) political activity actually comes from the 1960 regulation, not the statute, contradicting the Democrat talking points. The regulation implementing 501(c)(4) states, “The promotion of social welfare does not include direct or indirect participation or intervention in political campaigns on behalf of or in opposition to any candidate for public office.”

It also further defines what social welfare means under the law: “An organization is operated exclusively for the promotion of social welfare if it is primarily engaged in promoting in some way the common good and general welfare of the people of the community.”

These are the parts of the regulation that limit, and yet do not prohibit, the amount of political activity a 501(c)(4) can engage in. Under existing rules, an organization may carry on political activities so long as it does not constitute a majority of its activities.

As for the law itself, it explicitly prohibits 501(c)(3) charities from engaging in political activity, but not (c)(4) social welfare groups. Again, it was the regulation that put the limitation in place. Democrats have it exactly backwards.

Yet, officials still feign ignorance of the rules. In testimony on May 17, outgoing IRS commissioner Steven Miller suggested, “With respect to political activity, it would be a wonderful thing to get better rules,” adding the rules needed to be “more clear.”

At the House’s May 22 oversight hearing, Rep. Mark Pocan (D-WI) asked of Deputy Treasury Secretary Neal Wolin, “do you expect Treasury to come out with some guidelines measuring the primary activity of 501(c)(4) organizations so we can have some clear and concrete guidance for IRS employees?”

Wolin responded that Treasury Secretary Jack Lew “has charged the new acting commissioner with a report in 30 days that include, among other things, how we’re progressing with respect to the implementation of the various recommendations that [Inspector General J. Russell] George has put forward and that we have accepted.”

Those included the recommendation that the “IRS Chief Counsel and the Department of Treasury that guidance on how to measure the ‘primary activity’ of I.R.C. 501(c)(4) social welfare organizations be included for consideration in the Department of Treasury Priority Guidance Plan” that is issued annually.

No word yet on why it took 50 years for a regulation to suddenly result in the targeting of certain politically oriented groups in 2010. But let’s leave that aside. The law and the rules have been clear for decades. 501(c)(4) organizations are simply not prohibited from engaging in political activity. Period.

Therefore, there is no reason why 501(c)(4) tax-exempt organizations — which are allowed to engage in politics — would somehow be barred from receiving tax-exempt determination because they indicated they were going to engage in those very activities. Ironically, under existing rules these organizations are not even required to file for tax-exempt status.

So, this scandal really boils down to groups unnecessarily asking for permission from the IRS to engage in activities that the law allows, and the IRS harassing them for making the mistake of asking permission.

Yet, the Inspector General reports these regulations — issued in 1960 — were in part somehow the cause of the targeting. Wolin agreed, and promised that would change. “The existing guidance in this area as you know is very old, is [a] very complicated area,” he said, explaining that new regulations would provide “additional guidance we can provide so that we can bring better clarity to this area and help avoid the kinds of things that we’ve all just learned were happening.”

Again, administration officials are agreeing with congressional Democrats that “more clear” rules would somehow have avoided this scandal. They would not have.

Ironically, it was Miller, who just days before had asked for new rules, warned in his May 21 Senate testimony, “If we were to modify, we might still be in the same place, where we have to determine how much political activity needs to be done. Even under an ‘exclusively’ [standard], because it might not be a hundred percent you can’t do it, it might be X percent.”

He continued, “Even there, we could have a hard time parsing what’s politics, what’s not, what’s an issue ad versus education. These are very difficult tasks.”

All of which raises the question: Why would these questions come up in the determinations process at all?

Whether an organization carried on political activities or not will not even be particularly relevant on an application for tax-exempt status, because, again, they are allowed to engage in political activities.

Moreover, whether a majority of a group’s activities were political would not even be truly known until the end of the tax year after expenditures have been made — not before. This was a job for examinations of existing organizations, not for new ones applying for tax-exempt status. Attempting to discern that on an a priori basis is why this scandal happened.

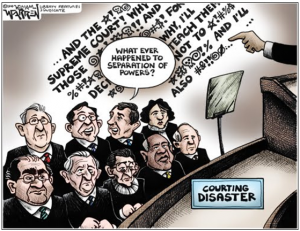

Finally, leaving no question whatsoever, the Supreme Court in 2010 ruled unequivocally in the Citizens United v. FEC decision that independent political expenditures by 501(c)(4) organizations are protected under groups’ First Amendment rights to the freedom of speech. They cannot be restricted.

As the court stated, “the Government may not suppress political speech on the basis of the speaker’s corporate identity. No sufficient governmental interest justifies limits on the political speech of non-profit or for-profit corporations.”

Meaning, the only part of the 1960 regulation on 501(c)(4)s that is questionable is its limitation on political activity, not its allowance.

The real question everyone should be asking is why, in light of the Citizens United decision that clarified that non-profit organizations’ political activity was protected by the First Amendment, did the IRS concern itself with political speech at all? How did it come into being that the IRS took that ruling, which protected speech rights, as an impetus to violate them?

Outgoing IRS commissioner Miller suggested in his May 17 testimony that “People in Cincinnati decided let’s start grouping these cases, let’s centralize these cases.” This meant quarantining the applications and sending them to Exempt Organizations (EO) Technical, based in Washington, D.C. for special scrutiny.

“The way they centralized it, troublesome. The concept of centralization, not,” Miller said, suggesting that targeting political activity of groups was permissible. Elsewhere in testimony, he agreed that the agency was targeting political activity: “the litmus test if anything was political activity.” But why were they doing that when other agencies were moving away from such tests?

For example, on Feb. 5, 2010, after the Supreme Court decision, the Federal Election Commission announced that it would “no longer enforce the statutory provisions or its regulations prohibiting corporations and labor organizations from making independent expenditures and electioneering communications.” So why did the IRS suddenly decide to do so?

This did not occur in a vacuum. It appears quite clear that the IRS either took it upon itself or was directed to defy the Citizens United ruling. It was just a month after the ruling that the agency began targeting cases of groups engaged in political activity. The question is why. We still do not know.

So, while congressional Democrats may be hoping that the Department of Treasury simply rewrites existing rules and bars 501(c)(4)s from engaging in any political activity, be warned. Should such regulations restrict speech protected by the First Amendment, they will invariably be struck down under the Citizens United precedent.

If anything, the IRS targeting of political speech reinforces the wisdom of the Supreme Court’s decision, recognizing the fundamental First Amendment principle that government must never be allowed to engage in such an abuse.

Robert Romano is the Senior Editor of Americans for Limited Government.