You could almost see it coming.

Predictably, after Federal Reserve Chairman Ben Bernanke announced on June 18 a potential 2014 sunset to the central bank’s quantitative easing program if and when unemployment hits 7 percent, 10-year treasuries jumped from 2.2 percent to about 2.56 percent.

So it is with the Fed-addicted market.

Because of the inverse relationship between interest rates and bond prices, the central bank — being a major purchaser of U.S. bonds — announcing that it would be leaving the market at a pre-determined point in the near-future, indicated that demand for those bonds will be lower. Therefore interest rates climbed higher.

In a similar vein, in a question-and-answer session with economists on July 10, Bernanke also suggested that the 6.5 percent unemployment rate target for ending the near-zero Federal Funds Rate policy by the Fed was by no means hard and fast.

“There will not be an automatic increase in [the] interest rate when unemployment hits 6.5 percent,” Bernanke said.

So, even with quantitative easing slowing down as unemployment slowly drops, the Fed will be in no rush to hike its own interest rates as the recovery proceeds apace. In response, markets rallied and the rates on U.S. treasuries stabilized.

Now that Bernanke has set the table, a key question is: Where will rates go from here?

On that count, there may be two key factors worth considering: 1) continued weakness in Europe, where credit is contracting, and in China, where it is slowing down; and 2) a smaller U.S. budget deficit — the Congressional Budget Office (CBO) expects a deficit of $642 billion this year, compared with $1.086 trillion last year — as revenues recover and sequestration proceeds.

By 2015, the CBO estimates the deficit could get as low as $378 billion.

From last year’s deficit, that’s a difference of $708 billion. The Fed’s current round of easing is only $540 billion of treasuries purchases a year. Meaning, although the Fed is slowing down its buying, that will be happening at a time the government is reducing its own rate of borrowing at an even faster pace.

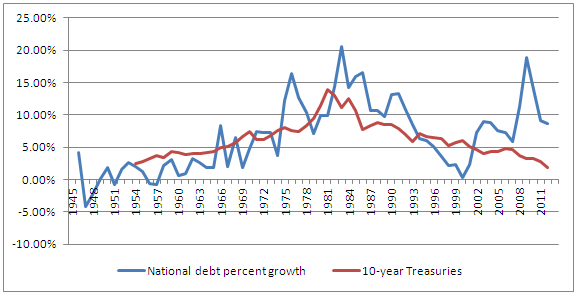

Historically, interest rates have tended to follow the growth of deficits around based on the supply of new treasuries entering the market (see: chart above).

In fact, rates have been dropping for the past 32 years overall. Is it finally time it will stop?

In the postwar period, the faster the national debt grew, the greater the supply flooding the market, and the higher the interest rate tended to be. And vice versa: the slower the debt grew, the lower rates tended to go.

There were two notable exceptions in the 2000s. However, the major increases in the deficit in the early and late 2000s were offset by a global flight into relative safety during tough economic times, plus Fed intervention into treasuries markets. So, interest rates still fell.

Now, continued weakness overseas coupled with a smaller supply of new bonds to buy indicate there will be downward pressure on interest rates in the near-term.

Many forget that prior to the announcement, bonds were already selling off and rates were rising. At the beginning of May 10-year yields were down to 1.66 percent. By the time he made his announcement they were already up to about 2.2 percent.

All of which could indicate that the bonds were oversold in response to the Bernanke announcement.

Other factors to consider include the domestic recovery, or lack therof. Recall, Bernanke’s suggested end of quantitative easing is dependent on labor market conditions, not on a set date per se.

Therefore, should the overseas downturn in Europe and Asia spill over into a continued slowdown here — coupled with low consumer inflation — would presumably cause an even greater flight to safety right back into treasuries. Another scenario where rates would seemingly drop.

And for those who wonder how low interest rates can really go in the zero-bound policy scheme, one need look no further than Japan, where 10-year government borrowing costs are at about 0.8 percent.

In sum, Bernanke has already made his announcement and outlined the rules. Where rates go from here will be determined primarily by market forces. Right now, on the horizon it appears to be an environment where the supply of treasuries will be dwindling when demand is steady or increasing.

Usually, that means rates are going to drop. The party might not be over yet.

Robert Romano is the Senior Editor of Americans for Limited Government.