“[W]e estimate that the second LSAP program, known as QE2, added about 0.13 percentage point to real GDP growth in late 2010 and 0.03 percentage point to inflation.”

That was the San Francisco Federal Reserve’s take on the impact the central bank’s second round of quantitative easing, totaling $600 billion of U.S. treasuries purchases.

At the time $600 billion comprised about 3.9 percent of the entire then-$15.2 trillion economy. Yet it only produced three hundredths that amount of growth, and seven thousandths that amount in inflation.

Yet, the Fed has the gall to still pretend that “The program’s goal was to boost economic growth and put inflation at levels more consistent with the Fed’s maximum employment and price stability mandate.”

Yeah right.

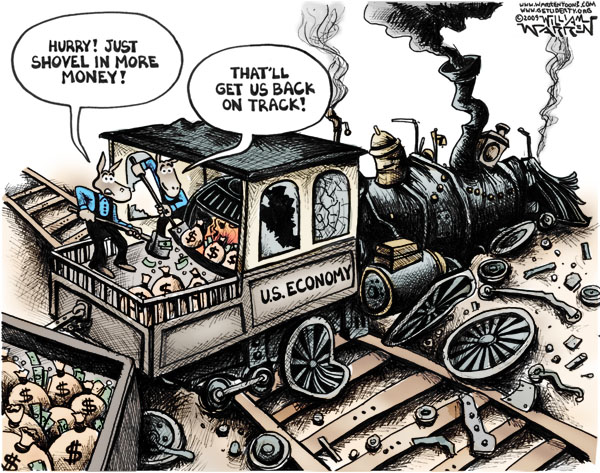

In reality, the Fed’s claim of statutory authority to pursue the bond purchasing program is entirely self-serving — nothing more than legal cover for an otherwise ineffective program at restoring growth, reducing unemployment, or achieving much of anything else was said about it.

Except for bailing out banks, that is. Since August 2007 when the crisis began, the Fed has increased its balance sheet by $2.7 trillion — purchasing $1.3 trillion of mortgage-backed securities and $1.4 trillion of treasuries.

That money winds up directly on bank balance sheets, and about 75 percent of it has been simply stockpiled as $2.03 trillion excess reserves by financial institutions. There it earns 0.25 percent interest from the Federal Reserve, or about $5 billion. Easy money.

In the meantime, banks got to unload a lot of risky assets they might have otherwise taken major losses on. For example, a 2010 Fed audit revealed that of the $1.25 trillion of mortgage-backed securities the central bank purchased after the housing bubble popped, some $442.7 billion were bought from foreign banks.

According to the Fed, the securities were purchased at “Current face value of the securities, which is the remaining principal balance of the underlying mortgages.” These were not loans, but outright purchases, a direct bailout of foreign firms that had bet poorly on U.S. housing.

They included $127.5 billion given to MBS Credit Suisse (Switzerland), $117.8 billion to Deutsche Bank (Germany), $63.1 billion to Barclays Capital (UK), $55.5 billion to UBS Securities (Switzerland), $27 billion to BNP Paribas (France), $24.4 billion to the Royal Bank of Scotland (UK), and $22.2 billion to Nomura Securities (Japan). Another $4.2 billion was given to the Royal Bank of Canada, and $917 million to Mizuho Securities (Japan).

According to the New York Fed’s website, the purpose of the program was to “foster improved conditions in financial markets.” Now we know by that the Fed meant in foreign countries, too.

In that context, the program had almost nothing to do with boosting growth or improving the economy — it was to prop up the privileged few power elite. So, tell us another one.

Robert Romano is the Senior Editor of Americans for Limited Government.