It looks like Greece may need another bailout of €10 billion ($13.4 billion) to refinance debt it owes to creditors, according to Greek Finance Minister Yannis Stournaras.

“If there is need for further support to Greece, it will be in the order of about 10 billion euros,” Stournaras told Greek newspaper Proto Thema.

The Greek sovereign debt crisis began at the end of 2009, when it was revealed that the government in Athens had hidden about €30 billion ($40.1 billion) of liabilities from the accounting of its national debt. At the time, all the experts assured us that there was no risk.

Greece was a tiny country, with a Gross Domestic Product just 2.5 percent of the whole Eurozone.

Besides, €30 billion was a relatively small number. And even if Greece was having trouble raising money on bond markets, there would be little ripple effect throughout the Eurozone, let alone the global economy.

Fast-forward three years. Greece has defaulted on €100 billion ($133.7 billion) it owed to private creditors, or almost one-third of its debt. Further debt crises have broken out in Ireland, Portugal, Cyprus, Spain, and Italy. The Eurozone is once again in recession. And it is not over yet.

Since the bailouts, Greece’s debt has grown again to €321 billion ($429.1 billion) as of June 30, more than it was in 2009 when the crisis began.

When Greece defaults again, this time on €10 billion, there are almost no private creditors left to steal from, according to Reuters: “more than 80 percent of Greek government debt is now in the hands of official creditors.”

That includes the European Stability Mechanism (ESM), the International Monetary Fund (IMF), and the European Central Bank (ECB). So, this time, “talks will be limited to allocating losses within the public sector,” Reuters references Fabric Montagne as saying, an economist with Barclays in Paris.

But who will take the losses? Without private sector involvement, the burden might fall on the IMF, which has lent €28.2 billion ($37.6 billion) to Athens, or the ECB, which has €30.8 billion ($41.2 billion) of Greek bonds.

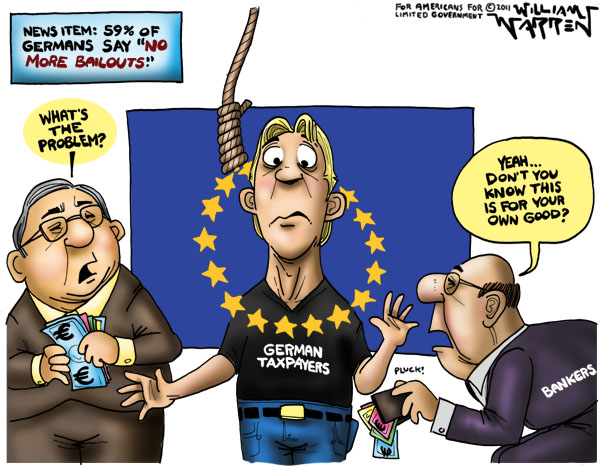

More likely however are that the losses would fall directly on taxpayers whose governments had lent €144.7 billion ($193.3 billion) through the ESM precursor, the European Financial Stability Facility, and the €52.9 billion ($70.7 billion) that was lent via the Greek Loan Facility.

That could pose political problems, however, particularly in Germany where parliamentary elections are scheduled for Sept. 22 for the Bundestag.

German Chancellor Angela Merkel ruled out another default in an interview with Focus magazine on Sunday, “I am expressly warning against a haircut. It could trigger a domino effect of uncertainty with the result that the readiness of private investors to invest in the eurozone again fall to nothing.”

Merkel echoed German Finance Minister Wolfgang Schauble who last week had ruled out another debt writedown by the Greeks.

Probably because such a move would be yet another blatant violation of Article 125 of the Lisbon Treaty, which explicitly prohibits bailouts: “A Member State shall not be liable for or assume the commitments of central governments, regional, local or other public authorities, other bodies governed by public law, or public undertakings of another Member State, without prejudice to mutual financial guarantees for the joint execution of a specific project.”

So, if member states are put on the hook via losses on Greek bonds, the liability will indeed have fallen on them, throwing the Treaty on the Functioning of the European Union into question. This is lawlessness.

Hundreds of years of history show that when the moment arrives when governments are no longer bound by a strict adherence to the rule of law, when they simply do as they please, representative institutions tend to disappear in short order. Let us hope that Europe bucks that trend — but don’t bet on it.

Bill Wilson is a member of the board of directors of Americans for Limited Government.