Since August 2007 when the financial crisis began, the Federal Reserve has expanded its balance sheet by more than $3 trillion, including $1.35 trillion of U.S. treasuries and $1.43 trillion of mortgage-backed securities.

It was “an unprecedented shopping spree,” says the former Fed official who headed up the program to buy the mortgage bonds in 2009, Andrew Huszar, in an eye-opening oped with the Wall Street Journal, “Confessions of a Quantitative Easer.”

In it, Huszar lays out the most stunning indictment of the central bank by a Fed insider ever: “As a former Federal Reserve official, I was responsible for executing the centerpiece program of the Fed’s first plunge into the bond-buying experiment known as quantitative easing. The central bank continues to spin QE as a tool for helping Main Street. But I’ve come to recognize the program for what it really is: the greatest backdoor Wall Street bailout of all time.”

Huszar even apologizes: “I can only say: I’m sorry, America.”

The biggest problem with the program, Huszar says, is “Despite the Fed’s rhetoric, my program wasn’t helping to make credit any more accessible for the average American. The banks were only issuing fewer and fewer loans. More insidiously, whatever credit they were extending wasn’t getting much cheaper. QE may have been driving down the wholesale cost for banks to make loans, but Wall Street was pocketing most of the extra cash.”

This is certainly borne out by recent data. Household debt, after growing more than 10 percent on average every year throughout the postwar period through 2007, has been shrinking slightly since the crisis began.

Moreover, of the Fed’s $3 trillion of expansion, some $2.379 trillion of it is sitting as excess reserves by financial institutions, not being lent, according to the central bank’s data. Another $661.6 billion was repaid to the 2008 Troubled Asset Relief Program (2008) according to a Treasury inspector general report.

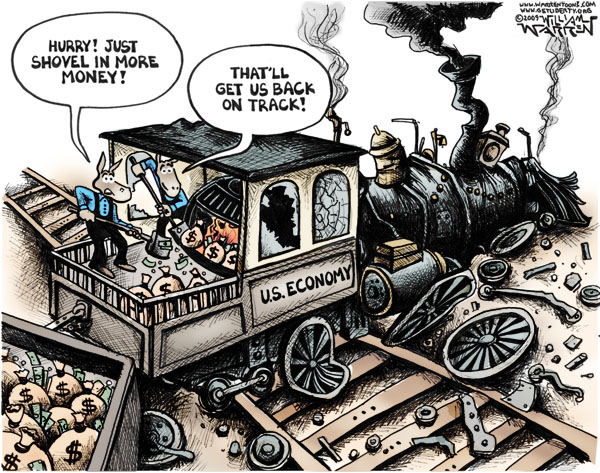

Put together, the Fed’s QE programs have done almost nothing to expand credit, despite that being the stated intention. Nor has it apparently done anything to boost the economy, for that matter, according to Huszar, writing, “Even by the Fed’s sunniest calculations, aggressive QE over five years has generated only a few percentage points of U.S. growth.”

Not much of a multiplier there.

In meantime, labor market conditions are as bad as ever, with 53 percent of young adults not even bothering to look for work today — because there’s none to be found.

Overseas, the monetary expansion has fueled inflation in the developing world, destabilizing regions such as the Middle East and North Africa. The overthrow of the governments of Tunisia and Egypt began as food riots. In China and other emerging markets, it has helped fuel a record credit bubble, which is now popping.

And it is helping to monetize the national debt, now $17 trillion, doing little to encourage Congress to get its dire fiscal outlook in order, with tens of trillions of unfunded liabilities for the nation’s entitlement programs, including Social Security, Medicare, and now, Obamacare.

What’s not to like? No growth, no jobs, no credit, global economic and political instability, bailouts for Wall Street and Washington, D.C., and leaving a greater fiscal catastrophe for the next generation.

At the end of the day, Huszar may be sorry, but our failure to get this unaccountable central bank under control today could mean one day the U.S. is no longer the world’s preeminent economy.

One day, we may all be sorry when we can no longer print money to pay the bills.

Robert Romano is the senior editor of Americans for Limited Government.