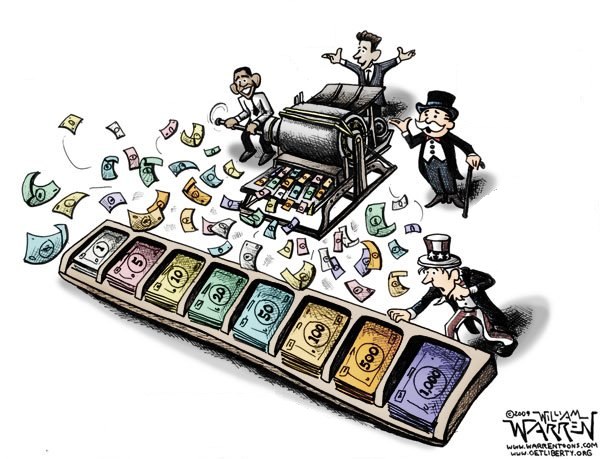

Stop the presses!

Instead of adding $1.02 trillion of treasuries and mortgage bonds to its balance sheet a year, the Federal Reserve has announced starting in January it will just be adding a “mere” $900 billion.

For that, headline writers the world over are proclaiming that the long-sought-for recovery is finally at hand. The Washington Post editorial board proclaimed that taper is “a good sign for the economy.”

So the logic goes, if the Fed’s quantitative easing programs, now entering their sixth year, were to help a fragile economy, then bringing it to an end must mean that the economy is improving.

And we might all take solace in that, except for the part where this means they’ll still be printing $75 billion a month instead of $85 billion a month until, in the Fed’s words, “the outlook for the labor market has improved substantially.”

That’s not much of a reduction — just an 11.8 percent slowdown. So instead of flying down the highway at 105 miles per hours, we’re only cruising about 93 miles per hour now.

What a relief.

Oh, wait, that’s not good. The Fed still said that the 7 percent unemployment rate “remains elevated.”

That the purpose of continuing to purchase $75 billion a month of securities is to “maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative, which in turn should promote a stronger economic recovery.”

So which is it? Is the economy really improving, or are unprecedented, emergency purchases by the Fed needed to accommodate financial conditions, keep a ceiling on interest rates, support mortgage markets, etc.?

These quantitative easing programs will have long exceeded Fed head Ben Bernanke’s tenure in office, which ends in January. Is this what he meant by a temporary program? It’s now a permanent fixture.

And there is little reason to believe it will end under Janet Yellen’s watch when she takes over the central bank in January.

Make no mistake, rising interest rates are the economic calamity everyone fears should the Fed’s program ever come to an end.

Consider the costs. For every point of interest treasuries for example rise, the annual gross interest cost to taxpayers will over time rise by $172 billion.

Forbes.com economic analyst Jesse Colombo foresees two scenarios where rates rise and send shockwaves through the financial system, and in particular, will prick the stock market’s current highs.

Either, “After several more years of the Bubblecovery, The Federal Reserve has a ‘Mission Accomplished’ moment and decides to end QE and eventually increase the Fed Funds rate, which pops the post-2009 bubbles that were created by stimulative monetary conditions in the first place,” or “[t]he Fed loses control of longer-term interest rates after investors sell their Treasury bond holdings en masse in fear of a sharp decline in the U.S. dollar’s value after years of money printing.”

Of course, the Fed at $75 billion a month is nowhere near pulling the plug on quantitative easing. Nor are foreigners, after a brief selloff earlier this year, yet dumping treasuries en masse.

In the short term that could mean more growth in stock valuations, but it also probably means the unemployment rate will remain elevated and growth will remain slow.

Over the longer term, however, there is somewhat of a game of chicken at play. Will investors dump treasuries and rates rise, or will they risk waiting for the Fed to end quantitative easing first?

One imagines a third scenario, where neither the Fed nor investors ever stop buying treasuries, and interest rates remain low forever.

And yet experience tells us nothing lasts forever. Which is not news, so no need to stop the presses. Although maybe the Fed should.

Robert Romano is the senior editor of Americans for Limited Government.