By Bill Wilson

It has been almost a year since Detroit filed for bankruptcy on its $18 billion of debt, and now state and local leaders are on the verge of a deal to bring the city onto its own feet again. Under the deal, city employee pensioners will receive a 4.5 percent cut, and the state legislature has overwhelmingly approved $195 million of additional aid to ease the transition to solvency.

In addition, Detroit is receiving assistance in the form of $366 million from charitable foundations and another $100 million from the Detroit Institute of Arts. Those enrolled in the police and fire fighters pension funds will not see a direct cut, but their cost of living adjustments going forward will be cut in half. Bondholders will take a big haircut.

Michigan taxpayers will unfortunately take a hit — the equivalent of $350 million over twenty years — which is not ideal, but ultimately, it’s up to Michigan to figure out how to deal with the problems Michigan created.

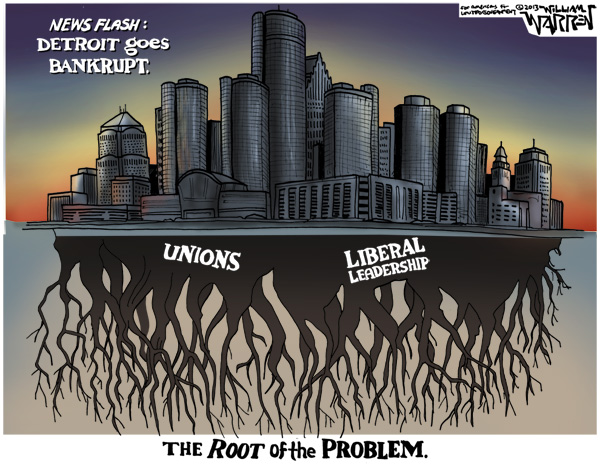

It’s one of those messy solutions where nobody really gets everything they wanted, but all in all, not a bad resolution considering the dire financial straits the city was in last year. This is what happens when cities spend themselves into oblivion.

That should be the end of it. But, not satisfied with the so-called “grand bargain” that is already moving into implementation — there is still another round in bankruptcy court to follow starting July 24 — there are those who are calling for Uncle Sam to step in.

Writing for Reuters, economist Allison Schrager is calling for an additional $100 million from federal taxpayers from a “blight eradication” program. In fact, Detroit has already received $52 million from Washington, D.C. from that very same program.

Schrager blasted the Obama administration for not doing more, writing, “The federal government should use Detroit as an opportunity to take a more active role in state and municipal pensions.”

Bad idea. Not only is Michigan already on top of the problem, meaning there’s no need for a federal bailout, the feds stepping in any more than they already have would set an awful precedent as fiscal conditions at the municipal level continue to worsen over the coming decades across the country.

According to data compiled by the Federal Reserve, state and local government employee defined benefit retirement funds and pension entitlements currently face $4.9 trillion in liabilities, a figure that has increased by almost $1 trillion since 2009. Of that, about $3.7 trillion is funded, or roughly 75 percent.

But that figure will surely worsen, something Schrager acknowledges, citing research by economist Josh Rauh stating that even if pension funds earn an expected 8 percent a year every year, by 2025 20 states will run out of money.

It’s a ticking time bomb. Detroit is only the beginning. But unwinding these unfunded liabilities is absolutely necessary in order to ensure state and municipal governments get on more sound financial footing going forward.

Any federal guarantee of escalating pension and health care liabilities, implicit or explicit, will rob state and local governments of any incentive to do what Michigan has done in Detroit — which is to fix the problem within taxpayers’ means.

Schrager cites the housing crisis of 2007 and 2008 as an example of what can go wrong if the federal government waits too long to act, but in reality, it was the government’s implicit guarantee of mortgage backed securities issued by Government Sponsored Enterprises Fannie Mae and Freddie Mac, coupled with the mortgage giants’ so-called affordable housing goals that encouraged the risky lending to begin with.

The federal guarantee was the problem, not the solution. The trick now is to disabuse states and cities of any notion that any bailout is coming.

A firm “no” from Washington, D.C. right now would encourage lawmakers to take preemptive action so they don’t have to deal with this in bankruptcy court in the not so distant future. States and cities should fix their own problems, not make everyone else pay for it.

Bill Wilson is a member of the board of directors of Americans for Limited Government.